Corporate Venture Capital Funding Booms As Banks Pour Billions Into Fintechs

by Fintech News Singapore April 2, 2020Corporate venture capital (CVC) funding hit an all-time high last year, with banks pouring billions into fintechs as they look to diversify and feel pressured by increasing competition.

From 2014 through Q3 2019, total CVC deals by banks and other financial services companies surged 500%, according to a CB Insights report released in November 2019.

In 2019 alone, financial services companies pumped US$8 billion across 329 fintech deals with nearly half (US$3.5 billion) coming from banks. In particular, Q3 2019 saw the highest deal activity on record by financial services VC.

According to the report, Citi Ventures had been the most active CVC investor since 2014 with 66 deals, followed by Goldman Sachs’ VC arm with 64 deals, and American Express with 55 deals.

Another study by CB Insights released in early 2020 found that out of the world’s 67 fintech unicorns, nine are backed by two or more financial services CVCs, showcasing that banks are behind some of the world’s most successful fintechs.

CVC on the rise

CVC spending is on the rise all around the world and is visible not just in fintech but also across all major segments. In the US, CVC outspent for the first time traditional venture capital funds in 2018, while in Europe, CVC investments represented 25% of total VC funding in the region.

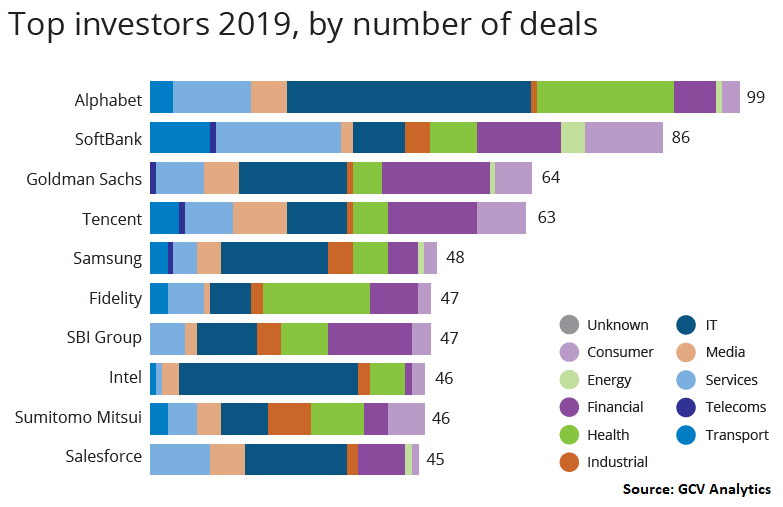

In 2019, the top CVC investors in startups by number of deals were Alphabet (99), SoftBank (86), Goldman Sachs (64), Tencent (63), and Samsung (48), according to data from industry group Global Corporate Venturing.

Top investors 2019 by number of deals, Global Corporate Venturing

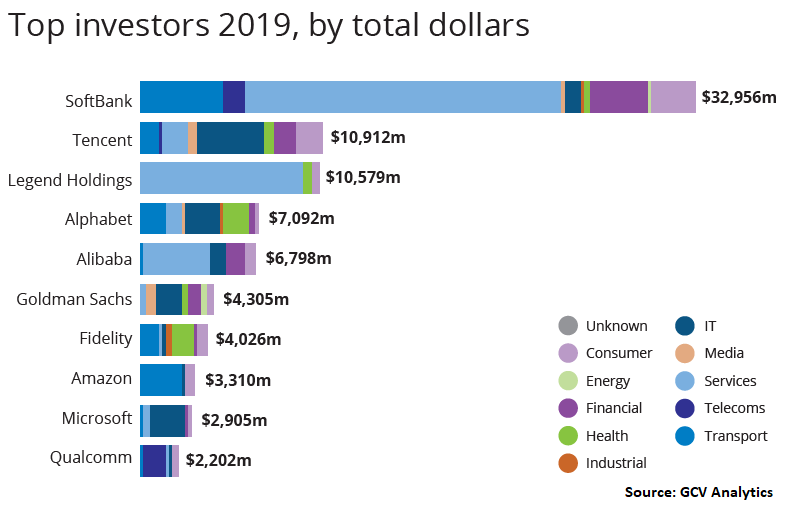

In terms of dollar amount, it’s SoftBank that invested the most last year with more than US$32 billion being injected into startups, followed by Tencent (US$10 billion), and Legend Holdings (US$10 billion).

