Singapore and Canada Successfully Trials Cross Border Payments with Central Bank Backed Digital Currency

by Fintech News Singapore May 2, 2019There’s a growing number of central banks taking a serious look at blockchain and distributed ledger technologies of late. The Bank of Canada and the Monetary Authority of Singapore (MAS) have conducted a successful experiment on cross-border and cross-currency payments using central bank digital currencies.

This is the first such trial between two central banks, and has great potential to increase efficiencies and reduce risks for cross-border payments.

Cross-border payments today are often slow and costly. They rely on a correspondent banking network that is subject to counterparty risk, inefficient liquidity management, and cumbersome reconciliation.

The Bank of Canada and MAS have been collaborating in the use of Distributed Ledger Technology (DLT) and central bank digital currencies to make the cross-border payment process cheaper, faster, and safer.

The two central banks have successfully linked up their respective experimental domestic payment networks, namely Project Jasper and Project Ubin, which are built on two different DLT platforms.

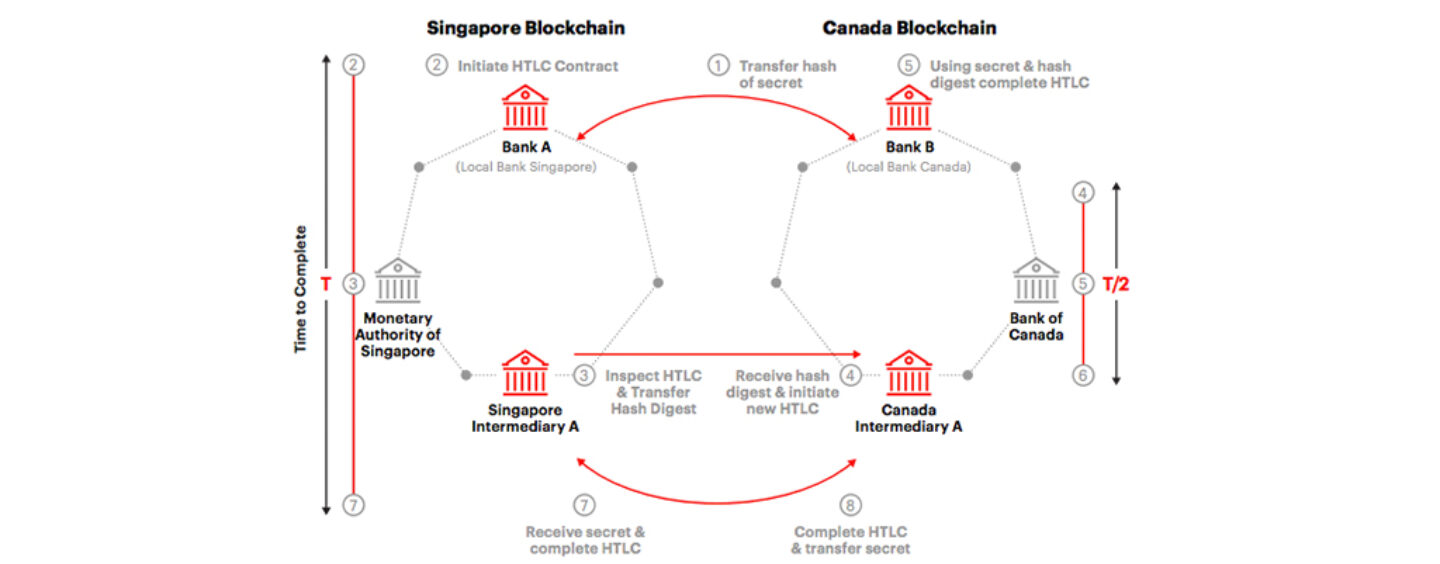

The project teams used a technique called Hashed Time-Locked Contracts (HTLC) to connect the two networks and allow Payment versus Payment (PvP) settlement without the need for a trusted third party to act as an intermediary.

The Jasper-Ubin project was carried out in partnership with Accenture and J.P. Morgan, who supported the development of the Canadian network on Corda, and the Singapore network on Quorum, respectively. Please refer to Annex for further details of the experiment.

Following the successful conclusion of the project, the Bank of Canada and MAS have jointly published a report that proposes different design options for cross-border settlement systems.The report describes the technical implementation of HTLC and highlights possible limitations and challenges with the implementation model.

Overview of HTLC

The report further suggests areas of research in DLT interconnectivity mechanisms and alternative network models. This represents opportunities for further collaboration among central banks, financial institutions and FinTech firms. The Bank of Canada and MAS would like to encourage the global financial community to build on these findings and work together to make international payments better, faster and cheaper.

Scott Hendry, Bank of Canada Senior Special Director, Financial Technology, said,

Scott Hendry

“The world of cross-border payments is complicated and expensive: our exploratory journey into the use of DLT to try to reduce some of the costs and improve traceability of these payments has yielded many lessons. The importance of international cooperation through projects such as this one cannot be underestimated. Only through continued collaboration and fundamental research will it be possible for this technology to mature and for policy-makers to fully understand its potential.”

Sopnendu Mohanty, Chief FinTech Officer, MAS, said,

Sopnendu Mohanty

“Project Jasper and Project Ubin have built on previous innovations in the payments area to demonstrate that cross-border payment and settlement can be made simpler and more efficient. Together these projects have addressed many technical questions and brought the technology to a higher level of maturity. The next wave of central bank blockchain projects can make further progress by bringing technology exploration together with policy questions about the future of cross-border payments. It is challenging work, and we welcome other central banks to join us in this global collaboration, to bring benefit to consumers, businesses and the broader financial industry.”