Open Banking in Asia Pacific: Market-Led vs Regulator-Led Approaches

by Fintech News Singapore March 22, 2023Open banking is steadily making its way into Asia-Pacific (APAC), and though the industry remains largely nascent compared with pioneers like to European Union, adoption is increasing at a stable pace, enabled by new regulatory frameworks and market-led initiatives.

A report by Asia-focused fintech consulting firm Kapronasia, in collaboration with software engineering company EPAM, looks at the state of open banking across the region, exploring the evolution of the competitive landscape and how open banking solutions are currently being served in APAC.

Southeast Asia embraces market-led approach

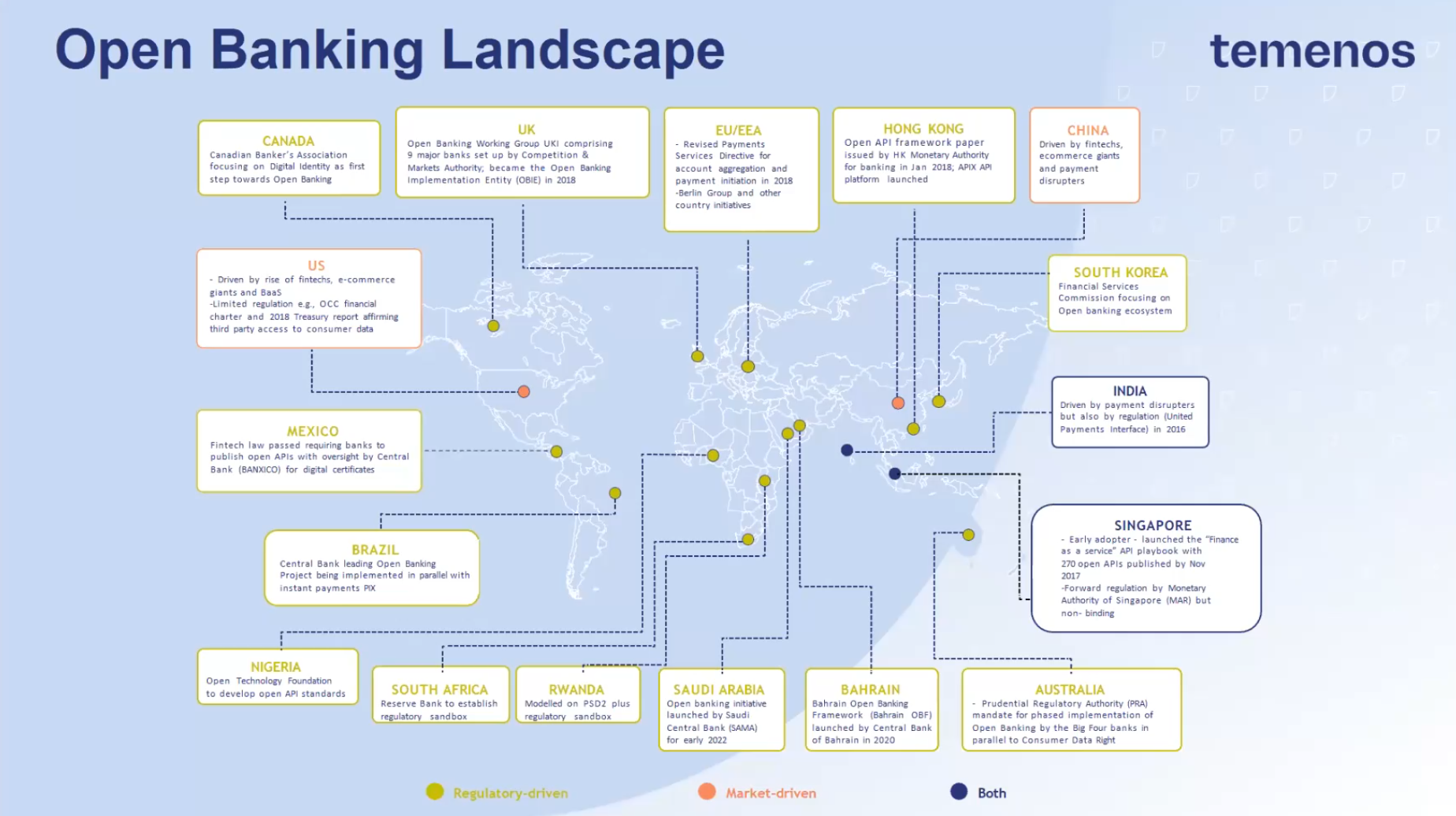

Snapshot of how Southeast Asian countries have approached the adoption of open banking compared to the rest of the world Source: Temenos

According to the report, there is significant diversity across APAC on how open banking is being approached, with some embracing a regulator-driven strategy and others, a market-led approach.

In Southeast Asia, for example, governments have largely let the market decide for itself, presenting instead recommendations and non-compulsory rules.

Most notably, Singapore was the first country in ASEAN to publish guidelines on open banking and to outline a plan for banking data to be made available through open APIs back in 2016.

And since then, the government has continued pursuing open banking opportunities and encouraged banks to adopt APIs by launching numerous initiatives such as the API Exchange (APIX) in 2018, the Singapore Financial Data Exchange (SGFInDex) in 2020, and the Singapore Trade Data Exchange (SGTraDex) in 2021.

APIX is an open architecture platform for fintech and financial institutions to connect, share ideas and innovate collaboratively; SGFInDex is a platform that leverages the country’s national digital identity system to let individuals aggregate their financial data from banks and government agencies; and SGTraDex is a digital infrastructure that allows for the secure sharing of data between supply chain ecosystem partners.

Though there is no mandatory requirement for banks in Singapore to open up their data, systems, and services, a recent research by Finastra has revealed high adoption of open banking among financial institutions, with 90% of professionals in the city state considering it either a “must have” or “important” and a further 90% agreeing that open banking has also had a positive impact on the industry and made it more collaborative.

