Tracxn Report: Fintech Growing Fast in SEA; Payments & Investment Tech Are Top Two Funded Segments

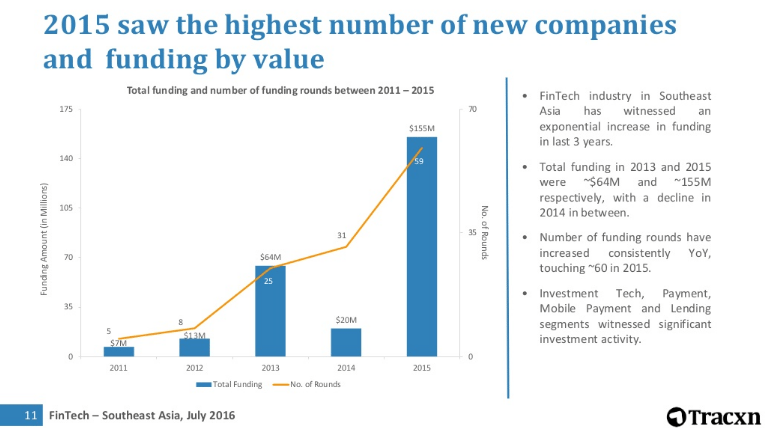

by Fintech News Singapore August 5, 2016Since 2007, over US$300 million has been invested into Southeast Asian fintech startups, with more than half of that amount being invested in 2015 alone. The rise in the funding activity comes along with the growth of the fintech startup scene.

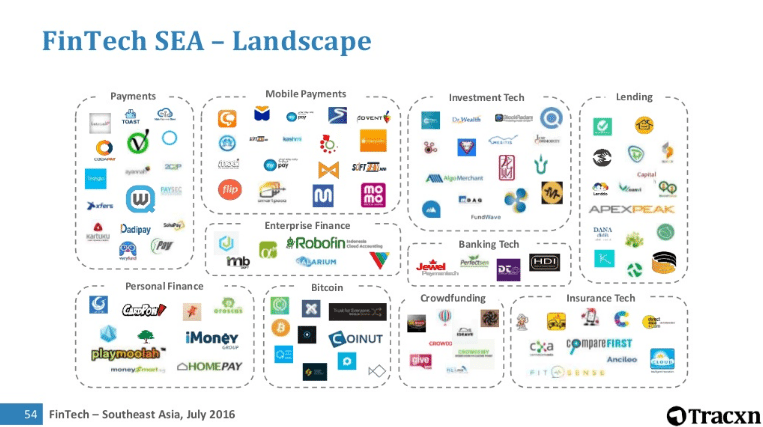

According to a new research paper by Tracxn, over 520 fintech companies have been founded in last ten years with 2/3 of them being incorporated in the last three years.

2015 in particular saw the highest number of new companies and funding by value. In 2015, US$155 million has been injected into the fintech industry through 59 deals. Notably, sub-segments such as investment tech, payments, mobile payments and lending have witnessed significant growth.

Payments and investment tech, the top two funded fintech sub-segments in Southeast Asia, account for US$80 million and US$120 million of investments respectively.

“Southeast Asia is definitely an interesting market for fintech,” Willcon Cuaca, founding and managing partner of East Ventures, said.

“In Southeast Asia, many countries like the Philippines and Indonesia have a large unbanked population. An interesting context is high mobile phone penetration rate and social media adoption.

“Fintech services that focus on mobile payments aren’t just offering a different service, they are solving a societal problem and leveling the previously unbanked up directly to banking 2.0.”

Most active investors in fintech

Golden Gate Ventures, 500 Startups and East Ventures are the three most active investors in the Southeast Asian fintech industry.

Golden Gate Ventures has invested in the likes of CodaPay, MoneySmart and Lenddo, while 500 Startups is backing a few blockchain startups including CoinPip and Neurowave, but also other ventures tackling different sub-segments through investments in the likes of Filipino online pawnshop PawnHero and financial market app Call Levels. East Ventures has invested in Seedly, a Singaporean personal finance app that has yet to launch, peer-to-peer lending platform MoolahSense, and Indonesian financial comparison service Cermati. These three venture capital firms have one startup in common: Omise, a Thailand-based online payment gateway company.

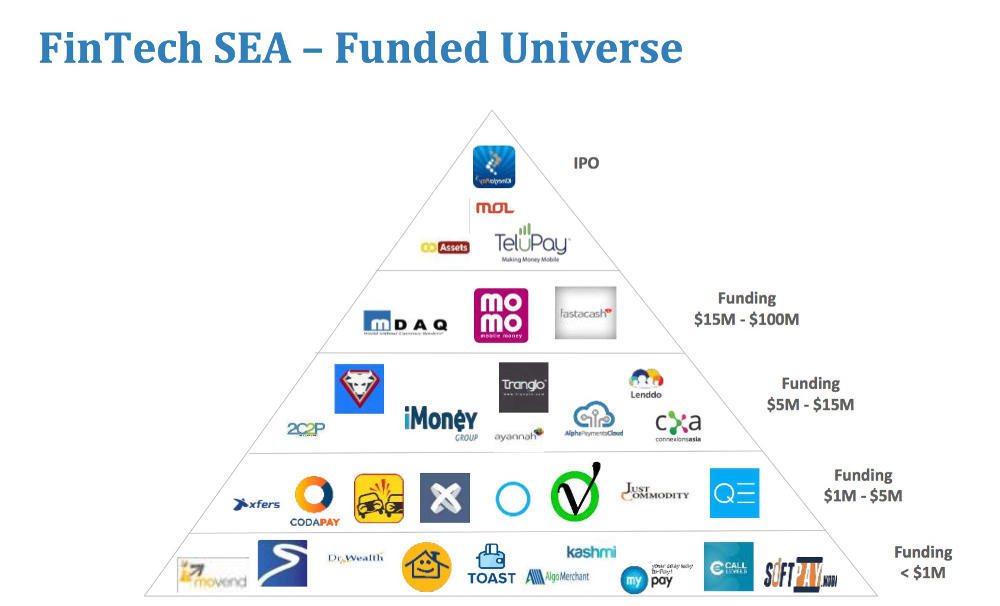

During the last few months, notable investments have been made in Southeast Asian fintech ventures. These include Singaporean currency exchange and international payments startup M-DAQ, which raised US$82 million in a funding round led by EDB Investments; Vietnamese mobile payments service MoMo, which raised US$28 million in funding from Standard Chartered’s private equity arm and Goldman Sachs; and Filipino digital commerce and payment services provider Ayannah, which raised US$3 million from 500 Startups, Wavemaker, Golden Gate Ventures, among others.

The report concludes with Q&A on Southeast Asia’s fintech landscape with industry experts.

Altona Widjaja, vice president of OCBC Bank in Singapore, highlighted the concerted effort by government bodies and ecosystem partners in Singapore to create an environment for innovation to thrive. “This is but the start of the journey and we will expect to see real innovative ideas being implemented in this digital and shared economy,” he said.

Widjaja further encouraged banks to start being pro-active, notably by partnering with fintech startups. “I think that the bank should be enabler of such players,” he said.

“In this shared and open economy, each entity should focus on what they do best and leverage on one another. I do not think there will be a one size fit all approach, be it own development or acquisition, different organization have different culture and approach. But what is clear is that everyone have to be a digital/technology company to stay relevant to their customers.”

Southeast Asia’s fintech startup scene