Report: Nine out of Ten Insurers Fear Losing Part of Their Business to Startups

by Fintech News Singapore July 12, 2016Annual investments in insurtech ventures have increased fivefold over the past three year, reaching a cumulative US$3.4 billion since 2010. As investment and interest in insurtech increase, insurers are feeling increasingly threatened by the new innovative ventures that are applying cutting-edge technology to revamp the insurance business. A survey conducted by PricewaterhouseCoopers (PwC) found that 90% of insurers believe that at least part of their business is at risk to fintech.

According to Stephen O’Hearn, global insurance leader at PwC, “insurtech will be a game changer for those who choose to embrace it.” He urges the industry to start acting and embrace both the challenges and opportunities offered by insurtech.

According to Stephen O’Hearn, global insurance leader at PwC, “insurtech will be a game changer for those who choose to embrace it.” He urges the industry to start acting and embrace both the challenges and opportunities offered by insurtech.

“Those who are savvy enough to address the ongoing disruption sooner rather than later will reap the benefits and emerge as market leaders,” O’Hearn said in a statement.

PwC, which surveyed management from 79 insurance and startup companies across the world to understand how the industry is responding to the rise of insurtech, compiled the findings into a report entitled ‘Opportunities await: How insurtech is reshaping insurance.’

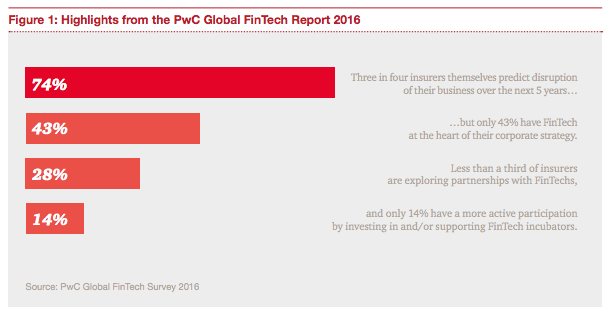

Insurance companies are well aware of the digital revolution, with 74% of respondents seeing fintech and insurtech innovations as a challenge for their industry. However, results show a disconnection between the amount of disruption perceived and insurers’ willingness to harness technology. While 43% of insurers said they have fintech at the heart of their corporate strategy, only 28% are reacting consequently by partnering with fintech ventures and less than 14% are activity participating in ventures or incubator programs.

Insurers said that the top threats related to the rise of insurtechs are pressure on margins (70%), loss of market share (65%), information security and privacy threat (60%), and increase of customer churn (58%).

That said, the rise of insurtech also brings a number of opportunities for incumbents and the industry as the whole. Respondents named the top opportunities as being cost reduction (80%), differentiation (60%), improved retention of customers (60%) and additional revenues (58%).

And yet, the insurance sector has not worked out a consistent approach to disruption, the firm claims. “Now is the time for executives to think forward, put innovation at the heart of their strategies and define to what extent they want to participate in the insurtech ecosystem,” the report says.

PwC points out four steps insurance companies can take to harness the rise of insurtech:

- Explore and monitor new trends and innovations by establishing, for instance, a presence in innovation hubs;

- Partner with startups and build pilot solutions to test in the market;

- Get involved in startup programs such as incubators, mechanisms to fund companies, and strategic acquisitions;

- Refine and redefine product portfolio strategy accordingly to changing clients needs and expectations.

Urging for more collaboration between corporates and startups, Jonathan Howe, UK insurance leader at PwC, said in a statement:

“The differences between start-ups and incumbents should be embraced as both are vital to the future of the industry. If the long-term mindset and experience of insurance companies can successfully be partnered with the creativity and agility of start-up companies, the industry as a whole will make progress in solving problems and bringing truly innovative products to market.”

Although insurtech in Asia is still in its infancy, interest in the sector has surged in recent years. Countries like Singapore are now home to innovative solutions and industry initiatives aimed at fostering development in the field.

This includes Aviva’s ‘Digital Garage,’ which aims at helping the insurance company to develop new innovative solutions, Fitsense, an app that helps you reduce your insurance premiums if you accept wearing physical wearables, and Claim Di, an app that simplifies the auto accident claims process.

Featured image by Ollyy, via Shutterstock.com.