Like Singapore, Malaysia has adopted a market-led approach to open banking but has been promoting the wider use of open APIs. In 2019, the central bank published a policy document titled Publishing Open Data using Open API, outlining a set of standards which financial institutions intending to publish open data APIs should follow.

Hong Kong, Australia opt for regulator-led strategies

In contrast to Southeast Asian countries, locations like Australia and Hong Kong have seen their governments and central banks playing a much more active role in defining the open banking ecosystem by introducing compulsory open banking regimes.

In Hong Kong, for example, the central bank issued the Open API Framework in 2018, setting out a four-phase approach for banks to implement open APIs. Though banks are required to develop APIs, they are able to restrict access to third-party providers with which they choose to collaborate.

The two first phases were launched in 2019, encouraging banks to make their product information available via APIs and allowing customers to apply for financial products via third parties. The last two phases were introduced from the end of 2021 and allowed access to account information and enabled payments and transfers.

As of March 21, 2023, nearly all of the 28 participating banks had launched all API functions, including product information, customer acquisition, deposit account information and online merchant payments, data from the central bank show.

In Australia, the government has taken a step further, setting instead the stage for consumer data portability. The Consumer Data Right (CDR) framework, which came into force in 2019, provides consumers with a right to efficiently and conveniently access specified data in relation to them held by businesses, and have these data shared with whichever authorized third parties they choose.

While the CDR was first applied to the banking sector, it has also been extended to other sectors of the economy, including the energy sector in late 2022, with telecommunications being next.

Open banking still in its infancy in APAC

The Kapronasia/EPAM report notes that while efforts to encourage the adoption of open banking have accelerated over the past couple of years in APAC, the space remain at a very early stage of development. Banks are just embarking on their digital transformation journey and are focusing on complying with regulations, where these exist, it notes.

