Fintechnews.PH picks every Friday for you the top 5 Fintech Philippines News of the week:

Follow the Fintech Philippines Facebook or Twitter channel to stay updated.

Also, you can subscribe to our monthly Fintech PH Newsletter here.

Here we go:

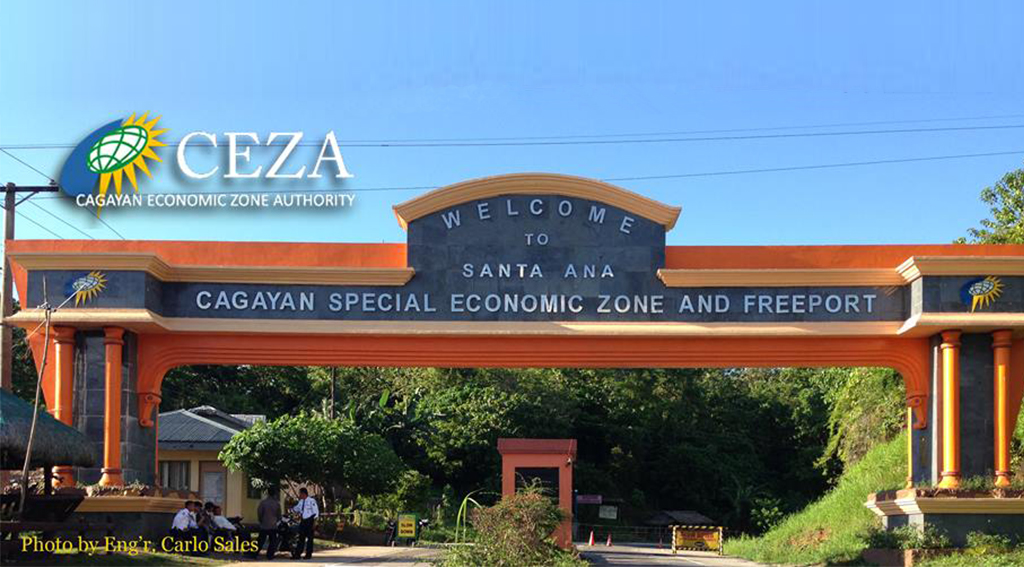

Creation of a Fintech City to Push Fintech in Philippines

The plan to create a “fintech city” in the Philippines will be pushing through as rules and regulations have been issued by the Cagayan Economic Zone Authority (CEZA), a government-owned and-controlled corporation tasked to manage and supervise the Cagayan Special Economic Zone and Free Port (CSEZFP) development.

The upcoming hub will be built within the CSEZFP that will house a fintech startup incubator, cryptocurrency mining farm, cryptocurrency exchange, and a blockchain center.

CEZA’s regulations will also include licensing of ICO projects. About 15 parties engaged in virtual currency, and blockchain, are seeking to operate within the first Philippine fintech hub.

See CEZA’s main rules here

BSP’s fintech regulatory unit okayed

The Monetary Board of the Bangko Sentral ng Pilipinas (BSP) has approved the creation of a regulatory subsector for fintech companies.

BSP Deputy Governor Chuchi G. Fonacier told the BusinessMirror, the new subsector will be under her department, adding one new division to the existing four. No positions have been given to the department yet. She said the unit is meant to ensure a level and safe playing field for the fintech firms given their growing influence in the banking scene.

Korean blockchain firm GLOSFER to build crypto exchange in Philippines

In photo are (from left) Kim Byungcheol, VP of GLOSFER; Park Rae-hyun, CEO of COINVIL; Chang Joonhyuk, Executive of COINVIL

Korea-based GLOSFER, which claims to be a first-generation blockchain company, is set to build a cryptocurrency exchange in the Philippines through its partnership with COINVIL.

GLOSFER disclosed, COINVIL will establish and operate a local corporation in the Philippines, while GLOSFER plans to build a cryptocurrency exchange and provide all solutions necessary for operating the exchange.

GLOSFER will also join efforts with COINVIL in formulating security policies and establishing a security system to help build a transparent and safe trading market.

“The Philippines will become the largest cryptocurrency trading market that connects Europe and Asia,” said CEO Park Rae-hyun of COINVIL. “Many countries across the globe already have a favorable view on the Philippines. By combining our infrastructure and sales capabilities with GLOSFER’s solutions and operations expertise, we will gain a competitive edge over others.”

Aussie firm Peppermint unveils new remittance tech in Philippines

Australia-based Peppermint Innovation Ltd has launched its new online international remittance portal, Bizmoto, aiming to leverage off its burgeoning Philippine mobile-banking platform.

Bizmoto, which roughly translates into “Your Business” in Filipino language, allows money to be transferred from Australia to the Philippines and is initially focussing on enabling ex-pat Filipinos living in Australia and their affiliates to easily transfer monies back to family and friends who are living in the Philippines.

This latest development makes the Philippines as a runway for Peppermint’s new remittance technology, as the ASX-listed company noted that “Bizmoto is in live pilot phase focused first on the Australian-Filipino remittance corridor before broad scale commercialisation across multiple corridors and other major markets.”

Peppermint added the Philippines was the fifth-largest international remittance market for Australia. Based on data collected by the World Bank, Australians transferred almost US$1 billion to the Philippines in 2016, out of a total of US$16.2 billion remitted around the globe.

Floyd Mayweather backs ride-hailing service U-Hop

Floyd Mayweather (center) during the announcement of his firm’s investment in U-Hop. Photo from Tech in Asia.

Boxing superstar Floyd “Money” Mayweather has made an undisclosed amount of investment in Manila-based ride-hailing app U-Hop, a local rival company of Grab.

A spokesperson for U-Hop told Tech in Asia that TMT is the only disclosed investor, and that the funding will be used for business expansion in Asia and North America.

U-Hop brands itself as an app-based on-demand car service and the cheapest choice for safe, reliable and affordable transportation. For a monthly membership of P3,999, passengers are given access to 40 prioritized rides anytime and anywhere around Metro Manila.