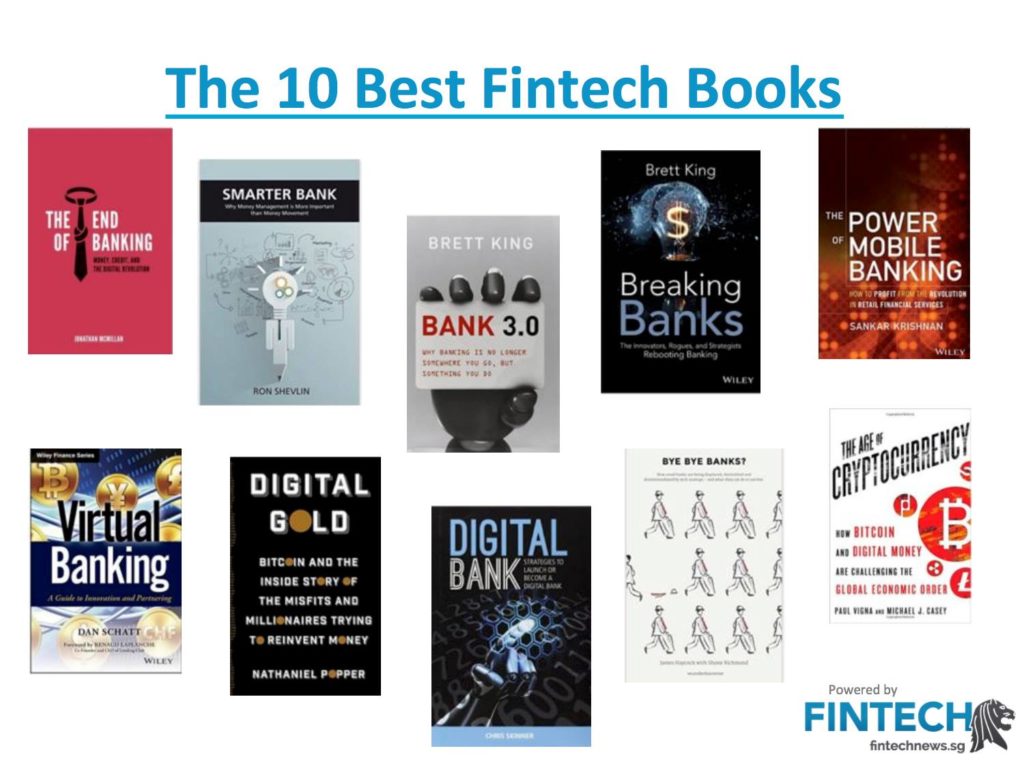

Top 10 Fintech Books

While blogs and news portals will keep you up-to-date in terms of companies and corporate news, books – which often result from extensive researches and interviews – will give you have a wider view on a particular sector, as well as its emerging trends and developments. We tried to select the best fintech books for you.

Whether you are interested in bitcoin, cryptocurrencies, peer-to-peer lending, mobile banking, or even more largely, just curious about the future of money and banking, we have compiled a list of the top 10 essential books about fintech you must have in your library. Maybe not all books are covering fully fintech, but they will give you the essential thinking you need for fintech and digital banking.

Here it goes: (just click on the cover to get to a bookshop).

Also have a look to our selection of “The 10 Best Fintech News Sites and Blogs”.

Fintechnews Switzerland has updated this list with brand new publications, check out: ” 9 (More) Fintech and Blockchain Books to Have on Your Bookshelf”

‘Bank 3.0: Why Banking Is No Longer Somewhere You Go But Something You Do’ – Brett King

‘Bank 3.0: Why Banking Is No Longer Somewhere You Go But Something You Do’ – Brett King

Following Brett King’s first edition of Bank 2.0 in 2010, a bestseller on Amazon in the US, UK Germany, France and Japan, the Australian technology futurist, public speaker and author, came back in 2012 with ‘Bank 3.0: Why Banking Is No Longer Somewhere You Go But Something You Do,’ a book that covers the latest trends that are redefining banking and financial services including mobile wallet, tablet computing, cloud technology, social media, as well as the emerging “de-banked” consumer trend.

