Get an Advantedj in making Investments with Financial Influencers

by Company Announcement September 11, 2017Advantedj, a P2P online platform for investment insights specifically for PMETs launched this week.

Unlike B2B startups, B2C robo-advisors, banks, online forums, and personal financial advisors, Advantedj levels the playing field with financial influencers for the disadvantaged amateur investors.

Through the platform, Advantedj encourages savvy individuals to become financial influencers (contributors) by sharing their investment ideas or themes they understand.

At the time of launch, there are more than 40 model portfolios or “Edjes”. Advantedj tracks the performance of all the Edjes, ranks and publishes them daily.

Kelvin Goh

“Unlike other advisory or trading platforms, we focus only on performance, actual verified results, to help investors make better decisions. Our internal ratings are dynamic and based on performance that matter to our members. You always benefit first before having to pay any fees. That’s our commitment and the fair way,”

says Kelvin Goh, one of the founders of Advantedj, who has over 15 years of experience in the wealth management industry.

On Advantedj, the average investor benefits from easily setting up free accounts. Instead of paying up to $500 on upfront fees plus other recurring fees on a $10,000 investment, they can subscribe to Edjes – paying a nominal $3 per day per subscription for valuable insights on what to buy directly.

Based on this, investors can quickly and cheaply build and manage their own portfolio directly. The entire process translates to immediate savings with long term benefits of being in control of your own investments.

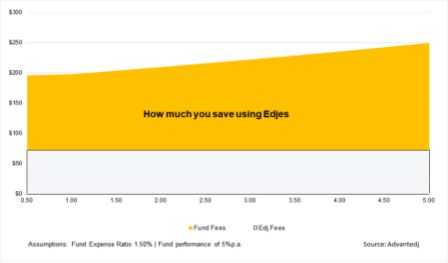

Based on estimates and comparing against buying into a popular mutual fund, a $10,000 investment amount using an Edj to manage your portfolio could potentially save you more than $1,200 over 5 years. That’s money that should belong to the investor.

The founders of Advantedj share a common goal to increase the awareness and investing knowledge amongst young adults. This is especially pertinent to those in their 30s as they face the real social challenges of providing for their parents over a longer period of time and the economic prospects of a job market with stagnating wage growth.

From Advantedj’s research, the average investor is often afraid of the stock market due to traditional barriers to information and good advice. He doesn’t trust financial advisors who often have a lack of accountability and experience. He values peer feedback, dislikes paying a high cost to get started and is interested in having more control over his investments.

“As an independent advisor, many clients gave the same feedback. They are wary of banks and intimidated by the amount of information available”

says Goh.

“Out of fear, they tend to keep their money in bank deposits, which currently earns less than 1%, lower than the inflation rate. They don’t realize that their hard-earned money is actually losing value by doing nothing.”

Unfortunately, there is a physical limitation to serve the huge gap in the PMET market. Advantedj is the only independent online platform that provides financial insights with the assurance that it is affordable, user-friendly and committed to results.

By addressing a growing problem today by fostering a self-sustaining and organic eco-system for investment insights, Advantedj is expected to gain a strong following regionally with the increasing number of PMETs in Singapore and neighboring countries.

In the next couple of months, the number of Edjes and functionalities will increase to make Advantedj the trusted platform to learn about, source and manage personal investments.

Featured image via Advantedj Facebook page