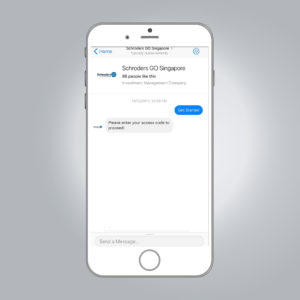

Schroders announced at its inaugural “Schroders Innovation Day” the official launch of Schroders GO, the asset management industry’s first online chatbot operating through Facebook Messenger, after successful beta testing that began in January 2018.

Schroders GO offers real-time communication to the firm’s intermediary client base, allowing clients to access information on all mutual funds recognised for sale in Singapore – not just Schroders’ – as well as financial markets and market views, without the need to download an additional app. The chatbot will gradually become accessible to most of Schroders’ intermediary clients in Singapore.

Lieven Debruyne

Lieven Debruyne, CEO Schroders APAC, said:

“Today’s official launch of Schroders GO marks a milestone for Schroders’ ongoing endeavour to innovation.

As the first asset manager in Singapore to digitalise the client service experience, we will continue to leverage our expertise in financial services and technology, in collaboration with our partners, to offer the best investment solutions to our clients, and help Singapore become a leading Smart Nation.”

Susan Soh

Susan Soh, Country Head of Schroders Singapore, said:

“Singapore is a well-equipped country with excellent local network, abundant talent pool and favourable government support, providing a sound environment for the development of financial technology (fintech).

Schroders is pleased to be one of the pioneers in this space, and the launch of Schroders GO is a prelude to our growing journey in this field. We are committed to providing more customised solutions that cater to our clients’ needs in Asia and globally.”

Since the beginning of the year, Schroders has worked closely with four primary partners – namely Citibank Singapore, NTUC Income, UOB and Synergy Financial Advisers – to optimise and improve the functionalities of Schroders GO. About 100 users across the four partners played an integral role in optimising Schroders GO during the beta period.

The chatbot has now been upgraded with new features such as Investment Linked Policies (ILPs) data and information on the Central Provident Fund Investment Scheme (CPF-IS). Schroders has also since further optimised the presentation of fund performance data (including non-Schroders funds), charts and market information in Schroders GO, to create greater convenience and relevance to its users.

Susan Soh concluded:

“We would like to express our heartfelt gratitude to our major partners, for their participation as it was vital in ensuring that the chatbot was of top quality. Schroders will continue to work closely with our clients to tailor the offerings based on their needs, and roll out supplementary features in phases by the end of this year.”

Schroders will gradually roll out Schroders GO to eligible intermediary clients in Singapore by the end of the year. Clients who have signed up will be provided with access for key users within the company, such as relationship managers and sales managers.

Schroders will gradually roll out Schroders GO to eligible intermediary clients in Singapore by the end of the year. Clients who have signed up will be provided with access for key users within the company, such as relationship managers and sales managers.

Supported by machine learning and natural language processing capabilities, Schroders GO is able to process both simple and multi-dimensional inquiries with topics ranging from funds, Schroders as a firm, external market information, to general contextual questions. It is available in English and is able to understand Singlish.

The Schroders Innovation Day 2018 was held in Singapore on 23 May 2018, gathering executives from institutional, intermediary, private banking and wealth management sectors, as well as tech innovators, to discuss the latest technological breakthroughs in the financial industry.

Featured image via Freepik