Asia Pacific regions are somewhat disjointed when it comes to banking and fintech-related regulations, with countries like China moving towards more region-specific and refined rules, while countries like Thailand and Indonesia are still trying to introduce basic, yet important regulations to help the financial tech segment grow while keeping customer and industry’s best interests at heart.

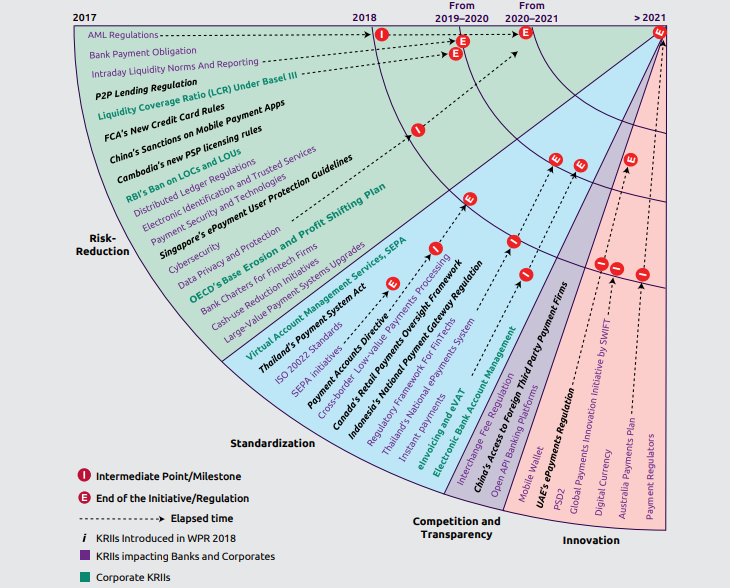

Many of the standards listed below only apply to one region or another, but showcases that these regions all look to each other, and are seemingly moving towards a similar standard to answer current demands on financial services. The following is a list of initiatives, regulations and standards that have been listed in the World Payments Report 2018, by Capgemini and BNP Paribas.

1. China’s Sanctions on Mobile Payments

Following the meteoric rise of payments platforms from companies like Tencent and Alibaba, Chinese regulators grow increasingly concerned about the amount of transactions that e-payment platforms manage on a daily basis. To address those concerns, some sanctions on these apps are being introduced, which would also have the effect of somewhat slowing down their rapid development. For example, the People’s Bank of China have raised the reserve fund requirements on payment platforms up to 50% from the earlier 20%.

2. Cambodia’s PSP Licensing Rules

Cambodia’s central bank in 2017 issued new regulations to govern payment service providers (PSPs), which requires all firms offering the service to accept electronic payments and have at least US$2 million, or 8 billion riel in registered capital, in hopes of increasing the stability of the sector and encourage the consolidation of smaller players. The licensed firms are required to deposit 5 percent of their paid-up capital with the NBC.

3. RBI’s Ban on LoCs and LoUs

Fraud worth Rs12,700 at Punjab National Bank has led the Reserve Bank of India (RBI) to ban the use of letters of undertaking (LoUs) and letters of comfort (LoCs), two instruments issued by Indian banks to domestic importers to get foreign exchange from banks abroad at a cheaper rate. The decision could potentially push up costs of imports by up to half a percentage point.

4. Singapore’s ePayment User Protection Guidelines

The Monetary Authority of Singapore (MAS) has issued guidelines to protect its people using electronic payments from frauds, errors and security threats in the midst of Singapore’s cashless push. The guidelines, issued in September 2018, covers users of e-payments and financial institutions (banks, insurance providers, firms with stored value facilities and other intermediaries). Users are expected to provide updated contact information, monitor transaction notifications to spot suspicious activities early, and practise good security measures like installing latest software updates, and patches for their mobile or computer devices used in the transaction, and also installing antivirus where applicable.

5. Thailand Payment System Act

The Payment System Act published on October 2017, empowers the Ministry of Finance and the Bank of Thailand to regulate and supervise payment systems for, among others, customer protection, risk management, financial stability, and etc. This includes requiring a license to operate by by the Ministry of Finance, and being subject to administrative fines and criminal penalties.

6. Indonesia National Payment Gateway Regulation

Indonesia’s central bank issued new payment gateway regulation in 2017 with a goal of providing efficient and secure payment system for banking customers. The regulation seeks to make transactions easier and cheaper for bankign customers by allowing electric money, debit and credit card of any issuer to be usable at any automatic teller machine, data capture device or payment gateway in the archipelago.

7. Thailand’s National e-Payments System

In 2016, Thailand announced a government-sponsored e-payment system which experts believed will help buoey the country’s growing e-commerce industry, and transform the country into a cashless society. The first phase is launching ane electronic money transfer service at all major Thai banks called PromptPay for peer-to-peer transfers, and the second phase is to allow electronic payments for goods and services, personal income tax returns and subsidiaries and welfare services.

8. China’s Access to Foreign Third Party Payment Firms

China’s central bank announced in 2018 that it is opening the country’s domestic market to third-party electronic payment firms to help competition in retail payments, as long as foreign third-party firms are required to set up a local business to apply for a payment services license from the central bank. The central bank also requires foreign third-party electronic payment firms to store client data and other financial information of their operations in China, which mirrors the regulations for foreign bank cards seeking to operate in China.

If you’re interested to find out more about the regulatory landscape in Europe check out this post here from our sister site Fintech News Switzerland

Image Credit: Freepik