TransferWise, one of the UK’s hottest fintech unicorns, has begun serving the Vietnamese market, only supporting inbound money transfers (for now?).

Transfers to Vietnam have gone live yesterday and are being charged 1.5% per transaction, or 95,000 VND for transfers under 6,300,000 VND. Users “get the real exchange rate for your money, … with no hidden charges.”

Transfers to Vietnam have gone live yesterday and are being charged 1.5% per transaction, or 95,000 VND for transfers under 6,300,000 VND. Users “get the real exchange rate for your money, … with no hidden charges.”

Founded in 2010 by Estonians Taavet Hinrikus, the first ever employee of Skype, and consultant Kristo Käärmann, TransferWise is a peer-to-peer international money transfer platform that allows private individuals and businesses to send money abroad without hidden fees.

How it works

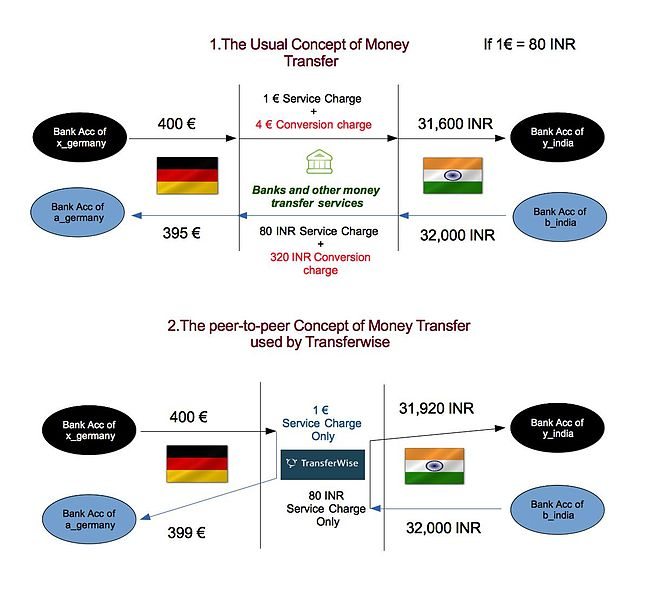

On the user side, money transfers with TransferWise are similar to those from conventional money transfers: the customer chooses a recipient and a currency, the money to be transferred is taken form his or her account, the transferring company charges a fee for the service, and, some time later, the recipient receives the payment in the chosen currency.

What differentiates TransferWise from traditional players is the way the startup routes the payment. Instead of transferring the sender’s money directly to the recipient, it is redirected to the recipient of an equivalent transfer going in the opposite direction. This “matching” model and mechanism allows the company to avoid costly currency conversion and cross-border transfers. This allows to reduce the Spread on the Currency Exchange. This is a great news for Vietnam Money Transfers.

Similarly to TransferWise, CurrencyFair offers an alternative to the expensive Western Union and MoneyGram by relying on peer-to-peer model.

But unlike TransferWise, CurrencyFair operates an online peer-to-peer currency exchange marketplace where users can set their own rates. The service charges 0.15% as its “standard peer-to-peer exchange rate,” while TransferWise charges between 0.5% and 2.5% depending on the currency. (For Vietnam 1.5%)

A fintech unicorn

In March, TransferWise raised US$26 million in a Series D funding round led by Scottish asset manager Baillie Gifford joining already existing investors Andreessen Horowitz, Peter Thiel’s Valar Ventures, Sir Richard Branson, Index Ventures, and Seedcamp, which brought a total funding to date up to over US$142 million.

TransferWise is headquartered in London with offices in Tallinn and New York, and is fully regulated by the UK’s Financial Conduct Authority (FCA). Currently, people are moving £500 million (US$650 million) every month on TransferWise. The service supports over 300 currency “routes” across the world.

In late-2015, online money transfer and remittances services startup WorldRemit began serving the Vietnam market, “one of the busiest markets for receiving remittances in Asia,” naming Vietnam’s large diaspora – numbering some 4 million individuals – as a huge opportunity for the firm. In May this year, the company announced a new cash pickup service through a partnership with local bank DongA.

Featured image: Vietnamese Dong by https://johnib.wordpress.com/.