The benefits of IoT span three particular categories, namely the Industrial 4.0 Revolution, smart cities and consumer IoT. Excluding Japan, the IoT market in Asia Pacific is expected to grow from US$250 bil to US$583 bil by 2019.

Meanwhile global spending on IoT is expected to hit nearly US$1.4 tril by 2021, up from US$8000 bil in 2017, the technology research firm International Data Corp reports.

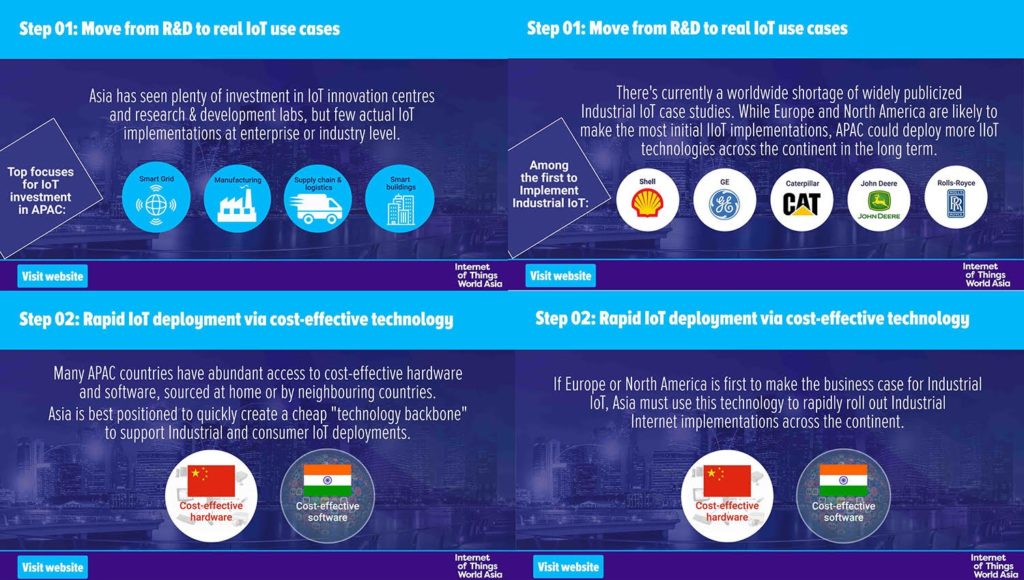

Yet despite the staggering growth trajectory much of Asia’s investments are largely geared towards investments in IOT Innovation centres. Here are 10 helpful tips for the industry to drive IOT adoption

Step 1 : Shifting Gears

In order for the sector to grow, the industry needs to shift from research towards deploying real life IOT use cases.

Surrounded by an abundance of low-cost manufacturing hubs like, Thailand, China, Malaysia, Taiwan and mainland China – Asia is in a prime position for rapid IOT deployment via cost effective technology.

Step 2- Deploying cost-effective technology

Since Europe and North America have already proved the business case for industrial IoT, Asia need only ride on that position to roll out industrial IoT for its manufacturing sectors.

Most of the technologies used in IoT is existing technology. This makes it possible for cost-efficient software and hardware to be procured from countries like China and India to accelerate IoT adoption.

China itself has developed a dedicated intelligent industrial IoT zone that serves as a hub for companies to develop smart manufacturing capabilities in artificial intelligence, smart logistics and intelligent finance, to name a few. The more such initiatives are launched within Asia, the better positioned Asia will be to serve as a technology backbone to support industrial and consumer IoT deployment.

Step 3 – Shedding legacy processes

The more foundational step seems to be the willingness by government agencies and organisations to shed legacy processes, which often stand in the way of new technology adoption.

A workable approach is the ‘continuous transformation’ practice. Instead of keeping legacy processes wholesale, firms can complete gradual changes through creating ways of investing in progressive improvements and integrating new technology at planned intervals.

The faster government agencies and organisations can shed legacy processes and increase digitalisation, the faster they will be able to take advantage of IoT solutions for greater efficiency.

Step 4 -Education

Businesses and citizens too need to be educated on IoT’s benefits. This is especially where cost remains a significant barrier to wider IoT adoption. Only 8% of enterprises in Indonesia, for instance, are said to have adopted IoT technology in their businesses due to the cost factor.

“Enterprises need to invest a fair bit of resources to adopt IoT successfully,” says Irza Suprapto, director at Asia IoT Business Platform.

