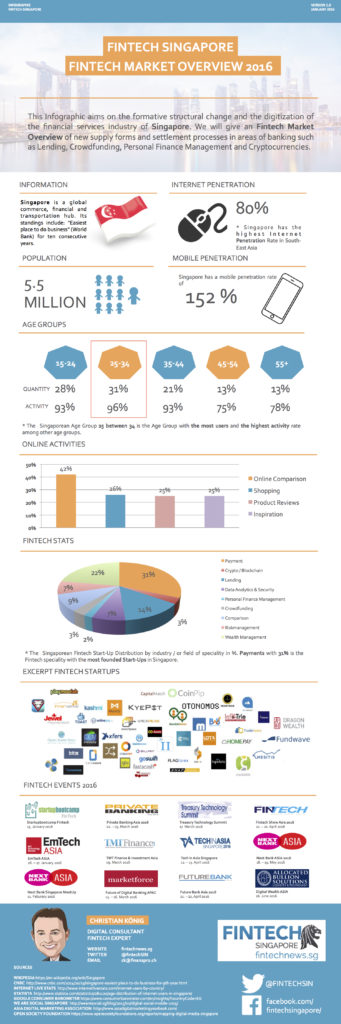

Infographic: Fintech Singapore Ecosystem as of January 2016

by Fintech News Singapore January 15, 2016Singapore, which started as an independent, separate country in 1965, quickly grew from being a tiny underdeveloped country to becoming one of the 20th century’s most successful development story.

How did that happen? Well, firstly, because the city-state knew how to take advantage of its strategic location and nature harbor. And thanks to its highly developed market economy and business-friendly legislation, Singapore has managed to attract literally thousands of foreign firms and capital.

Today, Singapore is located at the heart of one of the world’s most dynamic regions, and is considered as being among the most competitive, dynamic and innovative countries in the world.

For ten consecutive years, the World Bank has ranked the country as the “Easiest place to do business,” while INSEAD and the World Economic Forum has named Singapore the most “Technology-ready” nation.

But the city-state is not resting on its laurels as it announced in late 2014 its ambitious plan to become the world’s first “Smart Nation” by 2030. The term refers to a hyper-connected country that promises to offer better living conditions through the extensive use of technology.

Alongside the “Smart Nation,” the Monetary Authority of Singapore (MAS), the city-state’s central bank and financial regulator, has been assigned to help in the creation of a “Smart Financial Center, where technology is used pervasively in the financial industry to increase efficiency, create opportunities, allow for better management of risks, and improve lives,” according to Jacqueline Loh, Deputy Managing Director at MAS.

This project has led to the formation of the “Financial Sector Technology and Innovation” scheme, an initiative that aims to allocate S$225 million over the next five years to help foster the domestic fintech sector.

Poised to become a global leader

In addition to its highly supportive public sector, Singapore is fertile ground for financial technology companies, notably because the domestic market itself is prosperous for innovative, technology-based products.

Along with having a rather young population with one third of citizens being between 25 and 34 years old, Singapore has a mobile penetration rate of 152% and currently stands as the country with the highest penetration of mobile broadband subscriptions per capita in the world. In the same line, Singapore has the highest Internet penetration rate in Southeast Asia with 80%.

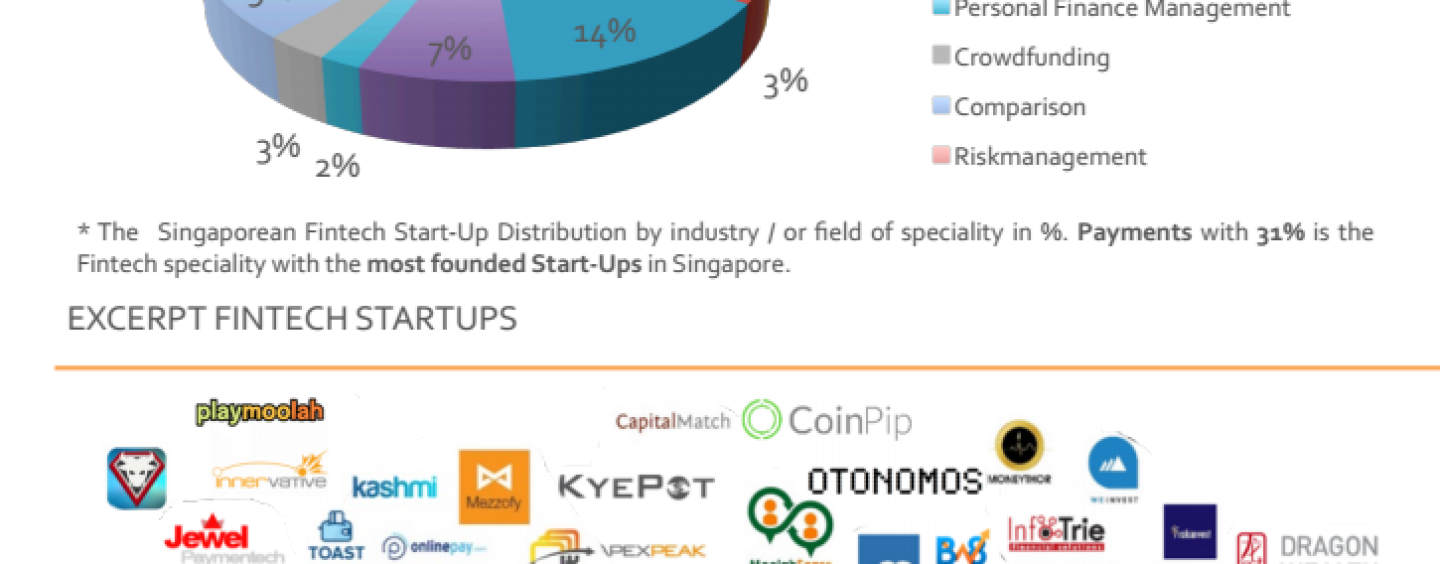

Singapore’s fintech ecosystem is vast and diverse with startups that are tackling all sorts of sub-segments, including payment – which currently stands as the dominant sub-segment accounting for 31% of all Singaporean fintech startups –, but also lending, crowdfunding, blockchain technology, cybersecurity, data analytics and risk management.

Some of the notable startups include MatchMove Pay, Fastacash and 2C2P, three major online and mobile payments companies, but also TradeHero, a stock market simulation app; GoCoin, a bitcoin startup; Canopy, a wealth management app; MDaq, a service for cross-border securities trading; MoneySmart, a personal finance portal; and Dragon Wealth, an award-winning wealth management service.

For the sake of clarity, we’ve made an infographic that sums up the Singaporean fintech ecosystem as of January 2016.

For all upcoming fintech events in Singapore but also Southeast Asia in general, you can check out this article we published earlier this week or consult this page: http://fintechnews.sg/fintech-events-singapore/

Fintech Singapore Infographic