MAS Unveils 100 Problem Statements For Fintech Festival 2017 Hackcelerator – Infographics

by Fintech News Singapore November 1, 2017Singapore’s annual Fintech Festival is coming back on November 13, 2017 for a week long event dedicated to financial innovation and digital finance.

Organized by the Monetary Authority of Singapore in partnership with the Association of Banks in Singapore and SingEx, the event is set to cover all aspects of fintech and feature some of the world’s leading tech entrepreneurs, senior executives from top financial institutions, policymakers and government agencies.

This year again as part of the Fintech Festival, the Global Fintech Hackcelerator is looking for the most innovative startups from across the globe to address problem statements contributed by the global fintech community and the financial services industry, and build solutions that solve some of the most urging issues in the financial, banking and insurance sectors.

This year’s 100 problem statements are:

24 problems on customer facing

Solving customer facing problems means building solutions used by individuals and businesses to consume and access financial services across multiple sectors such as banking, insurance, and payments.

Solutions would be for instance a system that allows the insurance claims process to be automated. The solution would also enable reduced filling errors and fraud, as well as allow for quicken payouts.

It can be a comprehensive personal finance management tool that enables consumers to understand the fundamentals of personal financial management. The tool would enable tax planning and planning of major life events.

These solutions would use technologies such APIs, machine learning, big data, and robo-advisors to allow insurance firms and financial institutions to better service customers digitally in an interactive, seamless, customer centric way.

19 problems on financial inclusion

In the field of financial inclusion, MAS and the financial industry are looking for solutions that provide individuals and businesses access to useful and affordable financial services.

These include an engaging investor education platform to improve financial literacy, a migrant worker identity authentication platform targeted at those who are unable to provide a proof of residence through a phone or power bill to access basic financial and banking services, as well as solutions for institutions to offer banking solutions and credit to the unbanked.

These solutions would leverage technologies such as big data, machine learning, mobile, blockchain, API and biometrics to provide alternative credit scoring systems to financial institutions, but also cashless payments solutions, micro-investment opportunities and insurance coverage to the under-insured.

19 problems on regtech

Regtech solutions would help financial institutions manage their risks better and fulfill their compliance and regulatory requirements more efficiently.

The solutions would use APIs, biometrics, eSignature, blockchain, big data and artificial intelligence to automate bookkeeping, risk analysis, fraudulent trade detection, and reporting of shares, among other tasks.

A solution could use blockchain technology to streamline anti-money laundering (AML) and know-your-customer (KYC) processes and provide a shared, secure and encrypted industry-wide platform to consolidate and validate information.

Another solution would help banks optimize collateral and risk management, as well as lower the cost of compliance, improve the speed of decision making and enable capital relief through financial structures.

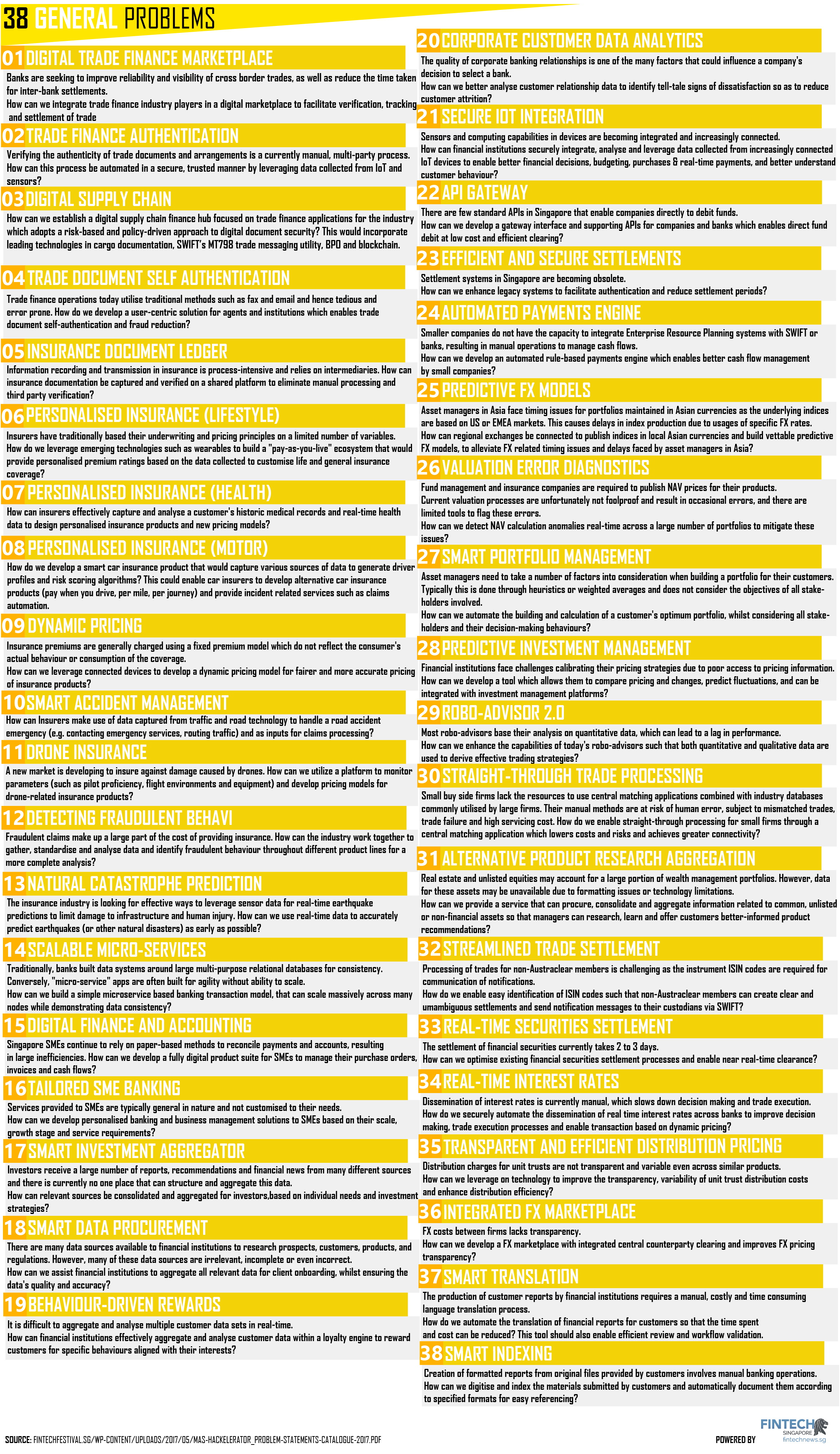

38 general problems

General problems involve for instance building solutions for personalized insurance coverage, drone insurance products, as well as platforms to improve processes in areas such as trade finance and supply chain management.

Using advanced sensors, big data, predictive analytics and telematics, startups can develop personalized insurance products based on data collected from individuals to customize life, general, health and car insurance coverage.

Another solution would leverage distributed ledger technology and mobile payments to improve reliability and visibility of cross-border trades as well as reduce the time taken for inter-bank settlements.

In trade finance, a platform could use blockchain, mobile, sensors, and the Internet-of-Things to automate the verification process of trade documents and arrangements.

The insurance industry could use big data, advanced sensors and predictive analytics to collect and analyze data to accurately predict earthquakes and other natural disasters as early as possible.