Top investors 2019 by total dollars, Global Corporate Venturing

Corporate venturing to drive innovation

Rapid technological advancements and evolving industries are pushing established corporates to develop focused innovation tactics, notably through corporate venturing (CV) initiatives.

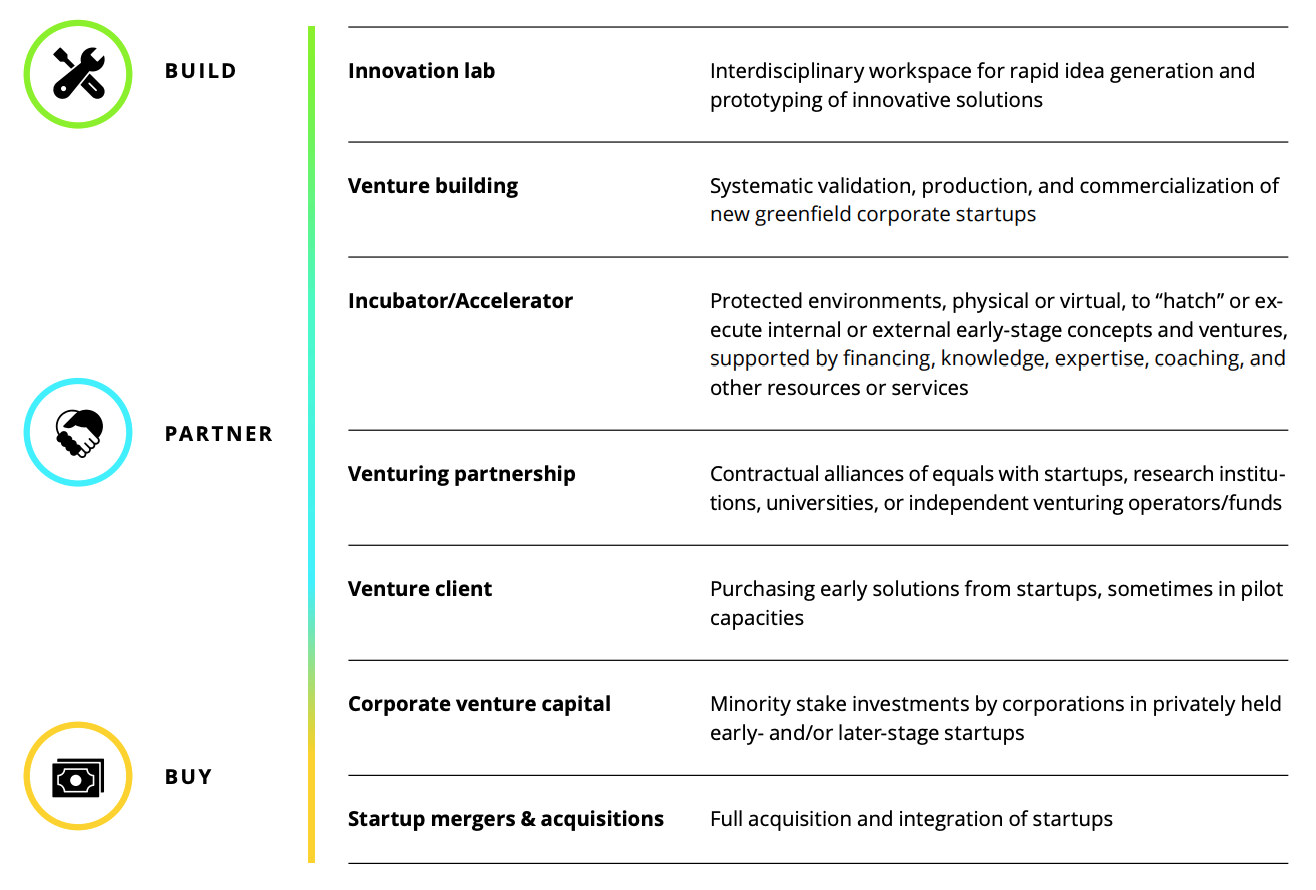

CV, which refers to any investment from a corporation to build, partner with, or buy new businesses, allows corporations to find new sources of entrepreneurship and innovation from both inside and outside the company. CV channels and initiatives can take the form of an innovation lab, a dedicated corporate venture building unit, an incubators or accelerator, an institutional partnership in the startup ecosystem, services from a startup, a CVC investment, or a M&A deal.

