Revolut is Coming to Singapore Very Soon, Here’s a Sneak Peek at Its Pricing

by Fintech News Singapore September 27, 2019UK-based fintech startup Revolut has unveiled pricing details for its digital offerings in Singapore and we expect the official going launch in Singapore very soon.

The startup, which offers banking services including a prepaid debit card, currency exchange, cryptocurrency exchange and peer-to-peer payments through a mobile app, secured its license to operate in Singapore in late-2018 and launched its services in beta earlier this year.

Readers of Fintech News Singapore has tipped us that they are already onboard for this service, while many Singaporeans are still on hold on their waitlist.

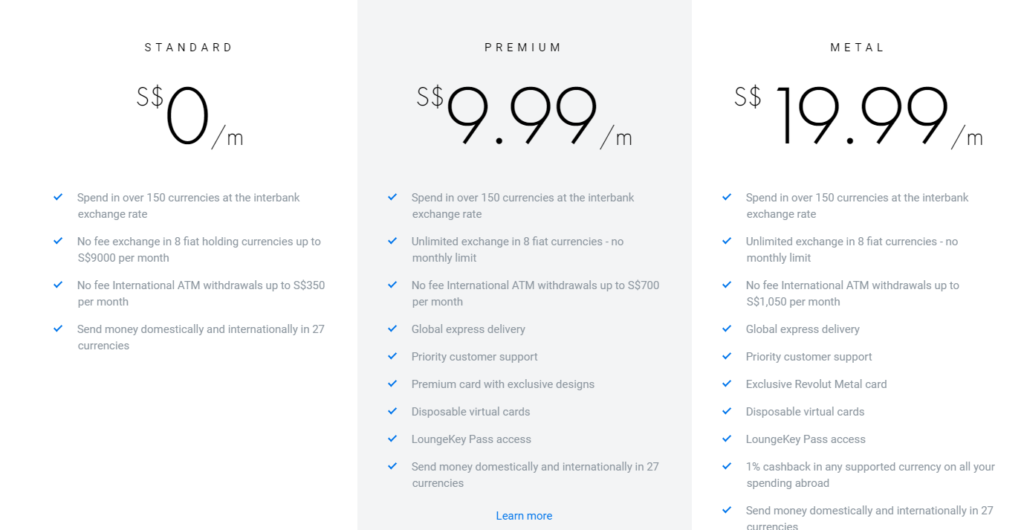

Revolut’s Singapore subsidiary will offer three plans:

The free Standard plan: which includes no fee exchange in eight fiat holding currencies up to S$9,000 per month, no fee for international ATM withdrawals up to S$350 per month, as well as the ability to spend in over 150 currencies at interbank exchange rate and send money in 27 different currencies;

The Premium plan at S$9.99 per month: which, in addition to all the advantages of the Standard plan, also offers overseas medical insurance, travel delay insurance, disposable virtual cards, LoungeKey pass access, global express delivery, priority customer support, unlimited exchange in eight fiat currencies, and a monthly limit of S$700 for free international ATM withdrawals; and

The Metal plan at S$19.99 per month: which takes all the perks of the Premium plan and adds the contactless Exclusive Revolut Metal card, a 1% cashback in any supported currency on all overseas spending, and a higher monthly limit for free international ATM withdrawals at S$1,050.

Revolut will come with several features including the Vault, which allows users to easily put money aside towards financial goals, Budgeting, which lets users set a monthly budget and track their progress in real-time, as well as instant spending notifications, and more. The company says opening an account will just take a few minutes and will be done directly through the mobile app.

Challenger bank Revolut announced plans to launch in Singapore in early 2018. The company recruited Uber Eats’ Eddie Lee to run its Asia Pacific operations, implying that more market launches will follow the Singapore roll-out.

On the company’s website, users from Hong Kong, Japan and New Zealand can already join the waitlists. Other markets where Revolut will be “coming soon” include the United Arab Emirates, Canada and Brazil.

Revolut secured its European banking license, granted by the Lithuanian regulator, in December 2018, and has an e-money license in the UK. In Singapore, Revolut is regulated as a remittance business by the Monetary Authority of Singapore (MAS).

Founded in 2015 and headquartered in London, Revolut offers digital-first banking services in several countries across Europe, the Americas, and soon, Asia-Pacific. In July 2019, the company rolled out commission-free stock trading for Metal customers in Europe and the UK.

One of the fastest growing fintechs, Revolut claimed more than 7 million customers and over £40 billion worth of transactions, as of September 2019. It is valued at US$1.7 billion and plans to raise as much as US$500 million this year from investors.

Despite Revolut’s rapid growth over the past years, the fintech unicorn has been hit recently with several controversies. In February, a Wired report revealed the human cost of the company’s rise, highlighting toxic workplace behavior and high employee turnover. In April, the Telegraph reported that Revolut was at risk of losing its European banking licenses amid questions over its alleged links to the Kremlin.

Featured image via https://www.revolut.com/en-SG/.