Oracle, Wharton Fintech Report: Millennials, An ‘Immense Opportunity for Banks’

by Fintech News Singapore May 20, 2016Totaling 80 million individuals who are commanding US$1.3 trillion in direct annual spending in the US alone, Millennials are the largest generation in world history. The demographic represents a diverse financial services segment completely different from their predecessors and an “immense opportunity for banks,” according to a new report by Oracle Financial Services and Wharton Fintech.

The document, entitled ‘The Millennial Migration: How Banks Can Remain Relevant In Their Decision-Making Eco-System,’ shares findings of a survey on over 4,500 respondents across nine markets and dives into the emergence of what it calls a “new model for lifestyle banking.”

The document, entitled ‘The Millennial Migration: How Banks Can Remain Relevant In Their Decision-Making Eco-System,’ shares findings of a survey on over 4,500 respondents across nine markets and dives into the emergence of what it calls a “new model for lifestyle banking.”

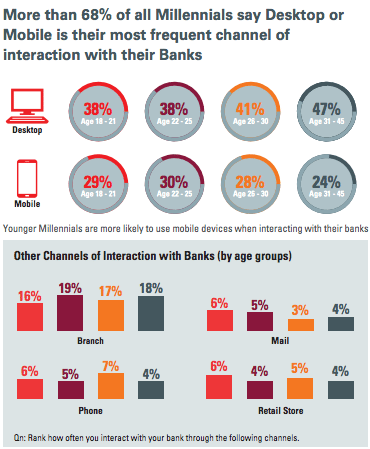

Findings suggest that Millennials have a “high dependency on mobile” and prefer interacting with their banks via online channels. Globally, 68% of Millennials chose mobile or desktop as their most frequent channel of interaction with their banks.

“With most of their interactions going digital, the future of digital banking belongs to banks who develop banking applications with a Mobile-First mindset,” the report says.

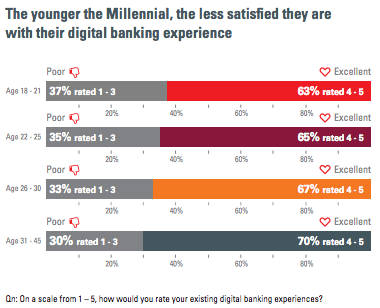

However, not all Millennials are satisfied with their digital banking experience. In fact, the younger the Millennial, the less satisfied they are.

Millennials are “more digitally savvy and their standards are high, being familiar with other digital players who have set benchmarks,” the report says.

The report defines Millennials as four seb-segments: Young Millennials, aged 18-21; Middle Millennials, aged 22-25; Mature Millennials, aged 26-30; and Grey Millennials, aged between 31 and 45 years old.

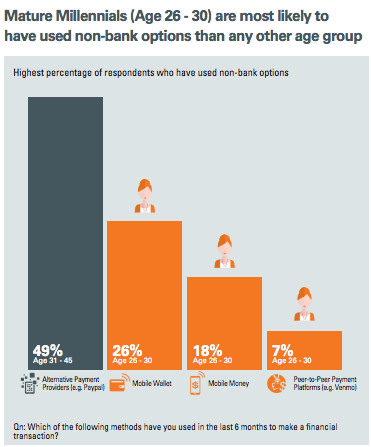

It notes an increasing use of non-bank options, which are gaining traction notably amongst Mature Millennials, the sub-segment that is the most willing to consider alternatives.

In the last six months, 49% of Mature Millennials claimed they have used alternative payment providers, 26% have used a mobile wallet, 18% mobile money, and 7% peer-to-peer payment platforms.

In particular, Mature Millennials and Young Millennials are the most open to non-traditional modes of payment. While Mature Millennials have the highest preference for mobile wallet and mobile money, Young Millennials have the highest preference for alternative payment providers and peer-to-peer payment.

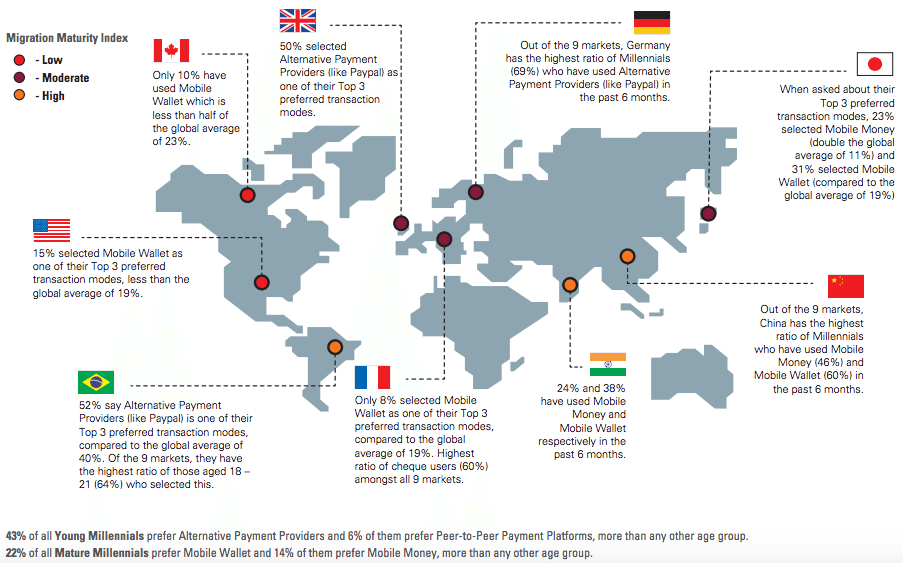

The Millennial migration to non-bank alternatives

Among the nine markets studied, the report suggests that China has the highest ration of Millennials who have used non-bank alternatives. China is followed by India and Brazil. North America on the other hand, is lagging behind.

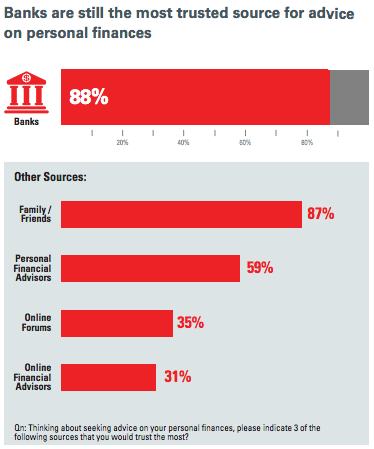

Overall, Millennials maintain a transactional relationship with their banks, considering them as a safe place to store money (60%) and the most trusted source for advice on personal finances (88%) above family and friends (87%) and personal financial advisors (59%).

“These observations reflect the potential for banks to evolve into a bigger player in Millennials’ lives,” the report says and advises banks to “capitalize on the high level of trust that Millennials currently have in them for providing personal financial advice, and design customized products and services that would enable Millennials to make their decisions easily and seamlessly without leaving their digital eco-system.”

Notably, banks should focus on integrating life moments and banking considering that Millennials are willing to explore new products and services aimed at a broader set of lifestyle and financial needs.

“Millennials currently do not see their bank as lifestyle-enabling, but are resoundingly open to banks offering new ways to help them prepare for Life Moments,” the report says. “Banks have to move swiftly before the opportunity is lost.”

Get the full ‘The Millennial Migration: How Banks Can Remain Relevant In Their Decision-Making Eco-System’ report: http://oracledigitalbank.com/#-section-research

Featured image: Young couple taking a selfie by victorsaboya, via Shutterstock.com.