Most specifically, Bank 3.0 highlights the growing gap between customer behavior and traditional financial services, an opportunity for non-banks competitors and startups to disrupt the sector.

‘Breaking Banks: The Innovators, Rogues, and Strategists Rebooting Banking’ – Brett King

‘Breaking Banks: The Innovators, Rogues, and Strategists Rebooting Banking’ – Brett King

Released in May 2014, King’s ‘Breaking Banks: The Innovators, Rogues, and Strategists Rebooting Banking’ is a collection of interviews of fintech entrepreneurs, experts and disruptors from all over the globe who are looking to redefine finance and banking.

The book features stories of these disruptors, case studies and testaments on their visions of the future of money. Topics that are covered include Bitcoin, peer-to-peer lending, social media, as well as the new emerging banking business models.

Another book by King that is eagerly awaited is called ‘Augmented: Life in the Smart Lane’ and will focus on the new emerging technologies that will enable people to gain instant access to more information. (a free chapter can be downloaded here)

The book, set to be released in June 2016, will highlight how technologies such as supercomputers, smart sensors, self-driving cars and AI-based personal assistants, will fundamental change the way we live, work and learn.

‘Digital Bank: Strategies to Launch or Become a Digital Bank’ – Chris Skinner

‘Digital Bank: Strategies to Launch or Become a Digital Bank’ – Chris Skinner

Following ‘The Future of Finance after SEPA’ and ‘The Future of Banking In a Globalised World,’ Chris Skinner’s ‘Digital Bank: Strategies to Launch or Become a Digital Bank’ offers an in-depth analysis on the digital revolution in banking as well as the work that have been done by incumbents such as Barclays into their digital transformation.

The book, which specifically focuses on mobile Internet, features analysis of new models of banking such as FIDOR Bank in Germany and new fintech startups such a Metro Bank and Zopa.

Chris Skinner is a writer, commentator and keynote speaker considered as one of the t most influential personalities in the fintech industry.

Skinner, a technology infrastructure and post-trade services veteran, is also the founder and chairman of the Financial Services Club, a European financial sector networking group. Chris Skinners new book “Value Web” will be about Blockchain and will be published in January 2016.

‘The End of Banking: Money, Credit, and the Digital Revolution’ – Jonathan McMillan

‘The End of Banking: Money, Credit, and the Digital Revolution’ – Jonathan McMillan

Released in November 2014 by two anonymous authors, ‘The End of Banking: Money, Credit, and the Digital Revolution’ is a “thought-provoking” book that dissects banking and explains how the industry “almost crashed out financial system.”

The book highlights how the digital revolution will be a game changer that will definitely end the banking system that we know of.

Alongside offering the main problems of our financial world, the book also provides with solutions to move forwards into a modern financial system.

Jonathan McMillan is a pseudonym used by two authors who wish to preserve their identities: one is a financial experts that works in the investment banking division of a global bank; the other is a scholar and a researcher who holds two bachelor’s degrees in economics and international relations, as well as an M.Phil. in economics from the University of Cambridge and a Ph.D in economics from the Swiss Federal Institute of Technology, ETH Zurich.

‘The Power of Mobile Banking: How to Profit from the Revolution in Retail Financial Services’ – Sankar Krishnan

‘The Power of Mobile Banking: How to Profit from the Revolution in Retail Financial Services’ – Sankar Krishnan

Written by career banker and financial services industry thought leader Sankar Krishnan, ‘The Power of Mobile Banking: How to Profit from the Revolution in Retail Financial Services’ covers the challenges and opportunities related to our new mobile-driven world.

Most particularly, the book explores mobile banking, mobile payments, as well as m-commerce, and highlights the key strategies for banks to deliver great services that will benefit users.