They are also been struggling with their core legacy systems and closed architectures, which aren’t optimized to take advantage of new technologies and app management approaches, the report says. These systems and setups often lack API capabilities, preventing connectivity with third parties, and are ill-equipped to integrate with easily cloud infrastructure that is capable of handling the exponentially growing data exchanges and transactions.

To stay remain and tap into new business opportunities brought about open banking and emerging distribution models such as banking-as-a-service (BaaS) and embedded finance, banks must tackle their legacy systems and underlying architecture.

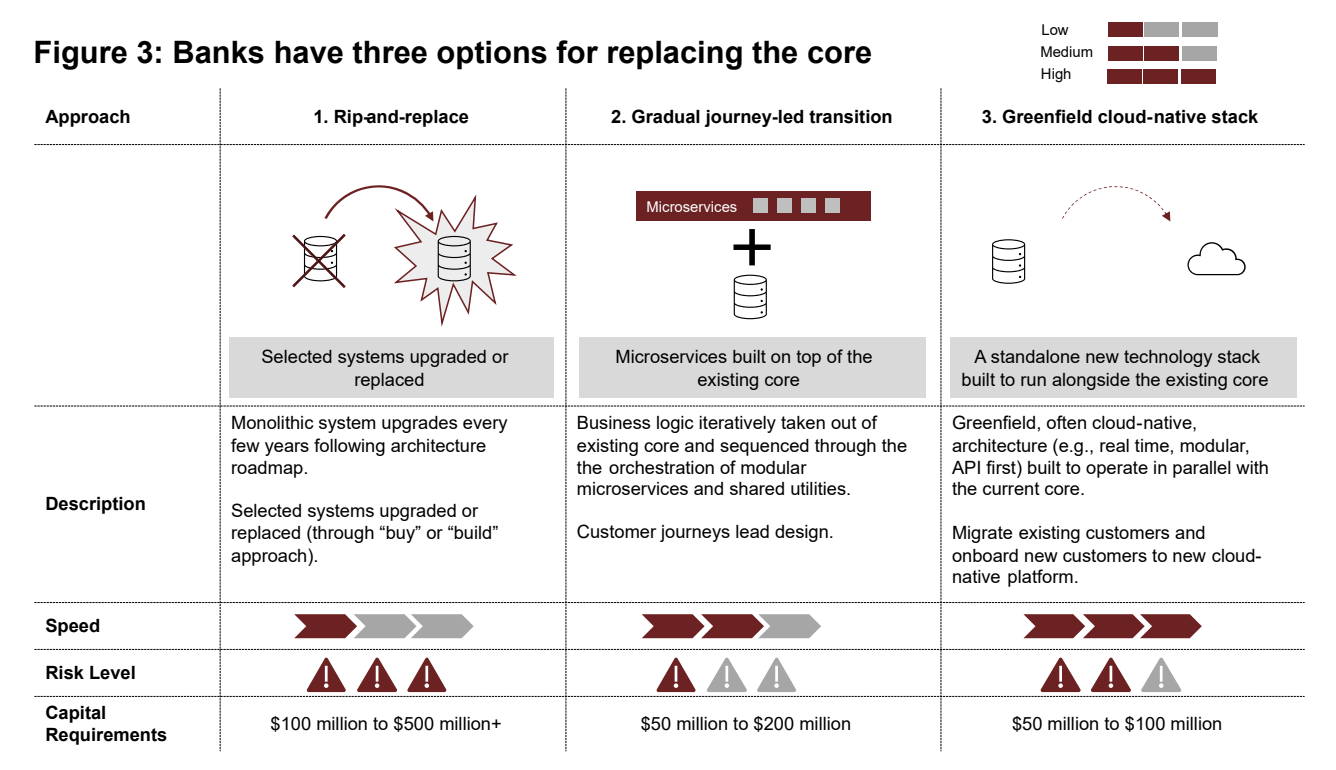

To this end, they will have to choose between three options, the report says: rip-and-replace their existing core; take a gradual journey-led transition approach; build a standalone greenfield cloud-native stack alongside their existing core; or they can opt for a hybrid strategy.

