ClaimConnect: Aviva Singapore Digitises Claims Process for Group Insurance Customers

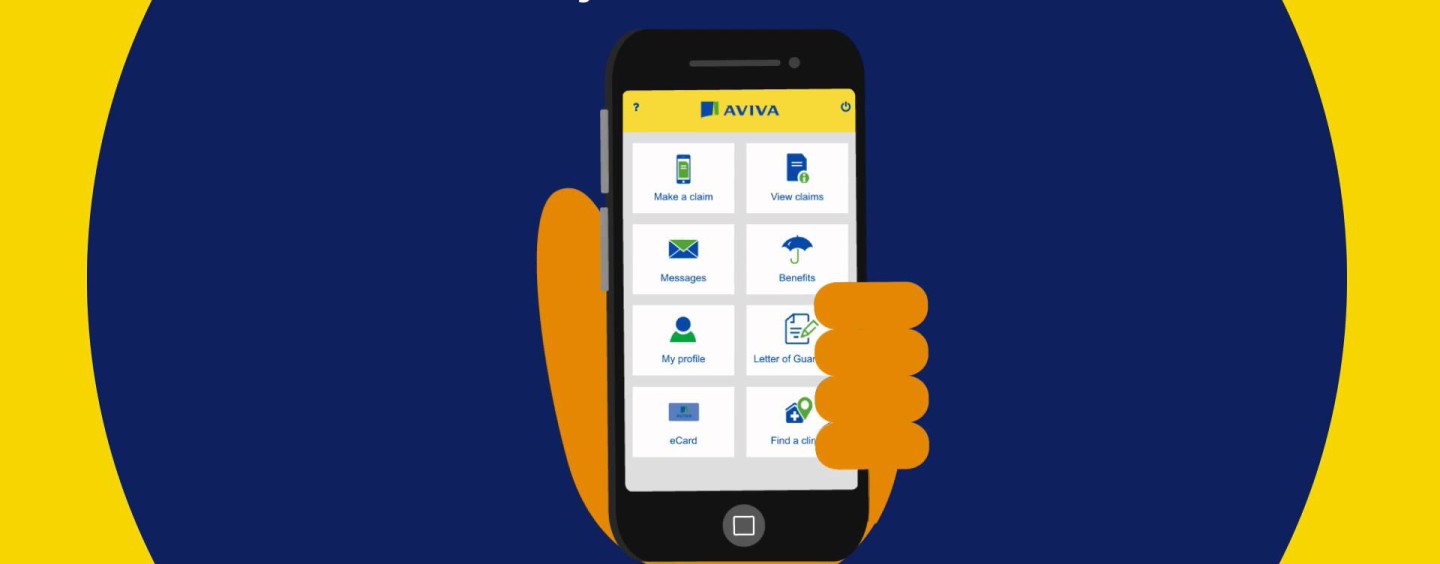

by Fintech News Singapore March 15, 2016Aviva, a leading insurer in Singapore, has introduced Aviva ClaimConnect – a mobile application and portal designed exclusively for its group insurance policyholders. It enables users to locate their nearest panel clinic with ease, and eliminates reliance on paperwork by allowing them to submit employee insurance claims electronically.

Aviva ClaimConnect

The key features of Aviva ClaimConnect are as follows:

Locate the nearest panel clinic in either a list or map view for easy navigation to the clinic

Submit claims electronically with scans of the relevant documents using the camera function on your phone (no additional paperwork required)

Receive updates on the status of claims via instant notifications

Access details of your company coverage for you and your dependants

Claims calculator to determine the claimable amounts of your hospital bill, based on your company’s coverage

View your claims history as well as your dependants’

No longer necessary to carry a physical employee benefits card when visiting a panel doctor (all your details are held on the e-employee health benefits card as part of the mobile app)

‘Digital First’ strategy

In December 2015, Aviva opened its ‘Digital Garage’ in Singapore which reinforces Aviva’s long-term commitment to supporting and promoting digital innovation in insurance in Singapore and across Asia for the benefit of its customers, in line with its ‘Digital First’ strategy.

ClaimConnect marks another milestone for Aviva Singapore in leveraging digital technology. Commenting on ClaimConnect, Mr Lionel Chee, Group Business Director at Aviva said, “This illustrates Aviva’s continued efforts to focus on the needs of our customers and partners by harnessing digital channels. We want to simplify the process and provide our HR partners, brokers and insured employees with an improved customer experience.”

As one of Singapore’s leading group insurers, Aviva receives about 50,000 group insurance claims per month from insured employees and panel doctors. Of this, about 13,000 are direct from employees seeking reimbursement. Since rolling out the digitised service late last year, about 140 companies who are insured with Aviva have already introduced the programme to their employees. 52% of the claims from those employees are now made via e-submission.

Shorter turnaround time, reduced paperwork, greater efficiency and less dependence on manual processes are among the key benefits of this environmentally friendly initiative.

Mr Chee elaborated, “ClaimConnect benefits HR personnel through greater ease and efficiency, and improving overall management of their employees’ claims. Apart from doing away with paperwork, HR can now conveniently perform a range of tasks such as managing the company’s insurance coverage and generating relevant reports.

“The claims process for insured employees is also significantly easier now that the whole process has been digitised. The straight-through process and instant notification shortens the turnaround time. With the claims calculator as well as access to coverage details and claims history, employees can manage their medical expenses and claims with more clarity.”

Mr Chee also shared that the insurer is pleased with the progress they have made with digital innovation to provide better services to customers and partners, and will continue to harness digital channels to make Aviva one of the easiest insurers to work with.