In his book Crossing the Chasm, Geoffrey Moore suggests disruptive innovations follow an s-curve, where there is a gap or chasm between early adopters and the early majority.

It would be fair to say Decentralised Finance or commonly abbreviated as DeFi is seeking to punch through this chasm. While it has been adopted by innovators and early adopters, it has not achieved the majority adoption its supporters were hoping for.

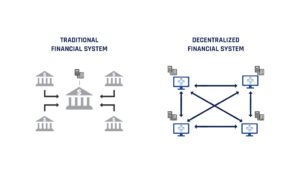

For the uninitiated, DeFi is a system in which financial products are accessible through a public decentralised blockchain network. This removes the need for consumers to transact through intermediaries such as banks and brokerages.

DeFi allows different players within the financial ecosystem – from buyers and sellers to lenders and borrowers – to transact directly with each other.

Smart contracts are the keys to DeFi’s ability to facilitate these peer-to-peer (P2P) transactions. Hosted on a blockchain network, these contracts are “smart” as they automate agreements between buyers and sellers, performing the role previously fulfilled by an intermediary.

Why the hype?

To understand the excitement over DeFi, we must first examine the current state of financial services.

The modern economy is set up in a hub and spoke model. These hubs consist of financial centres such as London, New York and Singapore. Economic activity radiates from these hubs into the surrounding spokes. This meant these financial hubs are often the wealthiest within their region.

While this model is beneficial for residents of these financial hubs as they benefit from large capital inflows, it creates a concentration of economic power that is not healthy for the global economy.

This flaw was exposed during the 2008 Global Financial Crisis (GFC) where the collapse of New York-headquartered Lehman Brothers laid bare the excessive risk-taking and lax regulations around financial institutions.

The GFC showcased the vulnerability of the global economy as a domino-like effect ensued after the US housing bubble burst and plunged the world into its worst economic crisis since the Great Depression.

After the GFC, trust in banks and large financial institutions dwindled. That marked the beginning of the blockchain revolution as decentralisation was proposed as a solution to prevent an economic crisis of GFC’s scale to occur again.

In 2009, the first blockchain was implemented as the public ledger for transactions made using Bitcoin, a form of cryptocurrency. Alongside Ethereum, it is one of two main cryptocurrencies used in DeFi transactions today.

In 2014, Blockchain 2.0 was born as the technology was separated from its initial currency goal and potential for other financial, inter-organisational transactions were explored. Today, DeFi networks are used in an array of financial services, including traditional ones such as payments and lending.

DeFi within SEA

Within Southeast Asia, a number of fintechs are seeking to leverage DeFi and build what some have termed the “future of financial services”.

In March, Singapore-based ShuttleOne launched a blockchain-based lending platform for SMEs. It claims the blockchain technology enables cross-border remittances to occur at a lower cost and in a more transparent manner.

Meanwhile, non-fungible tokens (NFTs) are also starting to gain popularity within the region. A unit of data stored on a blockchain network, an NFT acts as a digital certificate to verify the underlying digital asset is unique and therefore not interchangeable.

Singapore NFT marketplace Mintable raised a US$13 million Series A funding round in July. It had recently partnered with National Football League (NFL) quarterback Trevor Lawrence to sell his NFT collection for over US$225,000.

Sceptics remain

Supporters of DeFi have long advocated its transparency as it allows consumers to bypass opaque systems used by traditional financial institutions. Besides, the underlying blockchain technology makes it technically impossible to hack.

Others have argued DeFi promotes financial inclusion as the public nature of it allows anyone with an internet connection to access it. This solves the distribution challenges present in financial services, where the requirement for one to visit a physical bank branch to perform transactions has resulted in a large unbanked population in emerging markets such as Southeast Asia.

However, DeFi has its fair share of critics too. The public nature of these networks makes them easily accessible to hackers. More than US$285 million have been lost on Ethereum DeFi networks since, 0.65 per cent of its total current value.

Perhaps, the greatest hurdle the technology faces in achieving mass adoption is its borderless nature. DeFi is a global network that transcends borders.

However, different countries each have their own regulations around financial services with no two jurisdictions likely to share the same laws. Therefore, this begs the question of who will be held responsible for financial crimes on DeFi networks?

Crossing the chasm

While promising developments have been made on DeFi, we are not at the point where it can meet the high security and governance standards we expect of critical financial infrastructure.

For DeFi to achieve its function as the underlying infrastructure for financial services, it needs to be trusted by the majority. Without regulatory support to accelerate this, it is unlikely DeFi will be able to cross the chasm – much less in a developing economy like Southeast Asia.

Featured image credit: Money photo created by rawpixel.com – www.freepik.com