Bandboo’s New P2P Excess Protection Eases The Sting Of Accident Insurance

by Company Announcement October 26, 2017Bandboo, a Singapore-based insurance technology platform startup, announced a new product to protect drivers from costly car excess insurance payments.

Insurance excess, the payment drivers are liable to pay towards a claim made on a car insurance policy, can be significant. Bandboo’s membership-based Car Excess Insurance provides drivers with added protection by reducing or eliminating the excess by providing a pay-out equivalent to the excess charged, up to S$4,000.

Ashley Kee

“While Singapore roads are among the safest in the region, accidents can still happen from time to time. For those who make a living by driving, the risk of an accident occurring inevitably increases as they spend more time on the road.

When this happens, not only is there a loss of income, but they may also be slapped with expensive insurance excess liabilities. This is even more pronounced for independent private hire drivers,”

said Mr Ashley Kee, CEO and co-founder of Bandboo.

“Bandboo’s affordable Car Excess Insurance seeks to take away one of the worries that concern these drivers, giving them peace of mind so they can remain alert and focused while on the road.”

Bandboo’s Car Excess Insurance puts all premium payments, which range from as low as S$4.50 to S$9.00 a day, into a secure common pool. Claims are paid out from the pool, and tracked in a ledger that provides an open, accountable trail that cannot be tampered with.

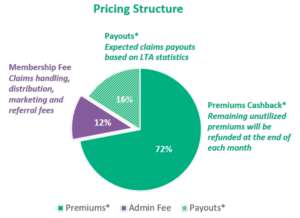

Pricing structure | image via bandboo.co

At the end of the month, all remaining premiums in the pool are returned to customers. The shared ledger tracks all transactions into and out of the pool, allowing members to see, in real-time, the number of members, premiums and claims, and to estimate the amount of cash back they will receive each month.

As all unconsumed premiums are returned, Bandboo covers its costs by charging a membership fee of 12% of the monthly premium amount, which goes towards the technology infrastructure, processing of claims and other operating costs.

Mr Kee continued,

“Having open ledgers ensures that our premium and payout records are highly transparent. They also allow us to give our members cash back on the unused portion of the premium pool with an extremely high level of accuracy and trust. This assures our members that they have been treated fairly and with honesty.”

To learn more about Bandboo’s Car Excess Insurance and how it works, please visit http://www.bandboo.co/.

Featured image via Bandboo facebook page