Banks have three options for replacing the core, Source: Readiness of Legacy Systems for Open Banking in Asia Pacific, Kapronasia/EPAM, Oct 2022

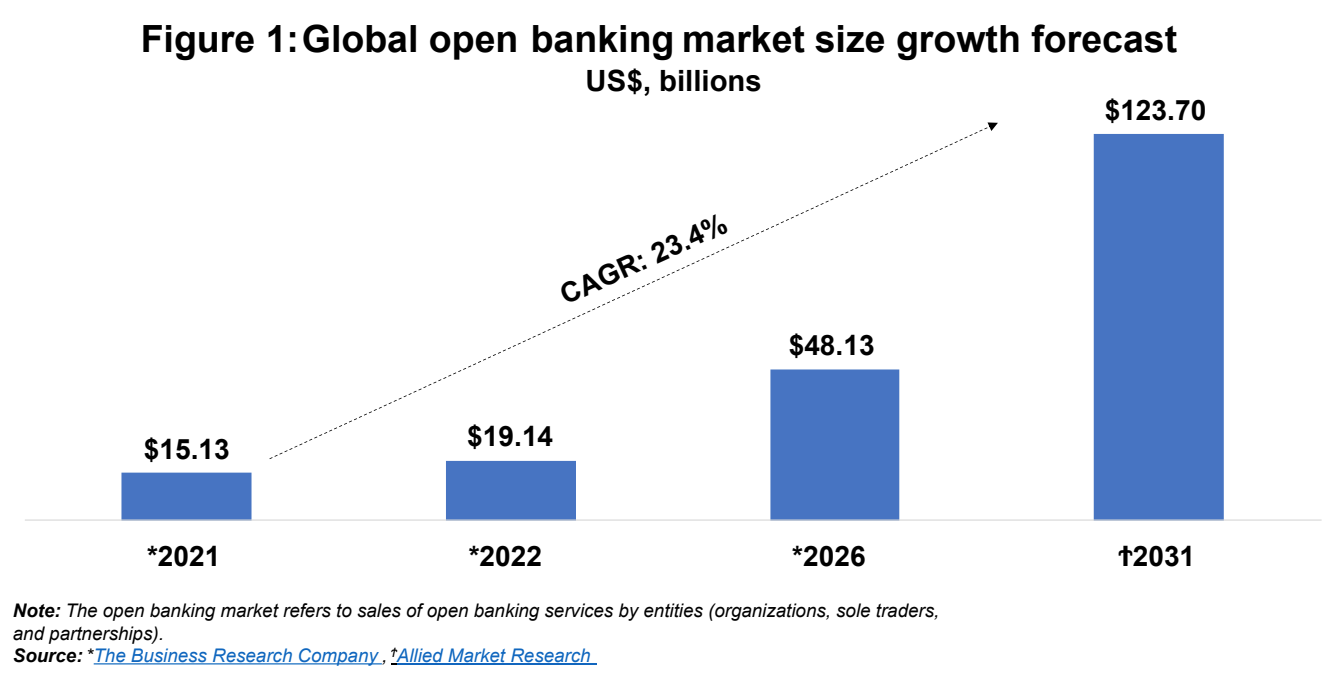

Between 2021 and 2031, the global open banking market is expected to grow at a compound annual growth rate of 23.4%, soaring from US$15.13 billion in 2021 to US$123 billion by 2031.

