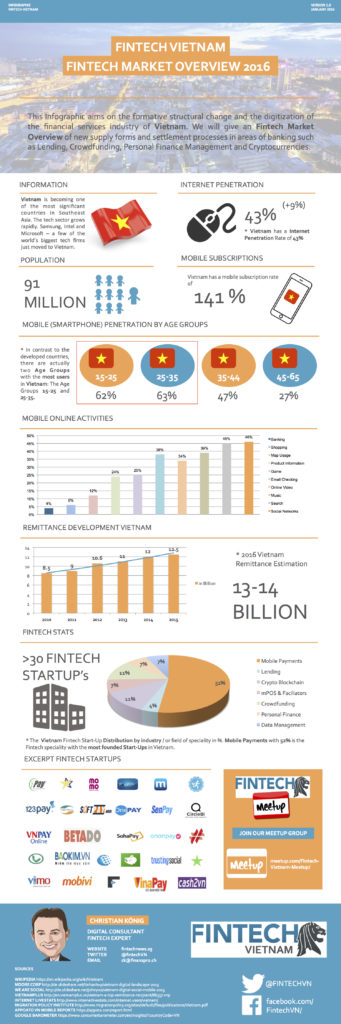

Infographic: the State of Fintech in Vietnam as of January 2016

by Fintech News Singapore January 20, 2016Vietnam’s nascent fintech sector has a prosperous future lying ahead. While the ecosystem is still relatively small with about 30 players, the sector is one of the hottest investment trends for startups in the country.

In August 2015, OnOnPay, a Hanoi-based fintech startup that allows users to top up talk time via mobile, closed “a six-digit amount” in seed funding from Captii Ventures. The deal marks the first investment from the Singaporean fund into a Vietnamese venture.

According to a report from DealStreetAsia, over US$7.8 billion will be poured into the fintech market in 2020.

So far, the most active VCs in the startup landscape include Tiger Global Management, Unitus Impact, and Templeton Emerging Markets Groups.

The craze and appetence for fintech services have been widely supported by an environment said to be inclined and tolerant to digital revolution.

93% use Mobile in Vietnam for Internet

In Vietnam, 44% of the country’s 92 million people population are Internet users, and their favorite device to go online are – you guessed it – mobile phones. A survey conducted by Moore.vn found that 93% of respondents use their mobile phone to go on the Internet, against 44% who use computers.

Hence, it comes with little surprise that 52% of all domestic startups are providing mobile payments. 1Pay, MoMo, Vimo and VinaPay are just a few of them.

Significant milestones in the mobile market were reached in 2015 with Bkav unveiling in May the Bphone, the first smartphone designed and made in Vietnam, and Apple, in October, officially opening a company in the country.

Timo is Vietnams first Digital only Bank

Recently, Lifestyle launched Timo, the first digital bank in the country. Powered by VPBank, Timo essentially focuses on convenience and simplicity, and aims to provide a solution to the changing consumer behavior in Vietnam.

Recently, Lifestyle launched Timo, the first digital bank in the country. Powered by VPBank, Timo essentially focuses on convenience and simplicity, and aims to provide a solution to the changing consumer behavior in Vietnam.

The bank provides users with all typical banking products provided by incumbent banks, including checking accounts and saving accounts, that are all manageable via a user-friendly mobile app. Plus, the service is free of charge.

14 Bio USD Remittance Market

Two sub-segments, Crowdfunding and crypto/blockchain, are following mobile payment startups in terms of the number of players. Both are accounting for 11% of the domestic fintech startup ecosystem.

Cash2VN, a service operated by domestic Bitcoin startup Bitcoin Vietnam, uses Bitcoin as a money transfer rail to allow users to send money to their loved ones in Vietnam.

The service, which launched in June 2015, charges a flat US$2 per transaction and aims to tap into the juicy Vietnamese remittance market. In 2016, it is estimated that Vietnam will received between US$13-14 billions in remittances.

Fintech Vietnam Startup Report

To make things clearer, we’ve made an infographic summarizing some of the essential characteristics of the Vietnamese fintech market as of January 2016.

To get an in-depth view of the Vietnamese fintech startup ecosystem, check out the fintech Vietnam Startup report released last month: http://fintechnews.sg/1112/studies/fintech-vietnam-startup-report/

Interested in meeting other fintech fans and experts? Join the meetup group: http://meetup.com/Fintech-Vietnam-Meetup/

Fintech Vietnam Infographic