Indonesia’s Financial Services Authority (OJK) is preparing new rulings for Indonesian fintech companies which the authority plans to finalize by the end of the year.

Chairman of Board of Commissioners of the OJF, Muliaman Hadad, said in April that the regulator will consult foreign authorities in the region to understand the ecosystem.

“We will start consulting our peers in China, Australia, Singapore, and Malaysia. I want to see their responses and suggestions first. However, we will try our best to finalize it this year,” Hadad said, quoted by DealStreetAsia.

As a country with high Internet penetration, high middle-class growth, and poor penetration of financial products, Indonesia is fertile ground for financial technology.

Today, we’ve put together a list of Indonesia’s top 7 fintech startups to keep an eye on:

HaloMoney

HaloMoney is a comparison website for financial products such as insurance, broadband, banking and loans, aims at empowering customers to take more control over their finances.

HaloMoney is part of Compare Asia Group, the region’s leading financial comparison engine which also operates in Hong Kong, the Philippines, Taiwan, Thailand, Malaysia and Singapore.

Bareksa

Bareksa.com is an integrated investment portal. Launched in 2013 by PT Bareksa Portal Investasi, it is the country’s first of its kind, offering customers with data services and investment tools, news and information, learning center, and an investors community.

Bareksa allows users to buy and sell mutual funds online and aims at facilitating people to invest.

CekAja

CekAja, a service of Jakarta-based Compare88 Group Pte., is a comparison website for financial products focusing on accuracy, security, and simplicity. The portal compares personal loans, credit cards, deposits, and syariah, a deposit that follows Islamic principles.

CekAja also offers comparison for mortgages, vehicle financing, vehicle insurance, property insurance, life insurance, and electronics insurance products, and helps customers apply for related services.

Doku

Established in 2007 by PT Nusa Satu Inti Artha, Doku is Indonesia’s largest and fastest growing provider of electronic payment and risk management solutions.

The company provides electronic payment processing, online and mobile payments applications, and serves some 800 businesses in Indonesia.

Veritrans

Another payments startup is Veritrans which operates an online payment gateway, supporting Indonesian e-commerce.

Veritrans processes payments through credit card, direct debit (Mandiri Clickpay, CIMB Clicks, e-Pay BRI), bank transfer (Permata Virtual Account, Mandiri Bill Payment), Indomaret, and digital wallet (T-cash, XL Tunai, BBM Money, Indosat Dompetku, Mandiri eCash).

Kartuku

Established in 2001, Kartuku (PT Multi Adiprakarsa Manunggal) is one of Indonesia’s oldest electronic payments companies.

Kartuku is a Third Party Processor (TPP) and Payment Service Provider (PSP) offering hardware products such as payment terminals, network access equipment, and card printers and encoders, and software solutions such as transaction processing switch, Internet payment gateway, smart card applications, and terminal line encryption.

NgaturDuit.com

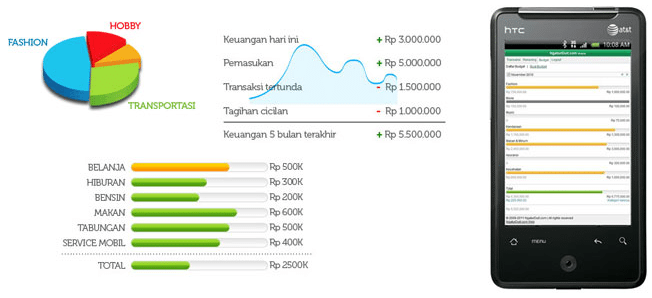

NgaturDuit.com offers tools and services aimed at helping users manage their finance including budgeting, expense reporting, investment portfolio monitoring and free consultation.

Featured image credit: Unsplash