China’s open and supportive regulatory environment, highly developed Internet and e-commerce sector, and growing demand for alternative finance solutions, have allowed the country’s fintech industry to flourish in the last few years. Today, China stands as a frontrunner in Internet finance.

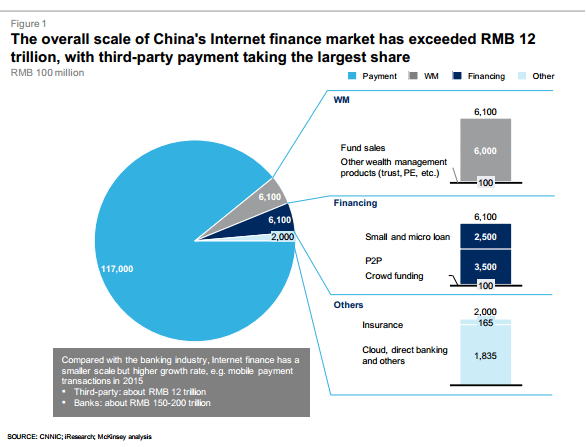

By the end of 2015, China’s Internet finance market has exceeded 12 trillion RMB (US$1.79 trillion) and user number reaching ~500 million, according to a new report by McKinsey.

More specifically, China’s peer-to-peer lending market currently stands as the largest in the world with transaction volume amounting to 500 million RMB (US$74.7 million).

In the financing field, supply chain financing and consumer financing are the two areas that are being the most explored with notable initiatives from e-commerce and retail giants JD and Gome.

In wealth management, Alibaba’s Yu’e Bao reached 700 billion RMB (US$104.59 billion) worth of assets under management within two years and currently stands as the second largest money market fund globally, the report says.

Third party payment, the earliest, largest and most developed segment in China’s Internet finance market, is often the foundation on which many other financial applications are built. The segment is dominated by large companies and first movers: Alibaba’s Alipay accounts for half of the market, while Tencent’s Caifutong takes nearly a fifth. Other forerunners include Yinshang and 99Bill.

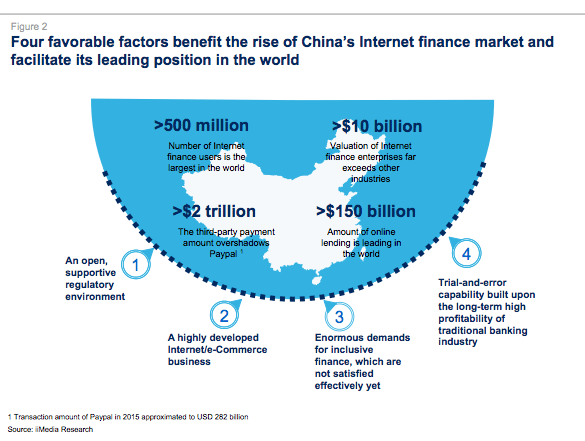

The report highlights four key factors that have contributed to China’s booming fintech industry and that have fostered further opportunity in a market already experiencing fast-paced growth.

Firstly, it points out the supportive regulatory environment which has encouraged fintech development and innovation. Chinese Premier Li Keqiang made multiple calls of support in the Report on the Work of the Government over 2014/15 stating that the government “will encourage Internet finance to seek a healthy development road under the backing of proper regulatory coordination and supervisory mechanism.”

Moreover, China’s thriving Internet and e-commerce industry has largely contributed to the changing lifestyle of the Chinese digital population. China’s Internet economy grew by 50% over the past five years and now accounts for 7% of the country’s GDP. Today, 30% of the Chinese population are users of Internet payments services, and online wealth management and stock trading have attracted nearly 100 million users.

With nearly half of China’s households being “low-income” and with traditional players moving slowly, Internet finance and fintechs are providing innovative solutions to under-served customers. Today, traditional commercial banks are serving the top 20% customers. Internet finance can cover the remaining 80% of customers and carve out an “inclusive finance” era, the report says.

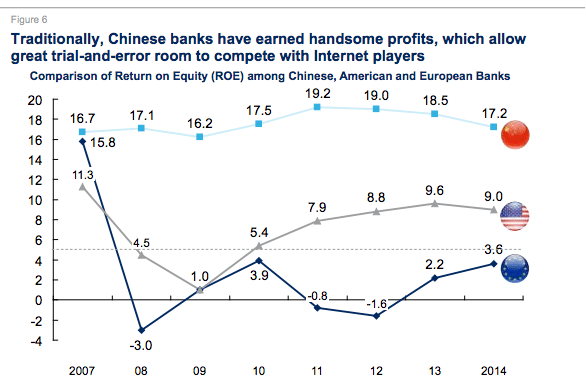

Finally, China’s highly profitable banking sector attracts and allows competition of Internet finance players. In comparison to European and American banks, Chinese banks have a much higher return on equity (ROE) rate: 17.2% for Chinese banks, versus 9% for American banks and 3.6% for European banks.

These profits have allowed Chinese banks to invest more aggressively in innovative digital attempts.

China is undeniably a frontrunner in the fintech race. The country is home to the two largest fintech startups in world: Ant Financial, the Alibaba affiliate that runs Alipay and other financial services domestically valued at US$60 billion; and Lufax, a peer-to-peer lender valued at US$19 billion.

As of its acceleration and incubation programs, the vast majority are located in Hong Kong with notable ones that include Accenture’s Fintech Innovation Lab, the SuperCharger Fintech Accelerator, as well as the DBS Accelerator powered by Nest.

In March this year, China welcomed FinPlus, an angel fund and accelerator solely focusing on fintech startups. FinPlus, operated by Fugel Holding, offers a six-month program aimed at introducing innovative fintech startups from around the world to the Chinese market.

In Q1 2016, venture investment into Chinese fintech startups accounted for 49% of funding across all geographies, according to the Pulse of Fintech.

Featured image: Alibaba coffee by Charles Chan, via Flickr.