When challenger banks were first introduced to the markets in Europe many pundits have touted it (perhaps over-enthusiastically) the destroyers of banks.

Promising to upend the banking sector as we know it and drastically transform the way consumers experience financial services.

A Map of Neo Banks around the Globe (Image Credit – Techfoliance)

Fast forward to today, we’ve still yet to see the dramatic claims realised. In fact quite the opposite has happened with a recent study indicating that British consumer’s willingness to bank with challenger banks has dropped quite dramatically compared to the previous year.

Interestingly this is against the backdrop of consumers who are increasingly embracing digital banking — suggesting that more of them are more comfortable with digital offerings from traditional banks.

Challenger Banks in Asia are mostly not startups

How then does Asia fare in comparison to its European counterpart? The immediate observation that is obvious is that the number of players are much less in comparison.

The challenger banks in Asia are mostly either backed by large tech companies, telcos or banks. Neo-banks who originated from startups intending to disrupt the financial services market is almost non-existent in Asia with the exception of Neat and PayTM.

Take for example WeBank, MYbank, Kakaobank who are backed by Tencent, Alibaba, and Kakao respectively or K Bank and SBI Sumishin who are both backed by telcos.

Unsurprisingly banks want a piece of the pie as well, as a first mover DBS launched digibank in both India and Indonesia and many other Asian banks are looking at launch their only fully digital bank in foreign markets as a means to compete with local banks with extensive branch networks.

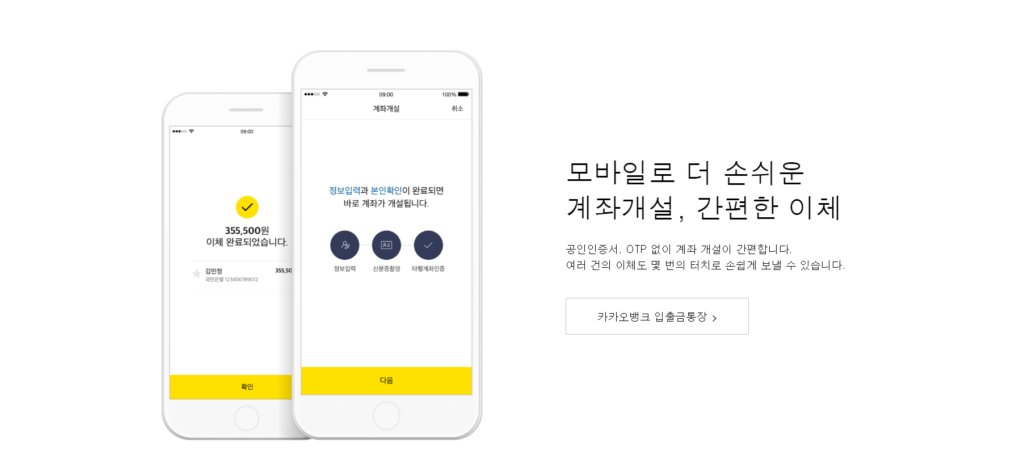

Strong initial enthusiasm for Challenger Banks in Asia

In its initial launch last year, Kakao Bank took the Korean market by storm, within 4 days of its launch it attracted over 800,000 customers. However there seems to trouble in paradise, compared to its double digit growth last year it’s been mostly hovering at a 3% growth this year.

In China things are looking a little bit more rosy with WeBank, as recent as 2017 they’ve disbursed over US$14 Billion in loans.

Meanwhile, Alibaba backed MyBank is performing admirably as well, it has served over 7 million small business owners since mid-2015. Their books don’t look too shabby either with net interest margin being around 3%-5% and low default rates of 1% non performing loans.

An interesting case for challenger banks in Asia is Timo, hailing from Vietnam it is the country’s first challenger bank which is a result of a partnership with VPBank.

In this partnership VPBank holds the license and Timo provides the digital front-end, which could serve as an interesting model to be replicated in other markets in Asia.

Regulatory support still lacking for Challengers Banks in Asia to grow

Image Credit: Wikipedia

With the exception of Hong Kong, many of the regimes within Asia still does not have a formal regulatory framework to deal with challenger banks which is why it is unsurprising to see that many of the challenger banks are an offshoot of a bank.

Hong Kong’s virtual banking license has attracted interest far and wide from both incumbent banks to fintech players. Their approach has been lauded by many in the industry one that’s far more conducive.

This is compared to some regimes where regulators turn existing regulatory framework and treat them like a normal financial institution or shove them into the sandbox where they probably don’t belong.

Still nascent but filled with potential

All in all the space is still relatively new and there many gaps that could be plug by challenger banks. However with the way things are going it seems more likely that banks and tech giants will be the one to plug it rather an ambitious start-up with a grand idea unless something changes.