Singapore’s Cautionary Roar: Navigating Crypto’s Popularity with Prudence

by Rebecca Oi March 14, 2023Singapore is well-known for its proactive approach toward technology adoption and innovation. However, the country’s central bank, the Monetary Authority of Singapore (MAS), has taken a cautious approach to crypto or cryptocurrencies.

The MAS views cryptocurrencies as inherently risky due to their volatile nature, and potential for illicit activities such as fraud and money laundering.

As a result, the central bank has consistently warned investors about the risks associated with cryptocurrencies, including their susceptibility to market volatility.

MAS has stressed that investors should not anticipate the same level of safeguarding with cryptocurrencies as they would with traditional investments like stocks and bonds. Furthermore, cryptocurrencies are not acknowledged as legal tender in Singapore.

Crypto funding in Singapore declined in 2022

Despite the cautious approach towards cryptocurrencies, Singapore has been a hub for fintech innovation, with a thriving ecosystem of startups and investors.

Singapore experienced its most significant fintech funding in three years in 2022, with a total of US$4.1 billion raised across 250 deals in mergers & acquisitions (M&A), private equity (PE), and venture capital (VC). Notably, the crypto sector made up US$1.2 billion of the total funding.

Nevertheless, according to a KPMG report, crypto and blockchain funding in Singapore experienced a decline of 21 percent from US$1.5 billion in 2021 to US$1.2 billion in 2022.

The decline in crypto and blockchain funding in Singapore can be attributed to several factors, including the Terra (Luna) crash on March 12, the bankruptcy of crypto hedge company Three Arrows Capital on June 29, and the FTX bankruptcy on November 11. These incidents highlighted the inherent risks of investing in cryptocurrencies and caused many investors to become more cautious.

KPMG predicts investment in crypto-focused firms will remain slow until this year’s first half as investors enhance their due diligence and governance processes. This caution is not unique to Singapore, with many investors and regulators worldwide taking a more measured approach toward cryptocurrencies.

Guidelines to discourage cryptocurrency trading by the general public

In 2022, the MAS issued guidelines to digital payment token (DPT) service providers, including cryptocurrency exchanges and brokers, and forbade promoting DPT services to the general public in Singapore. The MAS expects that DPT service providers will only offer their services to institutional and accredited investors, not retail investors.

In addition, the new regulations prohibit cryptocurrency trading service providers from participating in public advertisements and collaborating with third parties such as social media influencers. This implies that these companies can only market or advertise on their own official websites, mobile applications, or social media accounts.

According to MAS, the intention of these guidelines is to discourage the general public from engaging in cryptocurrency trading due to the considerable risks involved.

Furthermore, the central bank mandates that crypto service providers operating exclusively outside of the city-state must obtain licensing.

The central bank also requires DPT service providers to conduct appropriate customer due diligence and comply with anti-money laundering and counter-terrorism financing regulations.

The guidelines are designed to protect retail investors from the risks associated with investing in cryptocurrencies, such as fraud and cybercrime.

MAS Consultation papers on proposed regulatory measures

On October 26, 2022, approximately two weeks before FTX filed for bankruptcy on November 11, 2022, MAS released two consultation papers outlining proposed measures to mitigate the risk of consumer harm in cryptocurrency trading and to facilitate the development of stablecoins in Singapore’s digital asset ecosystem.

The first consultation paper outlines MAS proposals to guide how digital payment token (DPT) services and other services involving significant cryptocurrencies such as Bitcoin (BTC), XRP, and Ethereum (Ether) should operate.

The guidelines emphasize that leveraging or using credit facilities in DPT trading can result in more significant losses than the user’s initial investment. This is a reminder to investors about the high volatility and risks associated with trading cryptocurrencies.

According to the paper, the MAS has also proposed banning Digital Payment Token Service Providers (DPTSPs) from offering credit facilities to retail customers in cryptocurrency and fiat. Additionally, MAS is urging crypto service providers to cease accepting credit card deposits as payment for their services.

The second consultation paper outlines a proposed regulatory framework to facilitate the development of stablecoins in Singapore’s digital asset ecosystem. Stablecoins are a type of cryptocurrency designed to maintain a stable value by pegging it to a fiat currency or commodity.

The MAS believes that stablecoins have the potential to improve the efficiency and security of cross-border payments and reduce the volatility of cryptocurrencies.

