Report Points Out US$100B Revenue Opportunity From Digital Economy For ASEAN

by Fintech News Singapore July 11, 2016Like in other regions, digital technology is rapidly expanding its contribution to the economy in ASEAN-6 (i.e. Malaysia, Indonesia, Philippines, Singapore, Thailand, and Vietnam). While the digital revolution is expected to impact the overall economic landscape, Deloitte believes that consumer and retail, telecom, media and technology and financial services are the key sectors that will be the most affected and disrupted.

In a report, the consultancy firm assesses the potential impact of digitalization to conglomerates with particular interest in ASEAN. The firm estimates that the contribution of the digital economy will increase from the current 7% of the GDP to about 13% by 2020.

In a report, the consultancy firm assesses the potential impact of digitalization to conglomerates with particular interest in ASEAN. The firm estimates that the contribution of the digital economy will increase from the current 7% of the GDP to about 13% by 2020.

Conglomerates are playing a significant role in these economies, contributing to approximately 21% of the total ASEAN-6 economies’ GDP. This figure is expected to reach ~25% with revenues of about US$849 billion by 2020.

“We expect the digital economy to be a huge factor of growth for ASEAN-6 countries, with a potential to outpace the growth of the region and contribute up to ~13.0% of ASEAN GDP by 2020,” the report says. “Also, mastery of digitization for key markets are expected to provide significant variations in corporate performance, with significant upside potential of up to USD 100+ billion of revenue solely from the digital economy for top 40 conglomerates in ASEAN.”

In financial services, every financial institution has digitalization in its agenda as they face a growing number of challenges coming from clients, regulators, as well as the pressure to stay ahead in an industry that is experiencing growing competition from fintechs.

To address these challenges, financial institutions have recognized the need to build digital ecosystems and create cooperative networks to enhance connectivity among multiple players.

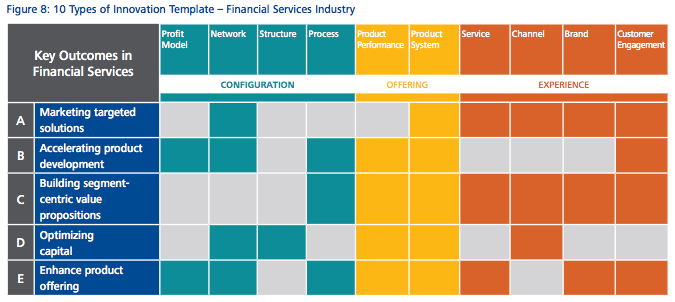

The report points out five specific types of innovation template and their outcomes in financial services:

Marketing targeted solutions: Through web-based linkages and the ability to inter-operate diverse digital business platforms of the financial institution’s partners, they can become digital platforms that allows for market targeted financial solutions to customers based on their unique personal preference. An example is AARP, a digital platform marketing providing tailored financial products and services for its members.

Accelerating product development: Financial institutions can build a digital ecosystem to facilitate open product innovation by establishing partnerships with third party developers. An example is Fidor Bank, which utilizes an open API infrastructure to develop bank products.

Building segment-centric value propositions: This refers to ecosystems that focus on personalized relationship-based segments. These digital ecosystems utilize technology to streamline their operational processes and create integrated offering. An example is FWD, a Hong Kong-based insurer that has developed a platform that allows its distribution partners across Asia to cross-sell their products.

Optimizing capital: Banks and financial institutions can partner with fintechs, especially those specializing in alternative lending, to create digital ecosystems where banks are able to aid high risk customers fulfill their financing needs by referring them to these platforms. An example is Santander UK, which became in June 2014 the first bank in the world to partner with a peer-to-peer lending platform.

Enhance product offering: Banks and third party technology providers can leverage their respective expertise to create a seamless digital customer experience with a full suite of financial and non-financial products. An example is Capital One, a US-based bank that launched in 2013 an e-commerce platform that lets merchants accept payments on mobile devices.

Image by Kzenon via Shutterstock.com

ASEAN is one of the largest economic zones in the world, a major global hub of manufacturing and trade, as well as one of the fastest-growing consumer markets in the world.

But as the digital revolution starts to disrupt a growing number of industries in all parts of the world, Southeast Asian countries must start being proactive to avoid missing out on major opportunities.

In a session on the emergence of the digital economy in Southeast Asia at the 25th World Economic Forum in June, global and regional IT leaders urged countries in the region to collaborate on harmonizing regulations and liberalizing the sector.

“What is happening is that the uptake of digital services is going so fast and is bringing down borders between these different nations,” said Sigve Brekke, president and CEO of Norway’s Telenor Group. Telenor, among other investments in the region, holds a mobile operator’s license in Myanmar. “But I don’t see ASEAN countries taking part in this. I am afraid that ASEAN is losing out. There are too many big words about digital opportunities, but I don’t see the action.”

Experts encouraged governments to coordinate policy frameworks as well as foster startups and create products to need the demand for digital services.

“The revolution is coming extremely fast,” Brekke said. “There are great opportunities for ASEAN companies to take charge of the future. Get your act together – the sooner the better.”

Featured image by Rawpixel.com via Shutterstock.com.