DBS Bank Report: Blockchain Technology to Unlock Southeast Asia’s Potential

by Fintech News Singapore April 19, 2016The most transformative blockchains will be those that can work across geopolitical boundaries and Southeast Asia has the most potential that can be unlocked with this technology, according to a new report by DBS Bank.

“Asia’s geopolitical context is unique globally – the region consists of loosely coupled countries who want to trade with each other, yet levels of trust between countries are disparate, preventing the region from realizing its potential,” states a paper by DBS Bank.

“We now have the technology for trust. With political will, investment, and industry collaboration, we believe that blockchains can improve the way.”

The report, entitled ‘Understanding Blockchain Technology And What It Means for Your Business,’ addresses distributed ledger technology and explores how it can improve the way business is conducted.

The report, entitled ‘Understanding Blockchain Technology And What It Means for Your Business,’ addresses distributed ledger technology and explores how it can improve the way business is conducted.

According to DBS Bank, blockchains have the greatest potential to increase productivity in Asia if applied regionally.

“Before blockchains, we needed to trust entities,” the document states. “With blockchains, trust is assured by mathematics and systems instead. In a region where trust in entities, including companies and governments, is low, blockchains have the biggest potential for impact.”

Singapore, which is looking to build a smart nation, could use blockchain technology to replace centralized registries. “With political will, Singapore can lead the way in creating trusted, tamper-proof repositories,” the bank says.

“Share registries, property, assets, insurance, and national identity can all be stored in secure blockchains, allowing for easier verification of ‘the truth’, reduce settlement times when assets change hands, and by using smart contracts, even automated title transfers could be done when specific parameters are met.

“Digital identities can be used across systems without systems necessarily touching or interacting. One blockchain for identity, that is validated against when needed, and with the user in control of which data is shared with the merchant.”

In situations where trust levels are low, due to differences in operational and regulatory landscapes, the transparency offered by blockchain could help by making the lack of trust less of a hurdle in these interactions. With trade data published to a common platform, regulators or other interested parties can plug into this and get a real time view of the trades.

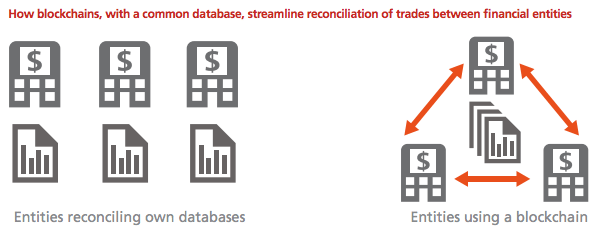

Blockchain technology could improve efficiency when financial entities are reconciling trades and help speed up payment between financial entities.

Infographic by DBS Bank, via ‘Understanding Blockchain Technology’ report

That being said, blockchain still needs to overcome a number of hurdles to reach mainstream adoption. It needs to “prove itself before conservative businesses take the plunge.”

“We are still in the early stages as the technology is still immature and hasn’t yet been proven at scale,” the report concludes.

Singapore’s DBS Bank has been investigating blockchain technology since early 2015, organizing blockchain hackathons, sponsoring startup acceleration programs and collaborating with other institutions.

In December 2015, DBS Bank announced a partnership with Standard Chartered to create a distributed ledger project for trade finance. The announcement came after the two banks successfully tested the technology among themselves before proceeding to develop the platform further.

DBS Bank is Southeast Asia’s largest bank, reporting US$319b in total assets as of September 2015.

Read the full ‘Understanding Blockchain Technology And What It Means for Your Business’ report: http://www.dbs.com.sg/treasures/aics/GenericArticle.page?dcrPath=templatedata/article/generic/data/en/GR/022016/160225_blockchain.xml