Wave Money Is The First Fintech Company In Myanmar To Launch An Open API Linking Merchants And Customers

by Company Announcement October 23, 2017Wave Money is the first fintech company in Myanmar to launch an open Application Programming Interface (API) platform with the introduction of the Wave Money Developer Portal which will enable cashless payments between merchants and customers.

This is the latest innovation from the fastest growing and leading digital financial services company in the country.

APIs enable different pieces of software to interact with each other. The Wave Money Developer Portal will make it possible for merchants to connect their e-commerce businesses to the Wave Money platform to easily enable cashless payments for goods and services from their customers.

APIs enable different pieces of software to interact with each other. The Wave Money Developer Portal will make it possible for merchants to connect their e-commerce businesses to the Wave Money platform to easily enable cashless payments for goods and services from their customers.

The launch of the developer portal from Wave Money is in recognition of the fastgrowing e-commerce sector in Myanmar and the company’s commitment to provide fast, easy and safe financial services to a diverse range of customers including businesses in Myanmar.

Around the world, e-commerce growth goes hand in hand with increased uptake in cashless payments and to enable this, Wave Money previously introduced the ‘Pay with Wave Money’ product, facilitating cashless payments from customers to e-commerce companies for goods and services.

In order to meet increasing demand from merchants for integration to ‘Pay with Wave Money’ and make it possible to scale quickly, Wave Money worked with a local Myanmar Company to build an innovative platform that makes it possible for merchants to very easily plug in payment functionality on their web and mobi sites.

Brad Jones

“When we launched Pay with Wave Money, there was a lot of interest from merchants who wanted to integrate cashless payments to their e-commerce websites and apps. However, the process was manual and that was not scalable. We then came up with the idea to build the Developer Portal as the first fintech open API in Myanmar, so merchants can integrate Pay with Wave Money themselves by simply entering specific information and uploading the necessary documents. We can now enable hundreds more merchants much easier and faster. This is a significant step towards building a cashless economy in Myanmar.”

– Brad Jones, CEO Wave Money.

The company’s investment and commitment to enabling digital payments in a market with high smart phone penetration will support Myanmar’s wave of digitization as more consumers look to brands to provide digital solutions to an historically cash based society.

Wave Money partners are also excited about this latest advancement in Myanmar’s fintech industry. Paul Leishman, President of Coda Payments was quoted as saying,

Paul Leishman

“This is an innovative development that will make a great product more easily accessible to partners. And since Coda launched Pay with Wave Money a few months ago the response from customers has been strong, so that’s a good thing. We work with payment channels across Southeast Asia and the Wave Money Developer Portal and API stands out as particularly strong so I’m sure the developer network will grow quickly.”

Wave Money also announced that it will host the ‘Wave Money Merchant Clinic’ inviting merchants and developers to interact with Wave Money staff, ask questions, discuss market needs and challenges and together pave the way for even greater innovation in the fintech industry in Myanmar. Further details on the event will be posted on the company’s Facebook page. Merchants and developers that would like to be notified directly can provide their contact details to any Wave Money call center agent.

The Wave Money Developer Portal can be accessed from https://partners.wavemoney.com.mm and can be used by any merchant in Myanmar.

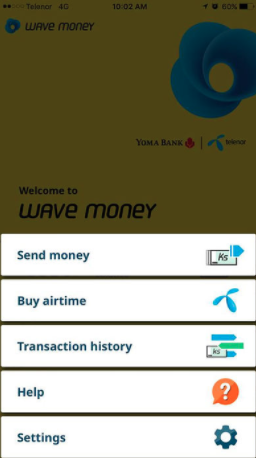

Figure 1. Sign up page for Wave Money Developer Portal

Pay with Wave Money

Cashless payments vastly increases the number of customers that a merchant can reach as very few people in Myanmar have debit and credit cards. For the merchant it also reduces the risk of cash on delivery incase the customer is not available at the exact time of delivery or does not have the exact amount of money needed.

Already Wave Money customers can enjoy the convenience of making cashless payments for Mobile Legends Diamonds, food delivery with Food2U, digital comic books on White Merak app among others. In the last couple of weeks, Wave Money customers have also been paying for tickets to the Yoma Yangon International Marathon using ‘Pay with Wave Money’. In the coming months, customers will be able to pay for more goods and services using Wave Money.

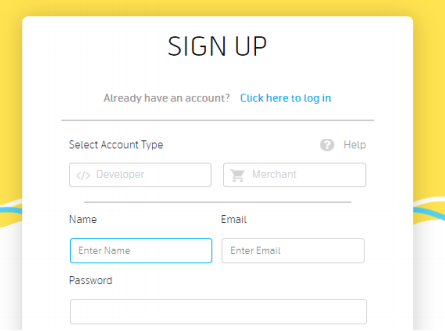

Figure 2. Pay with Wave Money for Mobile Legends Diamonds

For more information about ‘Pay with Wave Money’, the Wave Money Developer Portal or any other Wave Money products, contact the 24 hour Wave Money customer support center on 900 from a Telenor number and 097 9000 9000 from a non-Telenor number.

Featured image via facebook.com/pg/WaveMon