“[Additionally], having supportive government policies, strong connectivity infrastructure and leading edge technology minimises the risks business leaders take in adopting IoT projects.”

Governments’ roles in educating businesses and other stakeholders can be exercised, for instance, through the organising of programs and industry events to attract key experts and other interested parties to the fray.

Step 5 – Government buy-in

Government have a further role to play by investing into infrastructure development, programs, and other initiatives promoting IoT use.

IoT is one of the key forward initiatives that will help economies around the world maintain or increase their competitiveness. Currently most governments around the world are trumpeting Industry 4.0 initiatives in a bid to keep pace with rapid digitalisation

Singapore’s Smart Nation policy, for instance, has the key aim of leveraging IoT to correct an impending labour lack caused by its aging population, yet it is by no means the only one.

As a whole, its Smart Nation objectives are: mobility, smart industry, smart health, smart building and environment and smart governance. Sustainable economic growth is growth that contemplates all these objectives within its purview.

In this sense, it is apparent that governments will have a number of roles to play: not least of all, as regulators, agenda setters, educators and adopters.

Step 6- Avoiding fragmentation

On a national level, there needs to be collaboration between the private and public sectors to identify key challenges, formulate corresponding policy strategy, conduct R&D, and conceptualise potential projects and proof-of-concepts, among other things.

Internationally, countries also need to facilitate knowledge-sharing across the region. Although it may be difficult for digital infrastructure between countries to be completely streamlined, cross-border initiatives like the ASEAN Smart Cities Network could advance progress.

Smart city solutions in this planned network stretching across Vietnam, Malaysia, Thailand, and Singapore harness the benefits of IoT to tackle urban issues there. Such a collaboration would require open data platforms as well as the sharing of talent between countries to take place.

Step 7: Comparing national approaches

Singapore, South Korea China, Japan, Hong Kong and Australia have some of the highest levels of industry maturity and consumer adoption and as such are best positioned to implement nationwide IoT projects going forward.

These countries also have some of the most sophistication levels of smart city adoption thus far.

A top-down approach balanced with bottom-up solutions may work best for IoT adoption. Singapore’s Smart Nation agenda demonstrates the top-down approach but engineered solutions still need to become useful in the day-to-day lives of Singaporeans.

Despite the development of many initiatives, Singaporeans still prefers to use cash for payments, for instance. Deeper integration within day-to-day lives may require a bottom-up approach, such as the use of incentives. Only when there is sufficient demand will consumer IoT take off.

Image credit: Pexels

Likewise, Malaysia, which generally operates a bottom-up approach to IoT, implementation is nevertheless guided by a strategic roadmap in place since 2015. Higher take off will likely be dependent on stronger demand among businesses and consumers alike. In terms of industrial IoT, Malaysia is also a country where labour costs remain low, which at present delays the need for automation.

Meanwhile Hong Kong’s Smart City Blueprint mirrors Singapore’s Smart Nation agenda in terms of digitalising payments, urban mobility, and smart energy management. China’s IoT implementation, apart from manufacturing, also includes 500 smart city pilot projects in various stages development. These help to engage various stakeholders to provide solutions to multiple levels of urban problems.

Step 8-9: Maximising mobile penetration and becoming 5G ready

Rapid urbanisation, along with a burgeoning millennial population have caused mobile penetration rates to skyrocket across Asia. Mobile penetration in Asia Pacific is expected to hit 75% by 2020. This also means that Asia is well-positioned for higher consumer IoT adoption in the long run.

5G networks, with their high speed, high capacity and low latency properties will provide the necessary backbone for IoT to scale. This is where the US, China, South Korea and Japan are competing for quickest 5G commercialisation to date.

In Asia, China also seems to be leading the race towards installing wireless sites, having installed 350,000 new cell towers since 2015 as opposed to the US’ less than 30,000 as of 2018.

Image credit: Pixabay

Step 10: Risk management through cybersecurity

APAC also needs to realise the potential of IoT against the cybersecurity risks that come with it. The continuously evolving nature of cybersecurity threats could pose high risks for organisations should they succumb to them.

Multiplying security layers of defense could be one way of tackling this threat. Additionally, firms could employ end-to-end encryption between gateways and IoT devices. Most countries in Asia Pacific recognise the importance of cybersecurity in maintaining business growth, but thus could still be improved in ASEAN, where cybersecurity stipend is currently at just 0.06% of GDP.