Corporate Venturing channels, Multi-Channel Corporate Venturing: A Build, Partner, Buy approach for corporate leaders in the new decade, Deloitte Digital, 2019

According to Deloitte, CV is distinct from other innovation methods due to its focus on fast commercialization of solutions, clear contribution to the larger transformation journey, and blend of financial and strategic objectives for the group.

Through CV initiatives, corporates can generate new revenue streams, grow sales from existing assets, or assist a cost-reduction strategy, the firm says. They can also access emerging technologies, attract new talent, enter new markets, and learn about new ways of working.

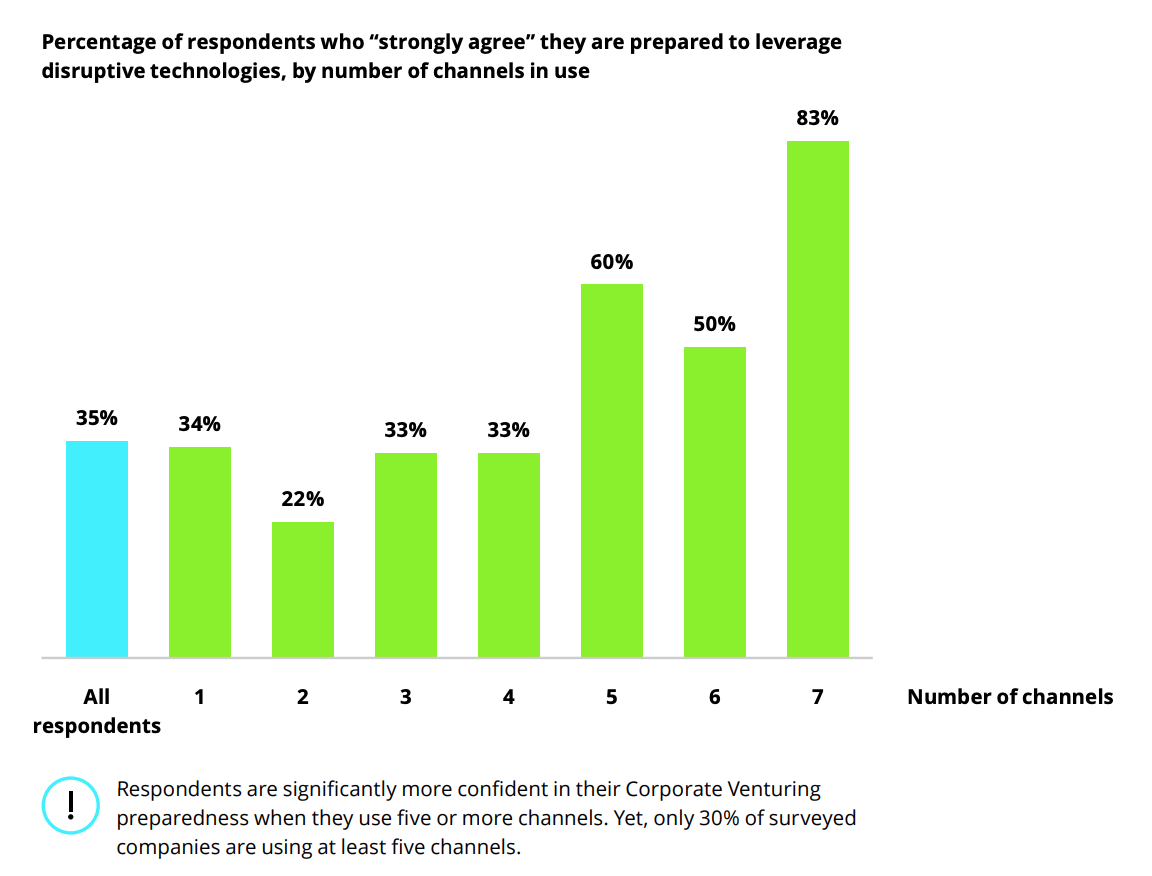

Deloitte, which surveyed 151 large European companies in 2019, found that corporates are confident in the potential of CV activities in enabling them to leverage and adopt disruptive technologies. It also found a positive correlation between the number of CV channels in use and confidence levels.

In fact, the more CV channels are being used, the more confident corporates are in their CV preparedness, the results show.

Percentage of respondents who “strongly agree” they are prepared to leverage disruptive technologies, by number of channels in use, Multi-Channel Corporate Venturing: A Build, Partner, Buy approach for corporate leaders in the new decade, Deloitte Digital, 2019