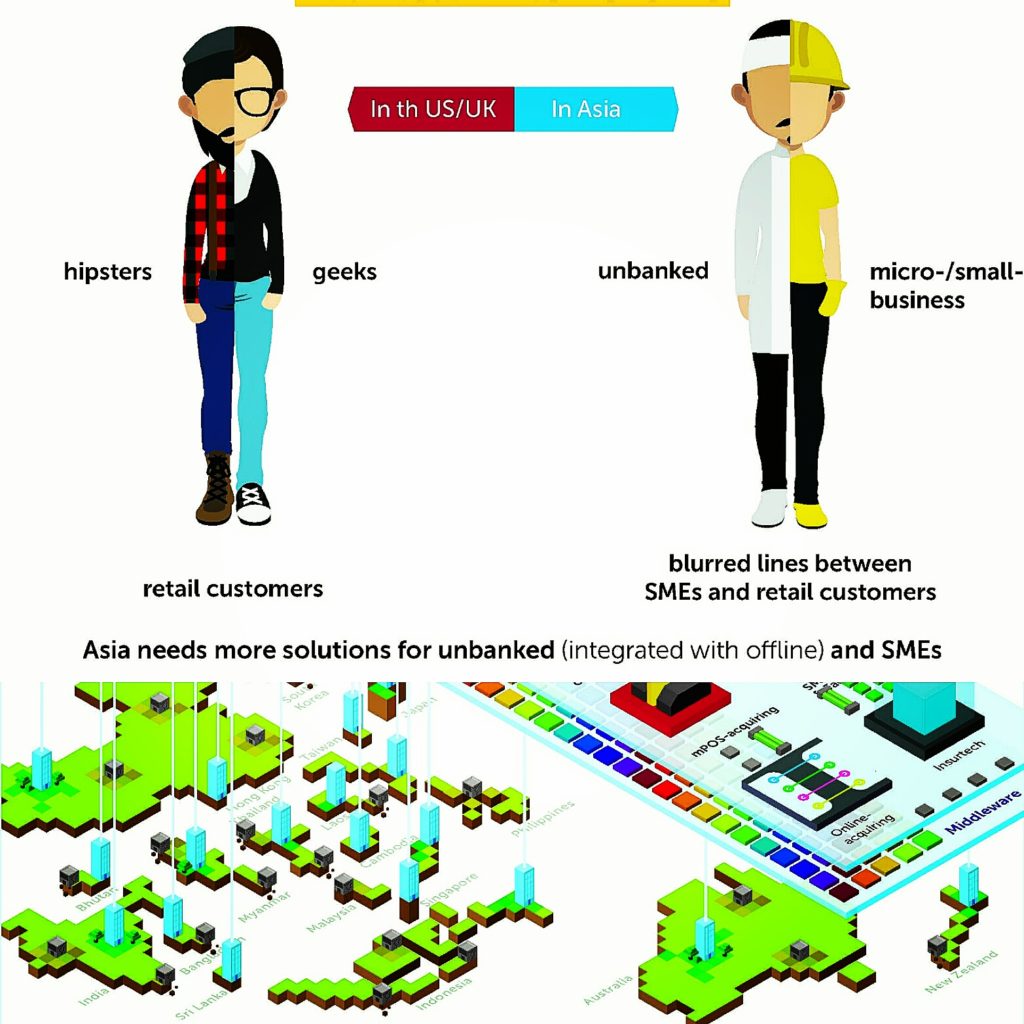

What Asia Can Learn From Africa To Succeed in Fintech For Unbanked?

by Slava Solodkiy November 13, 2016Facebook is currently considering acquiring mobile money giant M-Pesa in Kenya.

One month ago Visa payments network introduced a mobile-phone application to enable cashless transactions in Kenya too. The mVisa app will initially facilitate transactions for people with accounts at four banks. Africa had 557 million mobile-phone users at the end of 2015, according to the GSM Association.

The company estimates 84 million of them still pay by cash. About 1,500 merchants have signed up already and Kenyan lenders with units in the region want to introduce the system in neighboring nations. Visa is in talks to roll out the product in Uganda, Tanzania and Rwanda within two months.

In east Africa, many people have access to an easy source of credit. It takes just a few taps on a phone to obtain a short-term loan, which will arrive in a mobile-money account almost immediately.

Mobile wallets such as M-Pesa and Tigo Cash have already transformed microfinance. VisionFund channels 95% of its Kenyan loan payments and 98% of its Tanzanian ones through mobile wallets. The mobile networks seldom compete directly with microlenders.

Most of their loans are tiny—more nano than micro—and must be repaid in a month or two. They are strongest in Africa, where microlenders have always been scarce. But some are now offering bigger, longer-term loans.

Venture Capital Firms Focus On Unbanked Population

Irrational Innovations, a venture capital fund focused on Fintech and Financial Inclusion in SSA, has researched, explored, and mapped out how financial technologies are impacting multiple key aspects of people’s lives in Sub-Saharan Africa.

They discovered over 20 companies that use mobile phones and financial technologies to serve and promote sustainable development. This report includes companies that supply energy through solar panels and enable payment through mobile phones; health insurance and hotlines companies facilitated through mobile-based subscriptions; financial identity and credit scoring – assessed through mobile usage and behavior, and more.

