Singapore’s Path to Digital Economy Still Facing Some Roadblocks

by Company Announcement July 25, 2018Use of mobile banking has overtaken physical branch interactions by 15% during the past 12 months, according to the J.D. Power 2018 Singapore Retail Banking Satisfaction Study.

It is clear that Singapore’s Smart Nation journey to digitally transform its banking sector is well on course; however, there are a number of roadblocks to overcome before Singapore can truly be considered a digital and cashless economy.

Despite the mobile banking channels making significant progress, the user experience still has a way to go. Among mobile banking customers, 46% indicate having experienced a problem with their mobile banking app, such as long loading times and login problems, which is a higher percentage than the 43% in 2017.

“As banks continue to evolve the mobile banking user experience and digital offerings, they need to place the customer at the heart of their transformation. This may not only help to improve the perception of the bank as customer-oriented and innovative, but also deepen the relationship with their customers and build trust,”

said Anthony Chiam, Regional Practice Leader, Financial Services at J.D Power.

Building trust and confidence becomes even more crucial, as 41% of customers not yet using mobile banking app cite security and trust as the primary reason, an increase of 7 percentage points from last year.

Customers are facing an abundance of choice, amplified even more by disruptions in the industry, such as the trend toward virtual banking. Among customers who say they would be open to virtual banking—banking with no physical branches—52% indicate they would do so with an entity outside of the banking sector, such as fintech or technology companies; however, 66% of customers say they will remain with their current bank even if all of its physical branches were closed.

Following are additional key findings of the study:

- Overall satisfaction has increased: Customers are more satisfied with their primary banks in

2018, compared with last year (755 vs. 736, respectively, on a 1,000-point scale). - Popularity of peer-to-peer mobile payment services: Nearly half of customers have used PayNow in the past 12 months. The study also finds that 64% of bank customers use at least onemobile wallet or payment app, which is higher than in Hong Kong (52% in 2018)1 and Australia(19% in 2017)2.

- Apple Pay ranks highest in satisfaction among mobile wallets: The most frequently used apps are DBSPayLah! (28%); ApplePay (13%); GrabPay (12%); and NetsPay (12%).

- Key reasons for choosing a bank: Attractive interest rates (21%) is the primary reason for selecting a bank, followed by the branch being conveniently located near the customer’s work / home (18%) and trust in the bank (14%).

Study Rankings

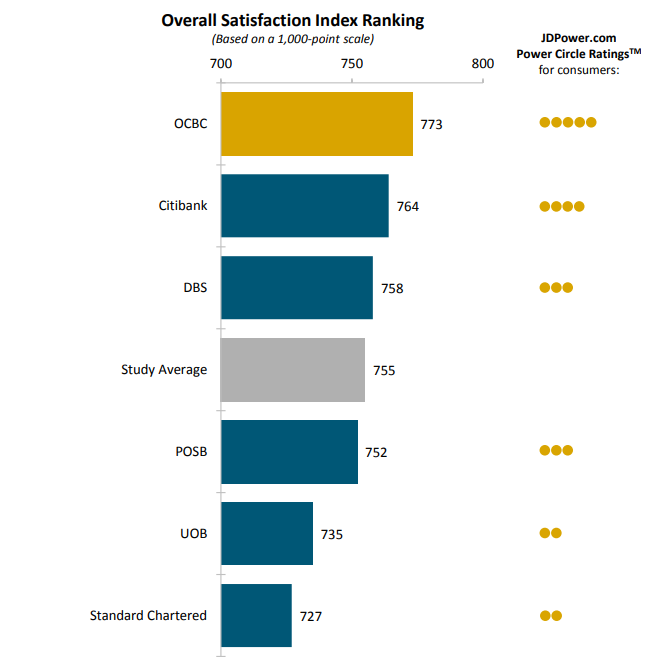

OCBC ranks highest in retail banking customer satisfaction with an overall score of 773. OCBC achieves the highest score in two of the six study factors: account activities and facility. Citibank ranks second with a score of 764 and DBS ranks third with 758.

OCBC ranks highest in retail banking customer satisfaction with an overall score of 773. OCBC achieves the highest score in two of the six study factors: account activities and facility. Citibank ranks second with a score of 764 and DBS ranks third with 758.

The 2018 Singapore Retail Banking Satisfaction Study examines customer satisfaction with the products and services provided by their primary financial institution. The study measures overall satisfaction in six factors: account activities (42%); account information (18%); facility (14%); product offerings (12%), fees (10%); and problem resolution (5%).

The study is based on responses from 2,520 retail banking customers. Coverage includes eight major banks in the market, six of which are rank-eligible, with scores based on customers’ primary bank experiences. The study was fielded in May through June 2018. J.D. Power conducts a series of retail banking studies across key financial markets, including Australia, Canada, China, Hong Kong and the United States.

Featured Image via Pixabay