Almost all countries increased regulation of the crypto finance industry in 2020. The COVID-19 pandemic provoked a significant boost of digital crimes, including money laundering, terrorist financing, online black marketing and other related criminal activity.

Certain jurisdictions have already implemented the legal framework, while others are just getting ready to do so. Although even pending legislative initiatives may make a big difference in the near future of the global financial system.

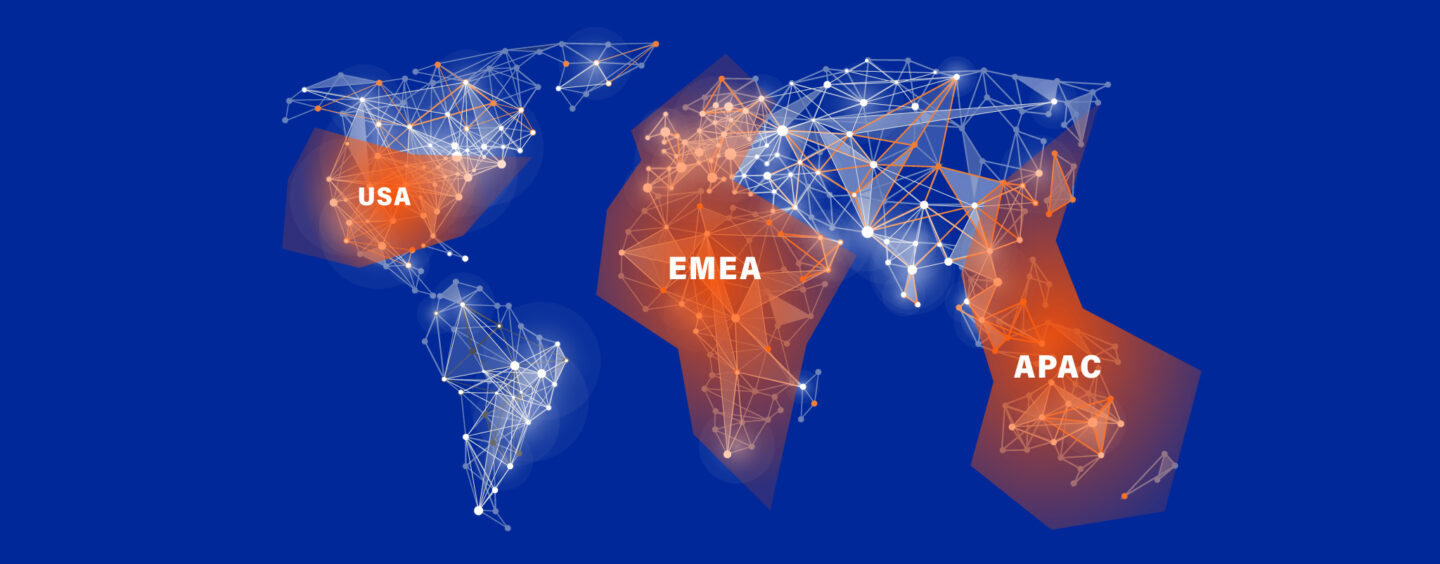

BASIS ID compliance team gives you an overview of the regulatory changes in crypto finance 2020- early 2021.

BASIS ID is a company of the ZignSec group. The software of BASIS ID verifies over 3,000 government-issued documents from more than 190 countries.

BASIS ID is a listed company group with NASDAQ First North Sweden (ZIGN:SE0012930105) and follows every regulatory obligation meaning strong reporting, corporate governance, licensing, and compliance with international laws such as GDPR, data localisation laws, and FATF.

| The highlights of the year 2020 were the tightened regulation in some jurisdictions and the active discussion around central bank digital currencies (CBDCs). |

US

Photo from Pexels

Between January 2019 and April 2020, US lawmakers have introduced a total of 32 legislative proposals for the cryptocurrency sector’ regulation.

Some of them are aimed at developing a regulatory framework, while others refer to the potential use of digital assets for illegal activities. Several bills explain how blockchain could be used by the US government exclusively and include evaluation of the digital dollar concept.

In December 2020 Financial Crimes Enforcement Network (FinCEN) and the US Department of the Treasury announced further regulatory requirements for cryptocurrencies. The most curious FinCEN’s proposition is about verifying bitcoin wallet holders in the case of outgoing transactions of $3,000 or more. The wallet holders data must be verified in compliance with the latest BSA regulations. Companies will have to report transactions above $10,000 directly to the regulator.

EU

Amid the coronavirus pandemic, the European Commission (EC) has accelerated work on the regulation of stablecoins and seigniorage-style cryptocurrencies.

The EU Fifth Anti-Money Laundering Directive (AMLD5) has been in place since January 2020 followed by the Sixth (AMLD6) in December of that same year, both aiming to promote global security and the integrity of the financial system. Many member states have already implemented these regulations, and a large number of cryptocurrency companies are providing services in full compliance with the directive.