Global open banking market size growth forecast US$ billions, Source: Readiness of Legacy Systems for Open Banking in Asia Pacific, Kapronasia/EPAM, Oct 2022

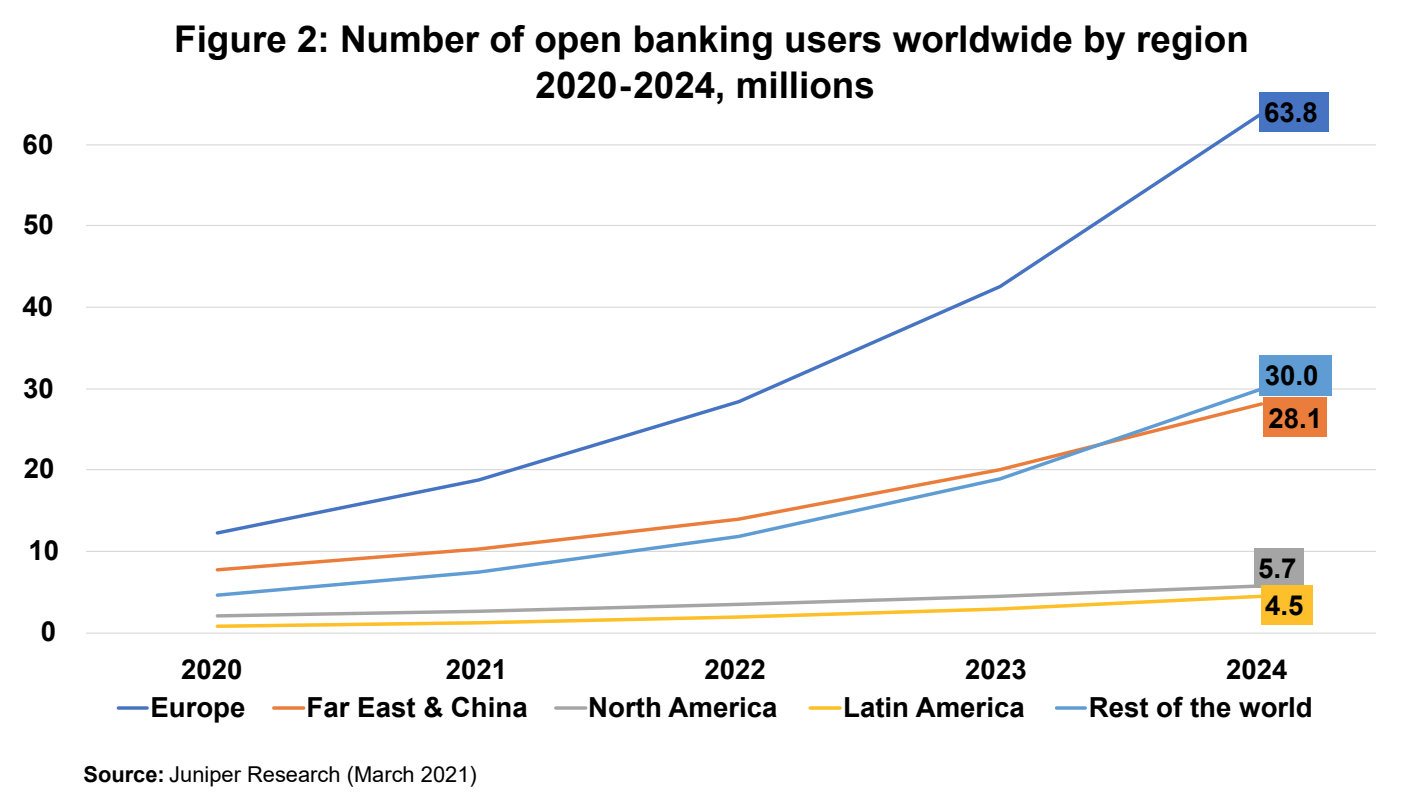

In terms of the number of open banking users by region, Europe is projected to remain the world leader in the years to come, rising from an estimated 28.4 million users in 2022 to 63.8 million in 2024.

The Far East and China will remain at the second position, rising from 13.9 million users in 2022 to 28.1 million in 2024.

Number of open banking users worldwide by region 2020-2024, millions, Source: Readiness of Legacy Systems for Open Banking in Asia Pacific, Kapronasia/EPAM, Oct 2022

Featured image credit: edited from Freepik