Mobile Social Network VisiKard Lets You Pay and Manage Your Money On-The-Go

by Fintech News Singapore May 11, 2016As commerce goes mobile and social networks become funnels for payments, the lines between social media, payments and mobile are starting to blur. This trend has led to the emergence of a new type of services that are blending payment capabilities with social networking called “social payments apps.”

Singapore’s Fastacash is one of them and has grown throughout the years to become one of the most successful payments in Southeast Asia.

Another player is VisiKard, an Atlanta-headquartered fintech company that provides a mobile, social media platform enabling users to connect with other people, places and events around them. The company has an office in Ho Chi Minh City and also operates in Vietnam.

VisiKard provides a social media environment that engages users through multiple verticals including entertainment, business, sports, events, deals, points, rewards, and much more.

It lets users “konnect” to anyone or anything via a “Kard Exchange” using a virtual trading Kard. Kards can represent individuals, businesses, places, events, athletes, artists and entertainers, and can be shared from person to person.

Alongside social networking features, VisiKard lets users manage their gift “Kards” and “PunchKards,” as well as send money to their contacts.

Faithful users receive rewards and special offers based on the stores and shops they often visit (geo-localization), and their personal hobbies and interests.

For local businesses, VisiKard provides a mobile market solution that enables them to create targeted marketing campaigns, boost consumer engagement and build customer loyalty.

According to VisiKard CEO Kenneth O. Lipscomb’s LinkedIn profile, the company has raised over US$6.5 million in funding and is expected revenues of greater than US$10 million in 2016.

Leading UK bank backs social payments app

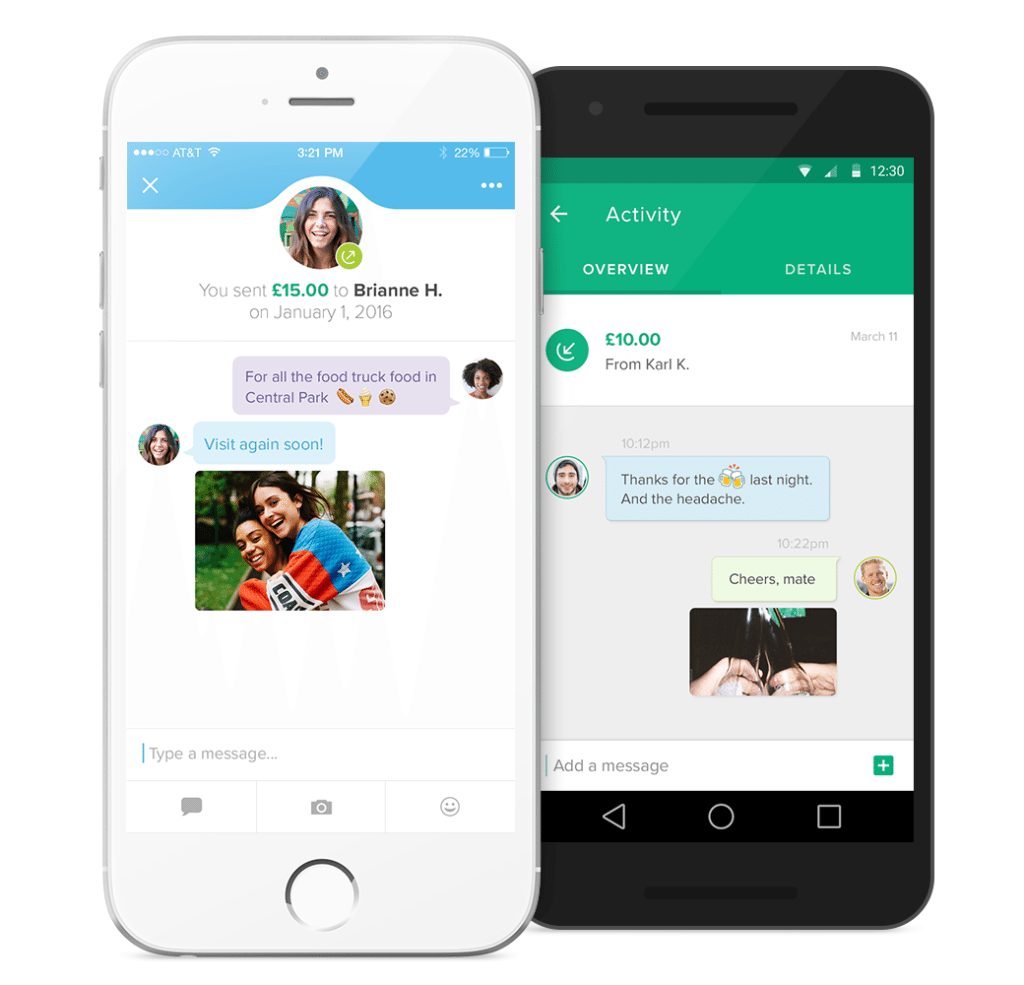

Following the likes of China’s WeChat Pay and AliPay, Circle has recently made headlines when the Boston-based startup launched its social payments app in the UK, in April.

Along with concluding a partnership with Barclays, Circle was granted an e-money license by the Financial Conduct Authority, an event that was deemed by Britain’s Treasury as a “major milestone” as the country works towards becoming a leader in financial technologies.

The app, which runs partly on bitcoin’s blockchain network, allows users to send money to their friends along with written messages, animated gif videos, and more, for free.

Barclays Corporate Banking is providing the account that Circle needs to store sterling for consumers, and the infrastructure to allow transfers from any UK bank account in and out of Circle.

Circle initially started as a bitcoin wallet but shifted its focus to social payments.

Jeremy Allaire, Circle’s founder, told TechCrunch, that the idea is “to connect the benefits of digital currency with the existing financial system. And the existing currencies that people use, day to day, the currencies they’re paid in, the currencies they pay people with etc, and connect that not just with blockchain technology but other major technical innovations that make doing what we do possible.”

“Money should work the way the internet works,” Allaire told Reuters in an interview.

“This is the thing that I think we’re all learning from the Chinese: that this merging of messaging, media and payments together really makes sense to people.”