Small and medium enterprises (SMEs) in the Association of Southeast Asian Nations (ASEAN) region are looking to invest more in technology in order to raise productivity and remain competitive, according to a report by EY, United Overseas Bank (UOB) and Dun & Bradstreet (D&B).

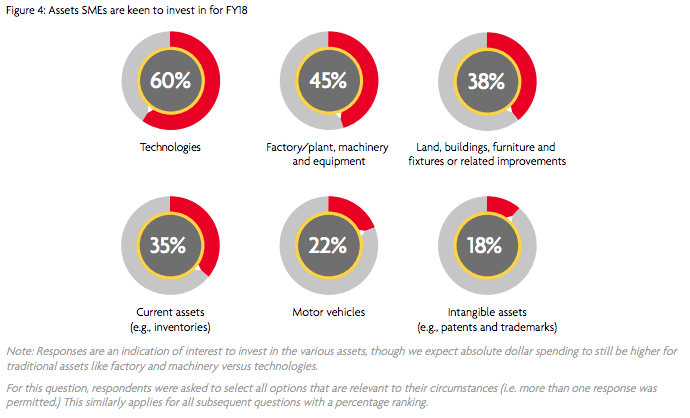

According to the ASEAN SME Transformation Study, 60% of the 1,200+ SMEs surveyed for the study said they will focus their investments on technology in 2018 to help drive business performance and raise productivity.

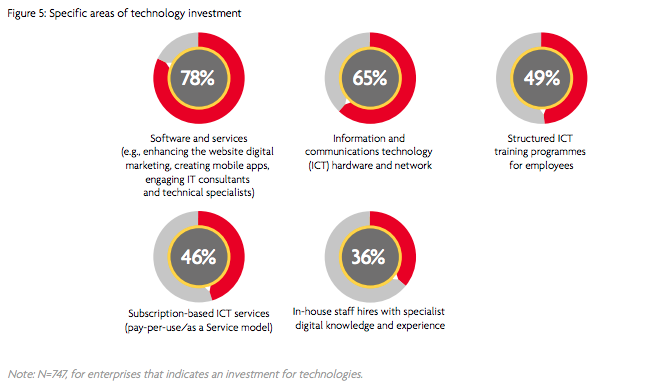

More specifically, 78% said they will invest specifically in software such as improving their websites and creating mobile apps, and 65% in hardware and infrastructure.

However, only a few SMEs in ASEAN realize the potential that pay-per-use or software-as-a-service (SaaS) for use in business processes such as accounting, invoicing and payroll, can offer to address their banking needs.

“Their preference for traditional licensed software could be due to their familiarity with these options over newer solutions such as SaaS,” said Lawrence Loh, head of Group Business Banking, UOB. “However, SaaS is often more cost-effective and enables the business to keep pace with technology advances.”

“There is significant opportunity for SMEs in the region to improve their digital agility,” said Liew Nam Soon, managing partner, EY ASEAN Markets, Ernst & Young Advisory.

“SMEs have typically been cautious in adopting cutting-edge applications. But that is changing as we see disruptive offerings such as robotics process automation, artificial intelligence and 3D printing beginning to rouse the curiosity of SMEs.

“In time, we expect that SMEs will increasingly subscribe to web-hosted applications to free themselves from managing IT functions internally.”

The study also found that despite global economic challenges, small businesses are generally optimistic, with more than half anticipating revenue growth and 26% projecting a double-digit expansion.

‘This optimism reflects the region’s positive environment – nations experiencing muted growth are approaching the tail end of their economic slowdown and restructuring while those approaching a ‘demographic sweet spot’ will benefit from multiple factors to fuel SME growth,” said Audrey Chia, CEO of Dun & Bradstreet Singapore.

“Technology will be the catalyst for growth and transformation. Enterprises must continually progress through proactively implementing productivity improvements, upskilling talent and embracing technological enablers to enhance and differentiate their product and services.”

As for their banking and financial needs, only 47% said they were satisfied with their core financial provider, but 37% said they wanted deeper engagement and holistic business advice.

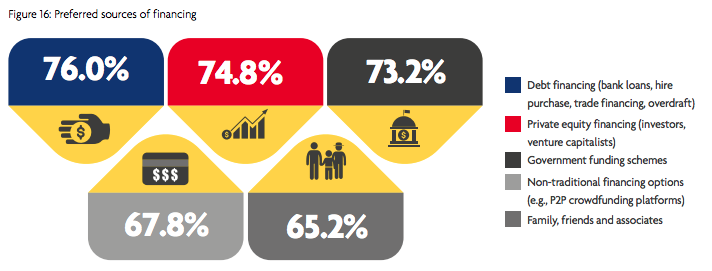

Almost three-quarters of respondents had at least one existing loan in 2017, mainly to raise working capital or cash flow to support growth. But while SMEs remain primarily funded through bank loans, tighter covenant enforcement and tough credit requirements have forced many to turn to other sources of funding.

Nearly 68% of respondents said they were open to non-traditional lenders, citing the main appeal as the much faster loan approval process with some alternative lenders capable of performing credit underwriting processes to qualify applications based on borrowers’ risk scores in almost real time.

This opens up opportunities for non-bank digital SME lenders, such as peer-to-peer lending and crowdfunding platforms to offer merchant and e-commerce financing, invoice financing and online trade financing specifically tailored for SMEs.

Alternative financing platforms in the region include Crowdo, a platform launched in 2013 with offices in Singapore, Kuala Lumpur and Jakarta, CoAssets, Southeast Asia’s first listed crowdfunding site, and Funding Societies, one of Singapore’s top crowdfunding platforms.