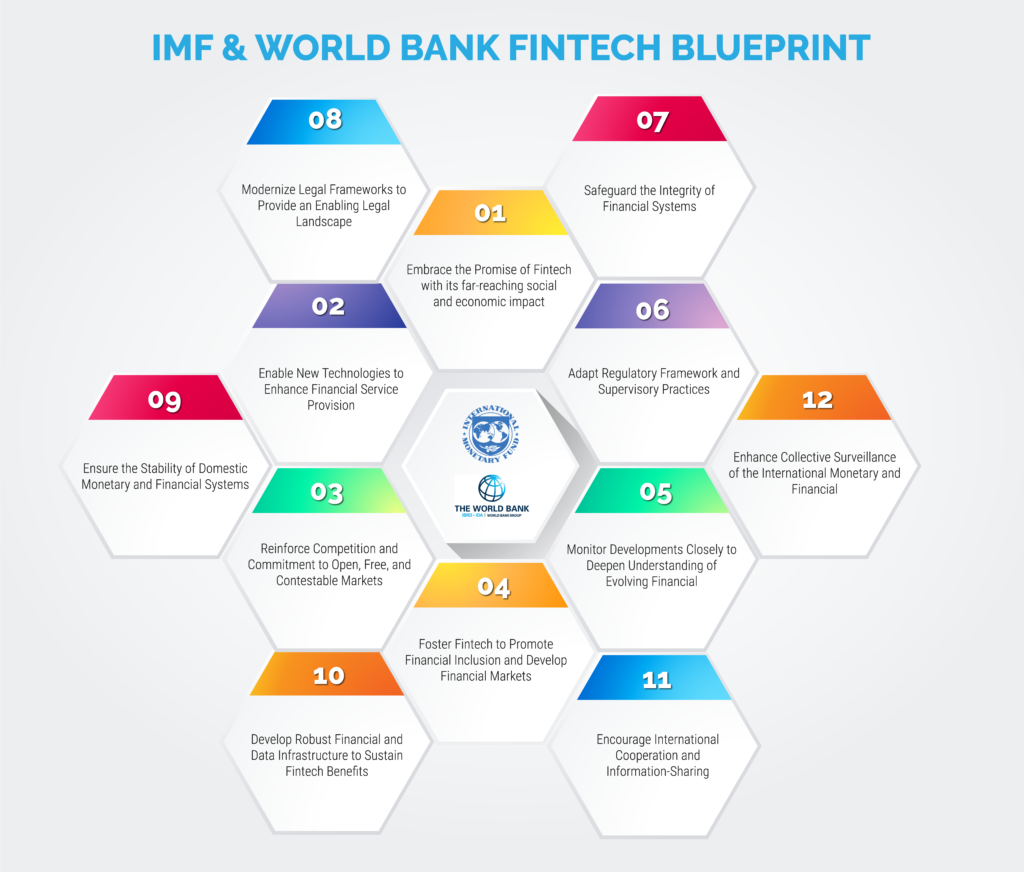

IMF and World Bank Sets Fintech Blueprint — 12 Policy Elements To Harness Fintech

by Fintech News Singapore October 16, 2018Fintech seems to be taking center stage these days with international bodies like the IMF and World Bank recognising its importance to society.

During the Bali Fintech Agenda, IMF and World Bank jointly launch a set of 12 policy elements which is aimed at helping member countries to harness the benefits and opportunities in fintech while managing the inherent risks that come with it.

Image Credit: Edited from Freepik

“There are an estimated 1.7 billion adults in the world without access to financial services,” said IMF Managing Director Christine Lagarde. “Fintech can have a major social and economic impact for them and across the membership in general. All countries are trying to reap these benefits, while also mitigating the risks. We need greater international cooperation to achieve that, and to make sure the fintech revolution benefits the many and not just the few.

“There are an estimated 1.7 billion adults in the world without access to financial services,” said IMF Managing Director Christine Lagarde. “Fintech can have a major social and economic impact for them and across the membership in general. All countries are trying to reap these benefits, while also mitigating the risks. We need greater international cooperation to achieve that, and to make sure the fintech revolution benefits the many and not just the few.

“The Bali Fintech Agenda provides a framework to support the Sustainable Development Goals, particularly in low-income countries, where access to financial services is low,” World Bank Group President Jim Yong Kim said. “Countries are demanding deeper access to financial markets, and the World Bank Group will focus on delivering fintech solutions that enhance financial services, mitigate risks, and achieve stable, inclusive economic growth.”

“The Bali Fintech Agenda provides a framework to support the Sustainable Development Goals, particularly in low-income countries, where access to financial services is low,” World Bank Group President Jim Yong Kim said. “Countries are demanding deeper access to financial markets, and the World Bank Group will focus on delivering fintech solutions that enhance financial services, mitigate risks, and achieve stable, inclusive economic growth.”

With their near universal membership, the Fund and the Bank, are well positioned to gather information from all countries and to reflect on their respective needs and objectives at various levels of economic and technological development.

They both also offer a forum for sharing the experience of countries that are not members of international standard-setting bodies on issues such as combating money laundering and terrorism financing, market integrity, and consumer protection.

The Financial Stability Board and several other international standard-setters have been reviewing the implications of fintech developments and have indicated regulation and supervision priorities.

The IMF and World Bank will start developing specific work programs on fintech, as the nature and scope of their members’ needs become clearer, in response to the Bali Fintech Agenda.

The IMF’s initial focus will be on the implications for national and global monetary and financial stability; and the evolution of the International Monetary System and global financial safety net.

Feature Image Credit: World Bank