Only 36% of Indonesia’s population is connected to formal financial institutions, leaving an estimated 110 million unbanked citizens due to banks’ high fees, lack of consumer trust and long distances to branches.

GOVERNMENT ASSISTANCE AND SUPPORT

The Indonesian Government is supporting Digital Financial Services through an emerging series of new regulations which are aimed at improving fnancial inclusion and access for unbanked citizens. For example, new legislation is helping banks to reach out and assist low-income micro-consumers to open bank accounts, receive and distribute savings and achieve other fnancial activities, all without minimum deposits or monthly admin fees.

Branchless banking and digital fnancial service schemes with mobile-based agents are also being developed and the Financial Services Authority (OJK) has issued consumer protection regulations regarding electronic payments processing.

KEY FINTECH PLAYERS IN INDONESIA

Comparison website for fnancial products such as insurance, broadband, banking and loans. Helps customers to take greater control over their finances.

Indonesia’s frst integrated investment portal with data services, investment tools, fnancial news and updates. Aims to facilitate investments and savings for Indonesians regardless of their banking status.

Indonesia’s largest and fastest growing provider of electronic payment and risk management solutions. Serves 800 Indonesian businesses and is spreading electronic/mobile payment apps across the country.

Online payment gateway processing credit/debit card payments, bank transfers and digital wallet cash transactions (T-cash, XL Tunai, BBM Money, Indosat Dompetku, Mandiri eCash).

Allows Indonesians to compare and apply for fnancial and general insurance products like personal loans, credit cards, conventional deposits, and syariah deposits.

One of Indonesia’s oldest electronic payments platforms (created in 2001). Provides hardware products – like encoders and card printers, network access equipment and payment terminals – as well as software solutions – internet payment gateway, transaction processing switch, terminal line encryption, and smart card applications.

Find out more about Indonesia’s Fintech Startups Scene

Financial inclusion: Rather than enduring the risks of a purely cash-based financial existence, Indonesians can handle their money more safely and effectively through Digital Financial Services.

Convenience: Digital Financial Services transcends geography, meaning that Indonesians don’t have to travel far and wide to access and manage their finances, they can do it all from their phone or computer.

Speed: Digital Financial Services can inform Indonesian banking consumers, giving them all the data they need to make important financial decisions while facilitating transactions in seconds, without any face-to-face meetings.

Minimal outlay: Digital payments platforms and financing services offer financial inclusion without the attached cost of monthly banking and admin fees.

>> Download the full report: Indonesia’s Booming Digital Financial Services Sector

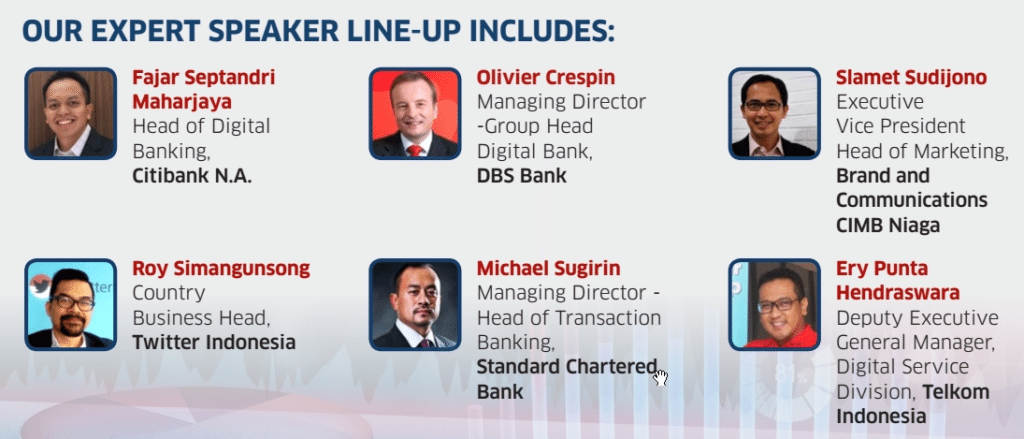

Attract new customers and drive revenue by developing a comprehensive digital strategy, to be be presented at Digital Financial Services Indonesia 2016 Summit, to be take place on November 8-9 in Jakarta, Indonesia. Save your seats now with special offer: 10% discount for Fintech News readers when registering with code “FINTECH_10”

Special Offer: 10% Discount When Registering With Code “FINTECH_10“

Halo Money

Halo Money

Bareksa

Bareksa

Veritrans

Veritrans Cekaja

Cekaja Kartuku

Kartuku