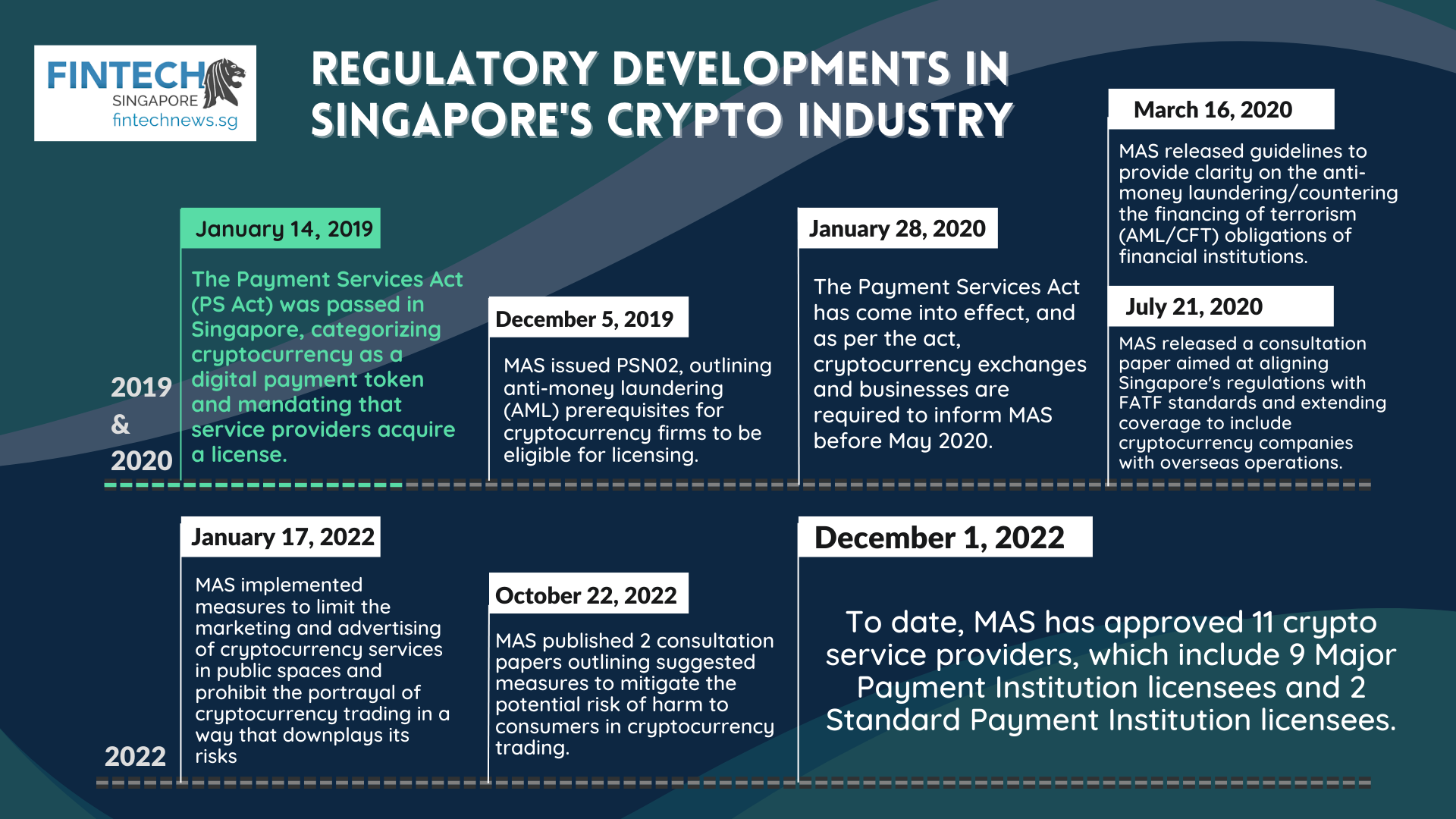

MAS gives the green light to eleven crypto service providers

Despite the caution towards cryptocurrencies, the MAS has given eleven crypto service providers the green light as of December 1, 2022. These entities comprise nine Major Payment Institution licensees and two Standard Payment Institution licensees.

The MAS has strict guidelines for these entities, which include anti-money laundering and counter-terrorism financing measures. The approval of these crypto service providers is a significant step towards regulating cryptocurrencies in Singapore.

However, it is essential to note MAS has taken a cautious approach toward cryptocurrencies and has repeatedly issued warnings about the potential risks involved in investing in them.

Singapore exploring the potential use of CBDC

MAS has been exploring the possibility of issuing a Central Bank Digital Currency (CBDC), which could provide a more secure and efficient payment means while reducing reliance on cash.

In addition to CBDCs, MAS has also been encouraging the adoption of blockchain technology, which underpins cryptocurrencies. The central bank has launched several initiatives to promote the use of blockchain in various industries. For example, Project Ubin is a multi-year project that explores the use of blockchain technology and its potential applications in the financial sector.

Project Ubin’s success has led to several spin-off projects, including Partior, Project Dunbar, and Project Ubin Plus.

By undertaking these initiatives, the MAS encourages the responsible adoption of new technologies and promotes innovation while ensuring that associated risks are appropriately managed.