IBM Gears up to Challenge Ripple and SWIFT With Its Blockchain Payments

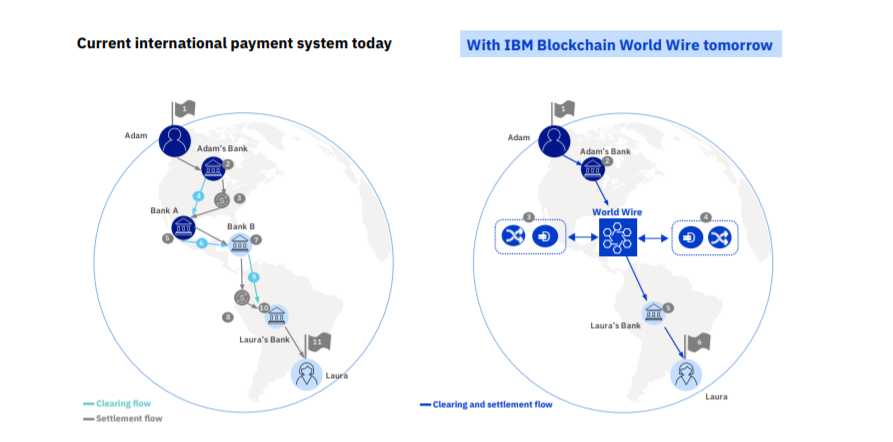

by Fintech News Singapore March 19, 2019IBM World Wire is the Big Blue’s foray into real-time global payments network for financial institutions using blockhain — a space where fierce competition is happening between SWIFT and Ripple.

IBM claims that World Wire is the first blockchain network of its kind to integrate payments messaging, clearing and settlement on a single unified network.

“We’ve created a new type of payment network designed to accelerate remittances and transform cross-border payments to facilitate the movement of money in countries that need it most, ” said Marie Wieck, General Manager, IBM Blockchain. “By creating a network where financial institutions support multiple digital assets, we expect to spur innovation and improve financial inclusion worldwide.”

To facilitate transactions on IBM’s World Wire financial institutions who are transacting with each other will agree on the use of a stablecoin or a central bank backed digital currency. The digital asset is then used facilitate the trade and supplies important settlement instructions. World Wire then simultaneously converts the digital asset into the second fiat currency, completing the transaction

IBM shares that World Wire has enabled payment locations in 72 countries, with 47 currencies and 44 banking endpoints. Local regulations will continue to guide activation, and IBM is actively growing the network with additional financial institutions globally.

The network already supports settlement using Stellar Lumens and a U.S. dollar stablecoin through IBM’s previously-announced collaboration with Stronghold.

Pending regulatory approvals and other reviews, six international banks, including Banco Bradesco, Bank Busan, and Rizal Commercial Banking Corporation (RCBC), have signed letters of intent to issue their own stable coins on World Wire, adding Euro, Indonesian Rupiah, Philippine Peso, Korean Won and Brazilian Real stable coins to the network. IBM will continue to expand the ecosystem of settlement assets based on client demand.

Featured Image via Flickr