Singapore is the first country to get Android Pay in Asia but won’t be the last as Google plans to expand to more countries in the region; although no precision has been made as to where the mobile wallet will head next.

Since last week, users in Singapore have been able to download and activate Android Pay on their devices, making Singapore the third country globally to get the Google mobile wallet after the US – since September 2015 -, and the UK – since May 2016.

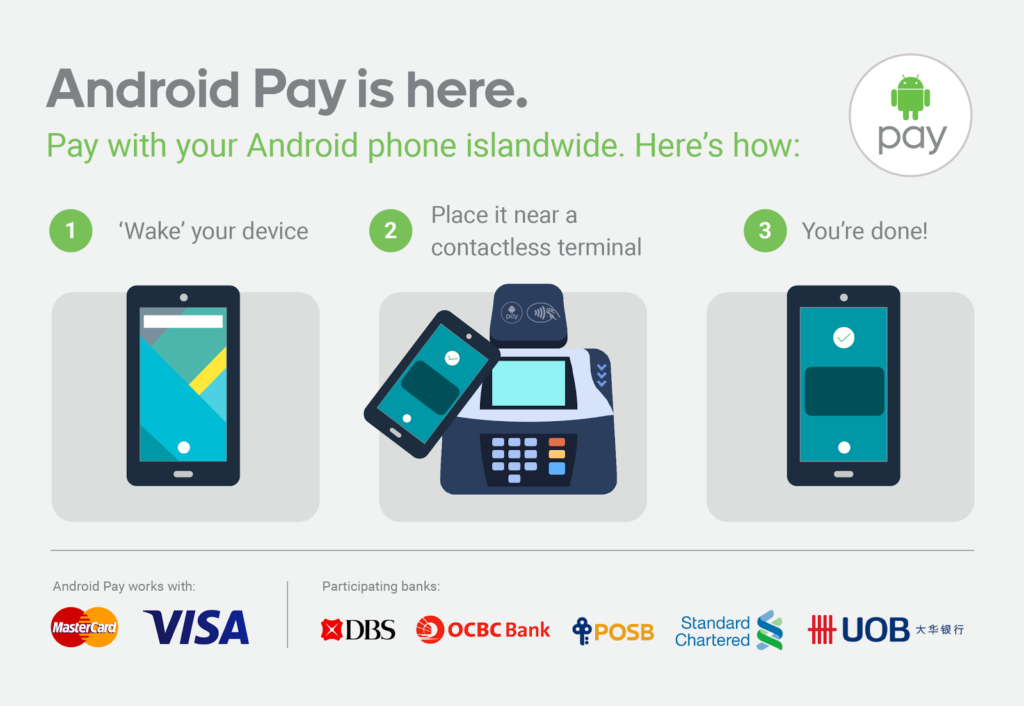

Android Pay is Google’s own version of the Apple Pay and Samsung Pay. Essentially, Android Pay allows users to store their credit cards, debit cards, loyalty cards, etc. and make contactless payments using NFC-capable Android phones at any equipped stores.

MasterCard estimates that there are currently over 30,000 contactless payments readers in Singapore located in grocery stores, supermarkets, movie theaters, among other outlets.

Android Pay is also supported by a number of online, digital businesses through in-app purchases in Singapore including Grab, Uber, Zalora, Shopee, Singapore Airlines, and more.

For its launch in Singapore, Google has partnered with several banks in the areas including DBS Bank, OCBC Bank, POSB, Standard Chartered Bank and UOB. MasterCards and Visa cards from these banks are supported as well.

Commenting on the launch, Joanna Flint, country director of Google Singapore, said:

“Singaporeans love mobile and are some of the fastest adopters of new technology in the world. It’s wonderful to see wide support in Singapore from the banks and the industry for Android Pay, enabling shoppers to use Android smartphones as a way to buy things when they’re on-the-go.”

The launch of Android Pay in Singapore comes shortly after competitors Apple and Samsung launched their respective mobile wallet and mobile payments functionality in Singapore as well.

But with Android Pay on many more devices than Samsung Pay – which only supports the latest Samsung handsets – and Apple, Google should manage to quickly get ahead of its competitors.

This comes with a number of other competitive advantages including the ability for users to easily make in-app purchases as well as its support of loyalty card merchants. Google is already working with a number of local reward points programs such as NTUC Link Plus! and CapitaLand’s Capitastar to add their rewards points.

That said, Samsung too, has one trick up its sleeve. The South Korean high-tech electronics manufacturing and digital media firm acquired fintech startup LoopPay in early-2015 for US$250 million, a deal aimed at powering Samsung Pay with a new technology called Magnetic Secure Transmission (MST).

MST essentially allows Samsung Pay phones to emit a magnetic signal that mimics the magnetic strip on a credit card. This means that Samsung Pay works on older credit card machines, not just NFC-capable ones, far broadening its reach.

Singapore penetration of contactless POS systems is still modest.

Check out a step by step guide how to install Android Pay in Singapore here.