By 2022, the EC plans to establish a regulatory sandbox for benchmarking smart contracts and blockchain-based products.

While European authorities try to regulate cryptocurrencies, stablecoins and security tokens on a par with other financial assets — the financial community is getting more and more concerned about these measures.

The International Association for Trusted Blockchain Applications (INATBA) is worried they could overburden the industry.

Another hot topic of the year in the EU is CBDC. Last year the European Central Bank (ECB) commissioned a group of experts to study the “viability of its release”, but even before the report was published, ECB lawyers had already applied for the registration of the”digital euro” trademark.

Work on launching the digital asset is scheduled for mid-2021.

Germany

Digital assets are now acknowledged as financial instruments in Germany, and there are many discussions about integrating blockchain into the stock market to increase their liquidity and enhance legal compliance.

Banks can sell and now store customers’ cryptocurrency in accordance with AMLD5 and AMLD6 requirements.

Though, the new German tax regulations set a limit of €10,000 on losses from cryptocurrency derivatives transactions. Residents will be able to reduce their income tax base by a maximum of this amount. It is de facto a ban on trading in crypto-derivatives! The new law will take effect this year.

Regulations have been also defined for providers of cryptocurrency ATMs – they need to obtain permission to install the devices in public places. At the time of publishing this article, there are 52 cryptocurrency ATMs in Germany.

UK

The UK Treasury Department has proposed to tighten regulations on advertising and promoting financial services and products, including those related to cryptocurrencies. These changes include establishing an additional regulatory “gateway”. Any financial entity who wants to approve advertising of financial products from unauthorised companies would first have to get approval from the Financial Conduct Authority (FCA).

The sale of cryptocurrency-based derivatives to retail traders has been banned in the country since October 2020.

Cryptocurrency companies were also required to apply to the FCA to do business, but due to the pandemic, dozens of them did not get approval in time. The FCA has extended a temporary registration period for them until mid-2021.

The UK is exploring the regulation of stablecoins and the feasibility of CBDCs. The Bank of England and the Ministry of Finance have been commissioned to investigate the issue.

Gibraltar

Gibraltar, known as one of the most cryptocurrency-friendly jurisdictions, will adopt new policies in the coming months to counter manipulation of the digital asset market. It will also implement FATF recommendations for the whole financial sector.

The updates provide clarity on token emission and include a risk management solution that will oblige cryptocurrency companies to collect and verify customer information.

Cayman Islands

The European Union has removed the Cayman Islands from the offshore blacklist. There are six cryptocurrency exchanges now in the jurisdiction whose customers held a total of $450 million in bitcoin in the first half of the year.

The Ministry of Finance of the Cayman Islands has decided to stimulate attractive conditions for virtual asset service providers (IDPs) who are yet obliged to operate following FATF requirements. They must comply with AML/CFT regulations and register with the local financial regulator.

Hong Kong

Hong Kong jurisdiction is the first in the Asia-Pacific region to be assessed by the FATF. In response, the government announced tighter regulation of the industry concerning money laundering and terrorist financing.

In November 2020, the local Securities and Futures Commission proposed a new licensing scheme that would cover all bitcoin exchanges. Previously, traders required regulatory approval if at least one security token was present on a platform.

Malaysia

Securities Commission Malaysia issued new IEO guidelines in October 2020, companies are allowed to raise up to RM 100 million (approx. US$ 24 million) but can only do so view platforms approved by the regulator.

Currently, they have yet to approve any platforms.

Singapore

Photo from Pexels

Since the beginning of the year 2020, cryptocurrency companies, including exchanges, are obliged to register and apply for a payment service provider license. It means all businesses in this sector must comply with the requirements imposed on payment service providers, including customer onboarding regulations.

The authorities have a more tolerant attitude towards individual miners and coins obtained from hard forks or free airdrops – they have decided not to tax them.

In conclusion:

The past year has shown that decentralisation and anonymity remain a concern for authorities, although some countries have been able to offer compromise solutions to the financial sector players.

More regulation, oversight and tax-related initiatives are emerging as more institutional investors get into the game.

While FATF recognises that the industry is just beginning to adapt to regulatory requirements, The European Union remains cautious about digital assets. In the first place, The EC is worried about the legality of their origin and the authentication of transactions.

Yes, cryptocurrencies certainly need “progressive regulation”, as Hester M. Peirce stated. But should they be that redundant?

Not everyone in the community is happy about the recent regulative course, despite the rise in cryptocurrencies prices. “Bitcoin is based on very different values” they say.

However, the balance of power is shifting in favour of regulators, who are not very keen on financial sovereignty and the inability to rollback transactions.

To adapt to them is to move ahead.

This regulatory review is brought to you by BASIS ID, a highly regarded provider of KYC, AML and UBO verification services.

To receive compliance advice or help in streamlining verification processes, contact BASIS ID and the company’s specialists will help you find a solution that ideally suits your needs