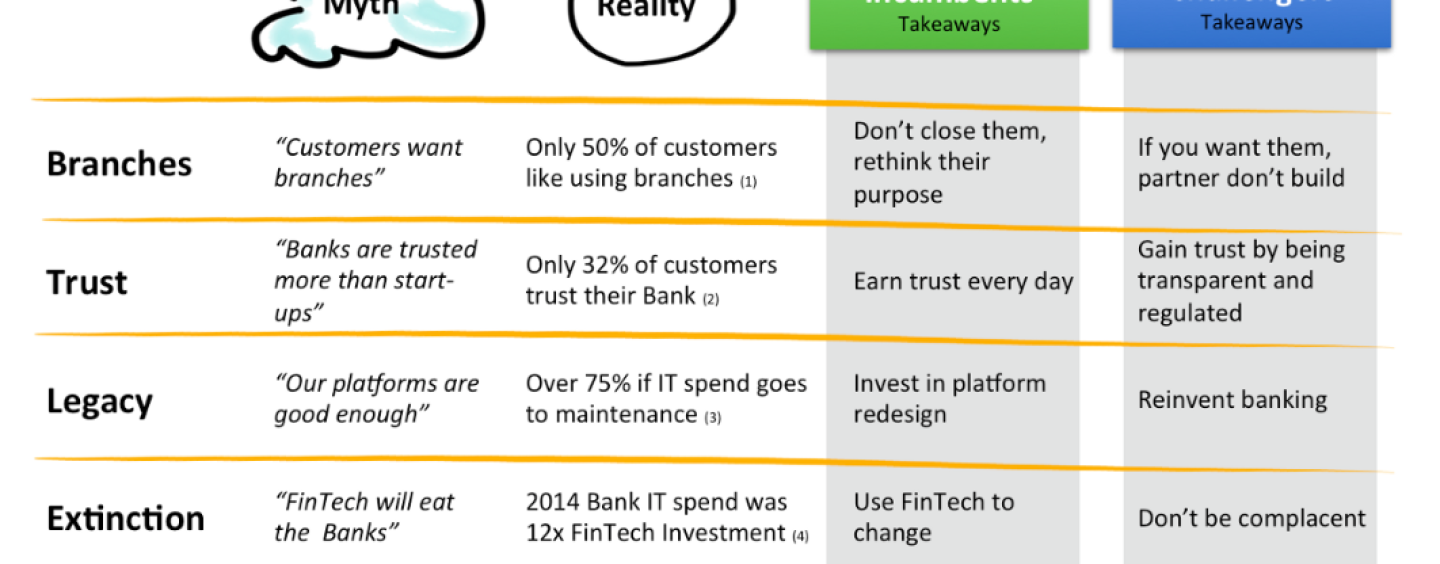

The technology and digital disruption on banking and financial services will profoundly change a very large, extremely profitable and well-established industry. Alessandro Hatami, a serial corporate entrepreneur with a passion for generating growth through digital innovation in payments and financial services, had observed and shaped his view about this big change through “Banking Myths”. There are 4 of them: (1) Customers still want human beings interaction at bank branches instead of robo interaction; (2) Banks gains more trust than FinTech start-ups; (3) Banking platform is able to be improved to satisfy any customers’ banking expectations and (4) FinTech identities will replaces the traditional bank.

Below is details of his opinion on Banking Disruption Myths proving facts.

Banking Disruption Myth 1: Customers Want Branches

“Customers will always want to speak to a human being and the branches are a bank’s greatest asset.”

Branches are staffed by committed, intelligent and knowledgeable professionals, keen to serve their customers, but saying that most customers want to speak to someone about their financial matters is simply not true.

FACT: A recent CapGemini EFMA report says that only half of the banks’ customers want to go to a branch to buy any banking products — an expensive channel to maintain in order to serve 1 in 2 customers.

Branches today do not provide customers with the convenience and transparency that a well-designed digital proposition, together with a simple internet search can provide. The comfort provided by a friendly conversation in branch is becoming increasingly less important to customers as they put ease of transacting ahead of human interaction.

