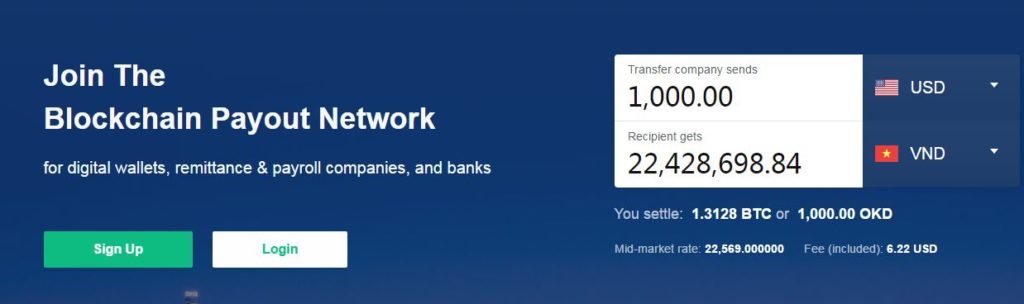

OKLink, a next generation global settlement platform, announced today the launch of real-time transfers to Vietnam.

Companies on the OKLink network can now transfer up to US$10,000 per transaction to a Vietnam bank account, cash pickup, or mobile wallet for a total delivery fee of 0.5% + 5000 VND. This is significantly cheaper and faster than traditional remittance channels.

Real-time remittance to banks, mobile wallets and same-day transfer to cash pick-up locations

Powered by Blockchain, OKLink’s settlement platform allows partners to make transactions within 30 minutes to any account at any of Vietnam’s 27 banks, including VietinBank, Agribank, Vietcombank and BIDV.

Transactions can also be made within the same day to cash pick-up locations across the country as well as real-time to ATM cards or to mobile wallets via Vimo, a mobile payment platform that handles fund transfers, bill payments, online shopping, top-ups, and cash withdrawal.

Jack C. Liu, Chief Strategy Officer at OKLink, said,

“To be able to offer such quick and cheap money transfers to Vietnam is really significant to OKLink’s partners and to Vietnam’s economic development. Remittances from Vietnamese nationals living overseas remain a key part of the country’s economy, equivalent to about 7 percent of its GDP according to 2015 data from the World Bank, and comprising nearly 2.4% of total global remittances.

This speaks to our mission to empower and connect the thousands of remittance companies all over the world and allow them to offer a cheaper and faster service to their customers through secure technology.”

OKLink, which launched in August 2016, currently offers payouts to 40 countries across Asia, Europe, and the Americas, and already has more than 100 partners on its network. As of December 2016, OKLink had completed over 10,000 transactions via its settlement network.