Fintech Mainstream Adoption To Be Driven By Emerging Markets

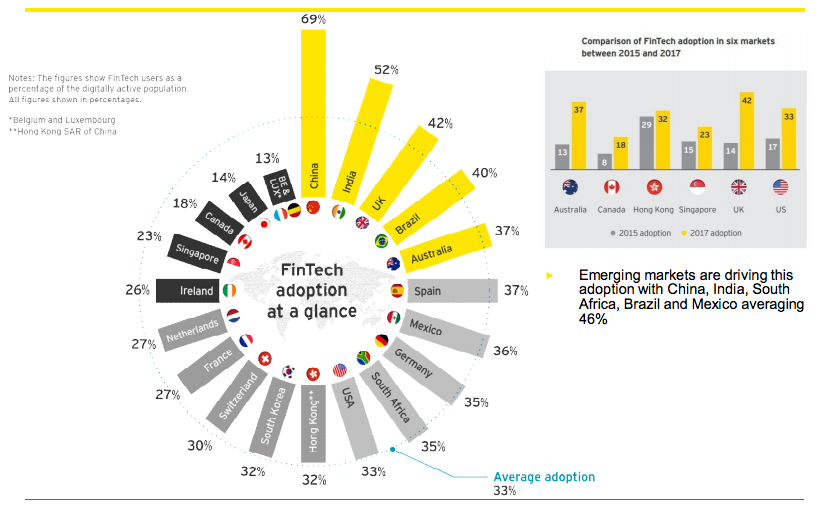

by Fintech News Singapore July 27, 2017Over the past 18 months, adoption of fintech solutions has surged globally with now 33% of digitally active consumers across 20 markets using such products and services compared with 16% in 2015, according to EY’s latest EY Fintech Adoption Index.

Fintech is poised to be embraced by the mainstream, driven by high adoption rates in emerging markets including China, India, South Africa, Brazil and Mexico, averaging 46%, the research found.

Fintech adoption rate across 20 markets, EY Fintech Adoption Index 2017

In particular, China and India have seen the highest adoption rates at 69% and 52%, respectively. According to the study, fintech firms in these countries have become successful at tapping into the tech-literate but financially underserved populations.

“Fintechs are clearly gaining widespread traction across global markets and have achieved the early stages of mass adoption in most countries,” said Imran Gulamhuseinwala, EY’s global fintech leader. “The EY Fintech Adoption Index finds, on average, one in three consumers already consume fintech services on a regular basis.”

Money transfer and payments services continue to fuel the growth of fintech with global adoption standing at 50% in 2017, according to the EY consumer survey. Insurance as well has made huge gains, moving from being one of the least commonly used fintech services in 2015 to becoming to second most popular in 2017 with 24%. According to study, growth has been largely fueled by the expansion into technologies such as telematics and wearables and in particular, the inclusion and growth of premium comparison sites.

“Fintechs, particularly in the payments and insurance space, have been very successful in building on what they do best – using technology in novel ways and having a laser-like focus on the customer,” Gulamhuseinwala said.

“It really is now a critical time for traditional financial services companies. If they haven’t already, they need to urgently reassess their business models to ensure they are able to meet their customers’ rapidly changing needs. Disruption is no longer just a risk – it is an undisputable reality.”

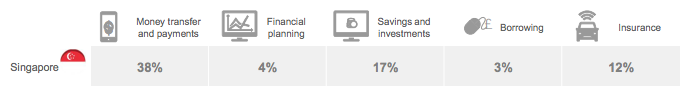

Fintech adoption in Singapore

A similar trend is observed in Singapore where adoption of digital money transfers and payments stands at 38%. Savings and investments too have seen good penetration in the market with an adoption rate of 17%. However, adoption of borrowing (3%) and financial planning services (4%) still remains particularly low.

Fintech categories that are driving adoption in Singapore, EY Fintech Adoption Index 2017

“We anticipate that payments, and savings and investments will continue to see strong growth in Singapore. This is evident in the number of fintechs that are establishing themselves in this space,” said Liew Nam Soon, EY Asean Financial Services Managing Partner at Ernst & Young Advisory.

“The Monetary Authority of Singapore’s recent consultations around single payment infrastructure and robo-advisors will further facilitate the provision of services targeted at the middle income group,” he predicts.

Fintech adoption in Singapore increased to 23% in 2017 compared with 15% in 2015. Yet, this remains lower than the global average.

Singapore falls behind Hong Kong and Switzerland where adoptions rates stand at 32% and 30% respectively. Similarly, money transfers and payments are the key drivers to fintech growth in these markets, with a 52% adoption rate in Switzerland and 46% in Hong Kong. These are followed by savings and investments with 25% in Hong Kong and 10% in Switzerland, and insurance with 28% in Switzerland and 20% in Hong Kong.

“While fintech adoption levels in Singapore are lower than the global average, the ground work has been laid and [Singapore’s] anticipated penetration will increase across all categories in the next twelve months, with the highest growth expected from borrowing platforms and financial planning tools,” Nam Soon said.

“The lower adoption levels doesn’t mean that Singapore consumers are not open to fintech innovation. On the contrary, it reflects the efforts of traditional banks working with fintech start-ups, which gives consumers fewer reasons to go directly to the fintechs, unless it’s a brand new innovation or value proposition.”

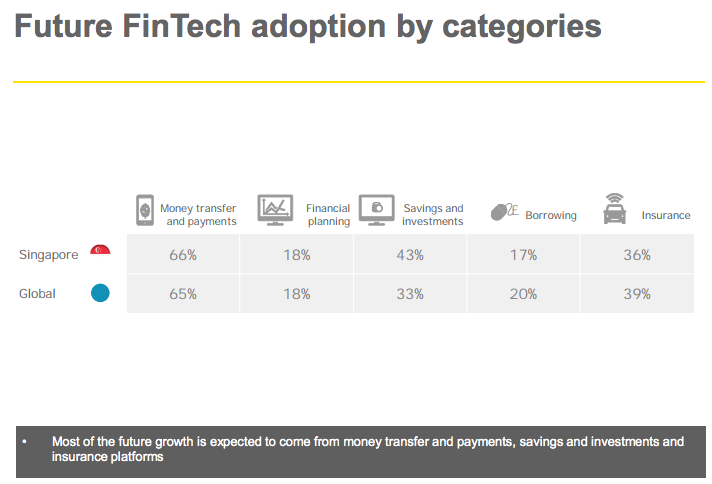

Fintech adoption to reach 52% globally

Fintech adoption could increase to an average of 52% globally, with the highest intended use among consumers in South Africa, Mexico and Singapore.

Adoption is expected to rise to 56% in Singapore driven by the government’s effort to place the city-state as a top fintech hub and friendly regulatory environment.

Future fintech adoption by categories, EY Fintech Adoption Index

Nam Soon said he expects “more usage by not just the millennials but the older generation, as awareness increases and the users gain greater comfort towards conducting financial transactions digitally.”

“This is not surprising given the vibrant fintech ecosystem – support from consumers, access to talent and capital, and governance,” he said.