Omidyar Network, an “philanthropic investment firm”, invested in Asia in such companies like Philippines-based big-data and online-scoring startup Lenddo, which was honored as a 2014 Technology Pioneer by the World Economic Forum.

Lenddo helps businesses and finance companies to simply and securely evaluate both the character and identity of customers using alternative data in order to extend credit and deliver life-improving services. Lenddo is already solving the challenges of identity and risk management associated with thin file customers in over 10 countries.

Not only Omidyar Network, but also IFC (International Finance Corporation) by World Bank, Bill and Melinda Gates Foundation, Quona Capital are very active right now in the Asia-Pacific region to support initiatives for unbanked population and bring successful experience of such African fintechs like M-Pesa to the region.

And not only capital – to invite talents is very important too. US-based Branch.co (by Matt Flannery, who changed the world of lending in developing countries when he co-founded Kiva.org) successfully has launched and tested several microlending products for SMEs in Africa and is now going to Asian region.

Singapore-based Nearex also provides payment solutions for non-banks’ customers in Africa and now deploying it in India and Thailand. Myanmar-based Red Dot Network by Irish entrepreneur John Nagle (and Philippines-based Ayannah too) provide great example how to create non-banking agent-based network for distribution of financial services in rural areas. But how to attract more foreign talents to help these markets?

Challenges

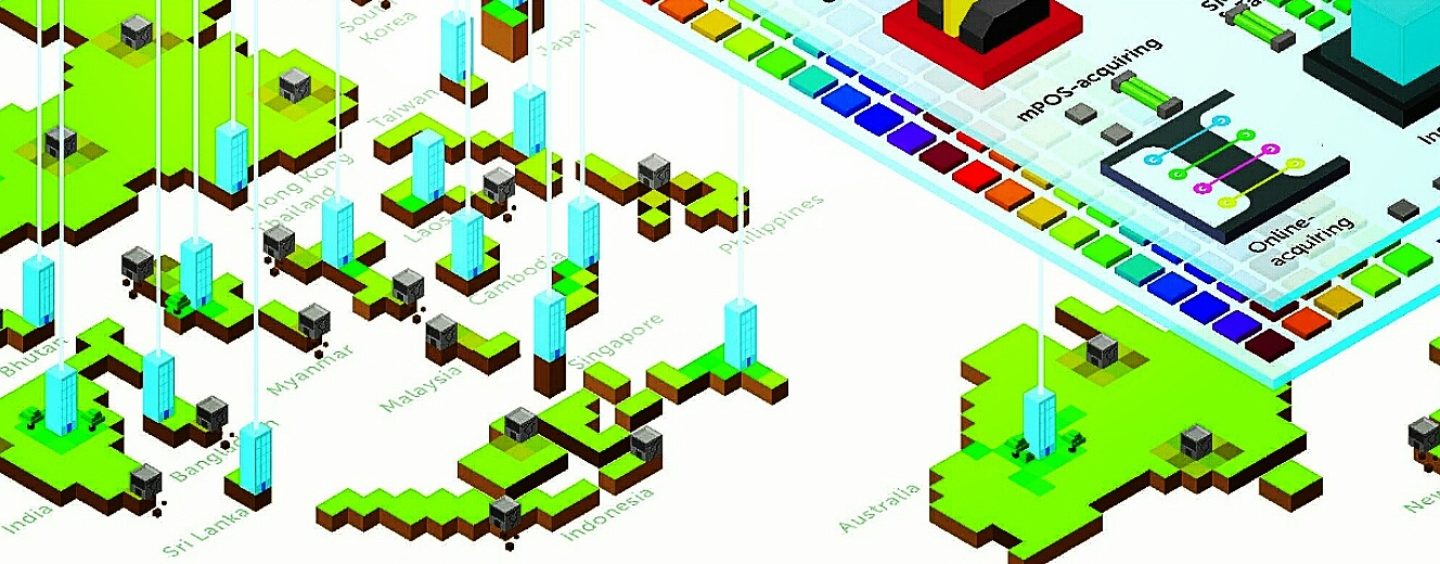

Lack of infrastructure (BaaS-platforms and open APIs) is one of the biggest challenges to attract foreign fintechs to unbanked-countries. This is especially important for such countries like Myanmar, Laos, Cambodia, Vietnam, etc, – such a platform will bring them into line with the developed countries in terms of market accessibility for fintech-startups.

Otherwise, companies will keep scaling to other markets, and these countries and their population will be isolated from the latest financial technologies (although they are vital to them!). Without this solution like BAAS.IS it is very expensive and hard to launch any fintech-service internally and for the best foreign solutions to expand to the region.

In September 2016 McKinsey in their recent “How digital finance could boost growth in emerging economies” report wrote that delivering financial services by mobile phone could benefit billions of people by spurring inclusive growth that adds $3.7 trillion to the GDP of emerging economies within a decade.

But without infrastructure changes (by new tech- and non-banking players) and regulators’ support of them (like it happen in Africa) it will never happen in Asia.