Furthermore, the purchase of a banking product is also often just as fast, or even faster, online than in branch. With few exceptions (see Metrobank in the UK for example), the customer does not get a fully operation bank product any more quickly when going to the branch.

That said, there is and will be a long term role for branches. The great work done by Swedbank with their branches is a good example. Branches will not vanish but it’s not going to be business as usual.

Banking Disruption Myth 2: Banks Are Trusted More Than Start-ups

“It is difficult for a new bank to recreate the trust relationship that banks have built with their customer through the years.”

This may come as a surprise to banks, but their customers no longer trust them.

FACT: a recent survey by PwC finds that today only 32% of customers trust their bank.

It used to be that your local bank staff knew their customers by name and the local branch manager was able to offer a personal touch that customers valued, but that is no longer the case. The long-serving bank manager is long gone and so has customer trust.

And it’s not just consumers but also businesses:

FACT: A recent survey by EY shows that 38% of UK SMEs would use a non-bank for banking services.

Lastly, regulators worldwide see their support of the emerging FinTech sector as an effective way of injecting more competition into the banking sector. They are working more closely with start-ups than ever before, making them safer for customers to engage with. And customers are increasingly aware of this.

Banking Disruption Myth 3: Our Platforms Are Good Enough

“The banks’ IT platforms are able to meet the challenges of the digital age — with small changes here and there they can meet any market and customer expectation.”

The banks’ legacy platforms are powerhouses. Daily, millions of payments, transfers, balance inquiries and other financial transaction are processed mostly with very few errors or inaccuracies. These platforms have grown organically adding layers of capability and complexity to core applications that were created many years ago.

Today, when incumbent banks develop new digital propositions, these usually point to legacy platforms that were not designed for online and mobile banking. These platforms are able to fulfil todays’ needs even though IT platform failures are not uncommon. But their performance in a prevalently digital world, where customers will attempt to access their data at a frequency far greater than today, is uncertain.

FACT: Globally Celent forecasts the Banks’ global IT spend in 2015 will be $197B of which over 75% will be used for maintenance of legacy platforms.

Maintaining legacy platforms is often what the majority the IT spending in a big bank is dedicated to, making innovation a secondary consideration. Are banks investing in faster horses rather than cars?

Banking Disruption Myth 4: FinTech will eat the Banks

“The incumbent banks are so entrenched in their ways that they will not be able to respond to digital disruption — they are doomed and new players and business models will replace them.”

This view is often expressed by Fintech entrepreneurs and their VC partners — and is a dangerous myth to believe in. The incumbent banks are formidable forces with huge customer bases, very deep pockets, a track record of delivering difficult things well and the ability to afford very smart people. The big banks see the effect of digital disruption as well as anyone else and they are responding.

It is true that they are constrained by the size of their success. It takes courage for the banks’ leaderships to look at colleagues, customers and shareholders and propose a radical redesign of their business, facing layoffs, huge development bills, channel conflict and most likely a good number of angry customers, when they are still making good profits.

The approach of the big banks has been very cautious — they are slowly innovating their front end, making incremental improvements to their systems and making small investments in FinTech. They are also slowly engaging with their FinTech competitors through dedicated funds or business accelerators; good examples of which are Santander Innoventures,Wells Fargo Accelerator and the Barclays Accelerator.

The outcome of this approach may after all succeed. In a world where money matters let us not forget that:

FACT: in 2014 Banks spent $180b on IT only, in the same year the Accentureestimated that the whole Global VC spend on FinTech was of $12.1b (up from less than $4b the previous year).

Banks may be slow and bureaucratic, but size, millions of customers bases and financial strength are good weapons to defend a business with.

Banking is going through profound change and the industry landscape we know today will be very different in a few years. The four myths discussed here point at two main errors of judgement when facing a challenge: Overestimating our own capabilities (Myths 1 and 3) and underestimating our opponents’ (Myths 2 and 4).

In the digital age, where a business sees the impact of a wrong decision instantly, getting it right quickly is crucial. Like in the travel, music and retail industries, banking businesses that get it wrong will not get a second chance.