20% of Financial Service Business at Risk to Fintechs by 2020

by Fintech News Singapore March 28, 2016Financial technology companies are shaping the financial services industry from the outside in, and more than 20% of traditional players being at risk to fintech companies by 2020, according to a new report by PowerwaterhouseCoopers (PwC).

In a new report entitled ‘Blurred lines: How fintech is shaping financial services’, Big Four auditor PwC argues that traditional financial services companies are being challenged by new entrants that are leveraging technology to provide products and services that are more suitable for today’s consumers’ needs and habits.

In a new report entitled ‘Blurred lines: How fintech is shaping financial services’, Big Four auditor PwC argues that traditional financial services companies are being challenged by new entrants that are leveraging technology to provide products and services that are more suitable for today’s consumers’ needs and habits.

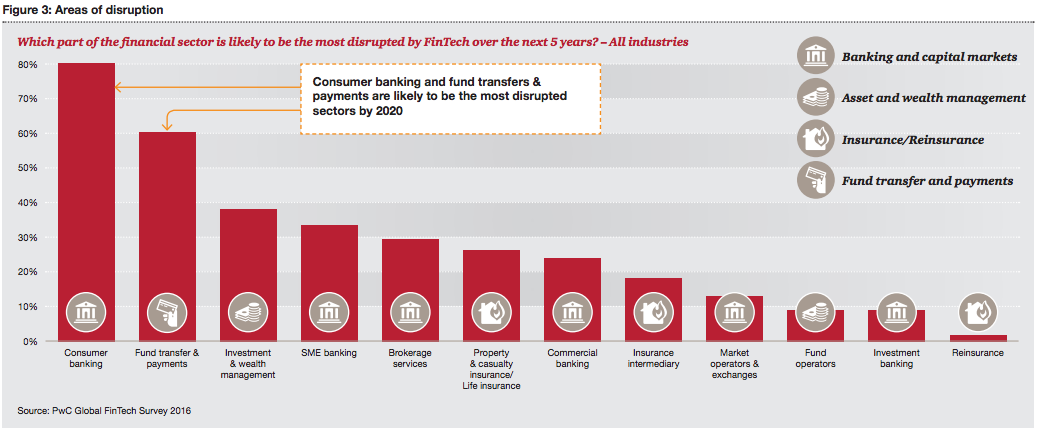

The survey, which interviewed 544 top senior executives from the financial services industry and the fintech sector from 46 countries, found that respondents majorly believe that consumer banking and payments are the two sectors that are likely to be the most disrupted by 2020.

“In consumer and commercial lending, for example, the emergence of online platforms allows individuals and businesses to lend and borrow between each other,” the document reads. “Lending innovation also manifests itself in alternative credit models, use of non-traditional data sources and powerful data analytics to price risks, rapid customer-centric lending processes, and lower operating costs.”

Similarly, the payments industry has also experienced a “high-level of disruption” with the increase of new technology-driven payments processes, new digital applications facilitating payments, alternative processing networks and the increased use of electronic devices to transfer money between accounts.

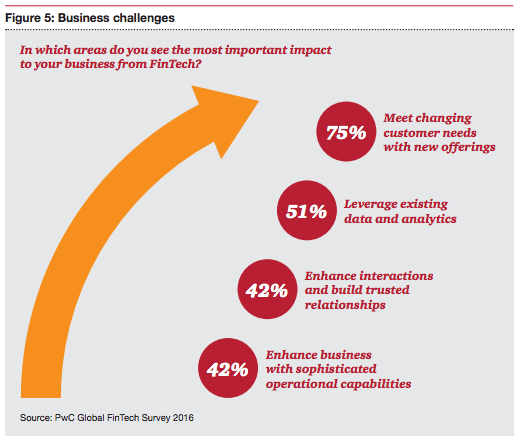

More precisely, fintech is disrupting the financial services industry with solutions that can better address customers’ needs by offering accessibility, convenience and tailored products, it says. “In this context, the pursuit of customer centricity has become a main priority and it will help to meet the needs of digital native clientele.”

Incumbents are aware of the threats and opportunities related to the rise of fintech. 67% of respondents named pressure on margins as the top threat, followed by the loss of market share (59%).

On the other hand, 73% of respondents ranked cost reduction as the main opportunity related to the rise of fintech, followed by differentiation (62%) and improved retention of customers (57%).

In response to this rapidly changing environment, incumbents have approached the fintech challenge in different ways. 32% said that they have partnered with fintech firms, 15% have set up startup programs, 14% have launched venture funds to invest in fintech startups, 11% have launched their own fintech subsidiaries and 9% said they have acquired fintech companies.

Overall, 78% of CEOs said they support the integration fintech at the top levels of management, and 60% of respondents said they have put fintech at the heart of their strategy.

Blockchain: an untapped technology rewriting the rulebook

Although blockchain technology shows a lot of promises notably by increasing efficiency, speed, and streamline processes, incumbents are still relatively unfamiliar with the technology, with 83% stating they are “moderately” familiar with it.

While 56% of respondents believe that the technology is important, 57% are still unsure or unlikely to respond to the trend, the survey found.

“Distributed ledger technology offer financial services institutions a once-in-a-generation opportunity to transform the industry to their benefit, or not,” PwC says.

The firm argues that the lack of understanding of the technology and its potential for disruption poses “significant risks” to the existing profit pools and business models. It advises financial services firms to be pro-active, and identity and respond to the various challenges and opportunities that this “transformative technology” offers.

Earlier this year, PwC formed a new team of technology specialists to exploit and commercialize blockchain technology in response to banks and financial institutions’ growing interest in the technology.

“There’s clear evidence that banks, institutions and even governments are looking at blockchain technology as a secure store and distribution solution,” Steve Davies, PwC partner and EMEA Fintech Leader, said in January.

“Now there is growing interest and a real demand from our clients to help understand the implications of blockchain and how to respond to it. So, as the blockchain juggernaut continues to gather pace, PwC will be well placed to service our clients’ needs at a global level,” Davies said.

Alongside its dedicated blockchain team, PwC has also partnered with leading blockchain solutions providers to extend its offering. Partners of PwC include Blockstream, a company specialized in sidechain solutions; Digital Asset Holding, a blockchain company that provides settlement and ledger services for financial assets; and Eris Industries, which specializes in smart contracts solutions to help businesses automate processes.

Read PwC’s ‘Blurred lines: How fintech is shaping financial services’ report: http://www.pwc.com/gx/en/advisory-services/FinTech/PwC FinTech Global Report.pdf

Here you can see a video summary

Featured image: Financial Internet Technology by Rawpixel.com, via Shutterstock.