‘Virtual Banking: A Guide to Innovation and Partnering’ – Dan Schatt

‘Virtual Banking: A Guide to Innovation and Partnering’ – Dan Schatt

‘Virtual Banking: A Guide to Innovation and Partnering’ a Wiley Finance series book, focuses on the impact of technology on finance and banking with a particular focus on digital payments.

The book gives an overview of the key trends and developments that are redefining the financial services industry and gives insights on the future of banking business models.

It also discusses innovations from incumbent banks, challengers and non-banks, and gives a comprehensive overview on electronic payments, mobile payments and virtual banking, as well as the key strategies to success in this changing environment.

‘Bye Bye Banks?: How Retail Banks are Being Displaced, Diminished and Disintermediated by Tech Startups and What They Can Do to Survive’ – James Haycock, Shane Richmond

‘Bye Bye Banks?: How Retail Banks are Being Displaced, Diminished and Disintermediated by Tech Startups and What They Can Do to Survive’ – James Haycock, Shane Richmond

In ‘Bye Bye Banks?’ James Haycock and Shane Richmond explore how technology startups are disrupting the financial services industry while providing key strategies for traditional banks to help them move forward into the digital era.

The book features interviews of senior executives of the world’s biggest banks and proposes a “Beta Bank” business model that will help incumbent banks understand better what today’s consumers really want and trigger their digital transformation.

‘Smarter Bank: Why Money Management is More Important Than Money Movement to Banks and Credit Union’ – Ron Shevlin

‘Smarter Bank: Why Money Management is More Important Than Money Movement to Banks and Credit Union’ – Ron Shevlin

‘Smarter Bank’ covers emerging technological trends and topics such as big data, engagement and innovation, and specifically targets banks and credit unions with the purpose of helping them become more profitable as well as teaching them how to benefit from emerging disruptive technologies.

The book covers the current main issues of the banking industry, the new competitive dynamic and environment, the rise of “smartphonatics,” as well as the mobile finance and mobile banking opportunities. An excellent book review by Jim Marous can be found here.

‘Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money’ – Nathaniel Popper

‘Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money’ – Nathaniel Popper

Published in May 2015 by New York Times technology and business reporter Nathaniel Popper, ‘Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money’ gives an extensive analysis of the history of bitcoin and how it has spawned a global social movement.

The book features interviews and insights from the world’s leading digital currency personalities and experts including Tyler and Cameron Winklevoss, Bitcoin’s mysterious founder Satoshi Nakamoto, an Argentinian millionaire and a Chinese entrepreneur.

Prior to The New York Times, Popper, a Harvard graduate, worked at the Los Angeles Times and The Forward.

‘The Age of Cryptocurrency: How Bitcoin and Digital Money Are Challenging the Global Economic Order’ – Paul Vigna, Michael J. Casey

‘The Age of Cryptocurrency: How Bitcoin and Digital Money Are Challenging the Global Economic Order’ – Paul Vigna, Michael J. Casey

Another must-have book about bitcoin and cryptocurrencies is ‘The Age of Cryptocurrency: How Bitcoin and Digital Money Are Challenging the Global Economic Order,’ written by Wall Street Journal reporters Paul Vigna and Michael J. Casey.

In this book, Vigna and Casey explain how bitcoin and cryptocurrencies in general are poised to launch a revolution. They also explore how these technologies could potentially reinvent the financial sector while bringing basic financial services to the world’s unbanked populations.

‘The FINTECH Book’

‘The FINTECH Book’

A book that is worth a mention but which hadn’t been released yet is ‘The FINTECH Book.’

The book represents the world’s first crowd-sourced book about the global fintech sector and is authored by 166 thought leaders and experts from 27 countries. According to Susanne Chishti it’s expected to be released in March 2016. You can already preorder the book here.

Have we missed an essential fintech book? Please share your thoughts and comment below or contact us through social media.