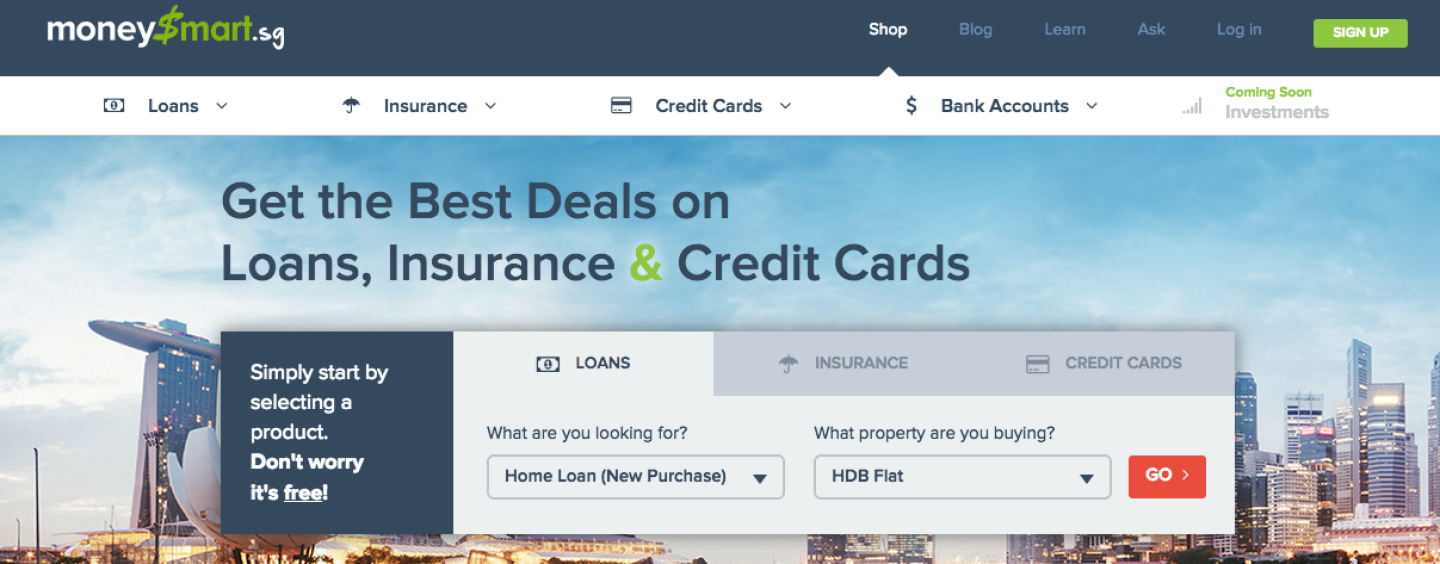

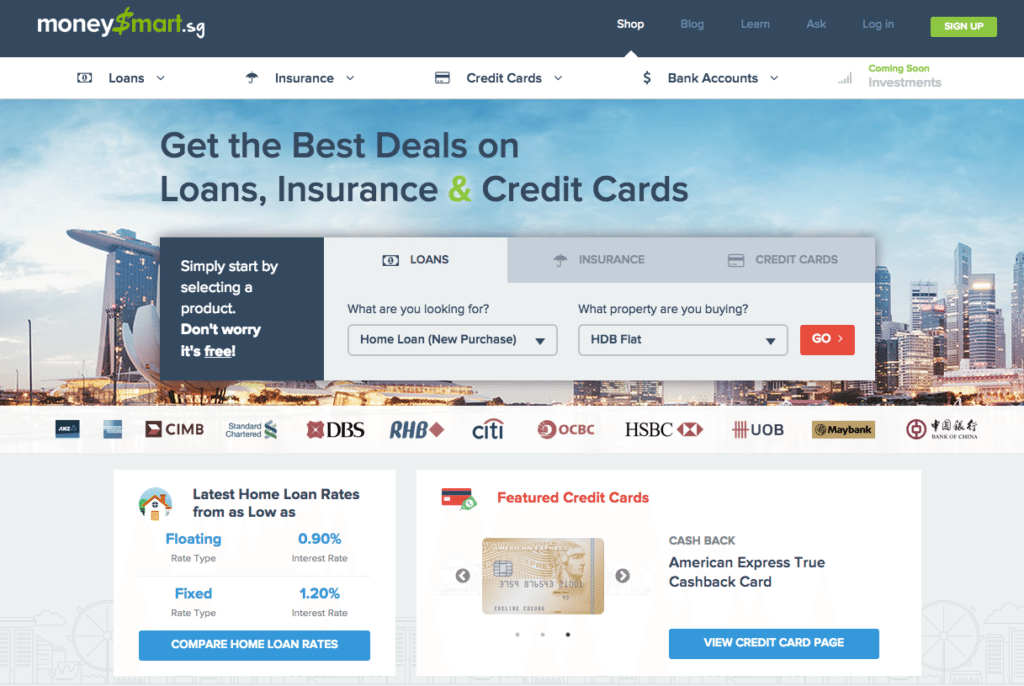

Personal finance portal MoneySmart seeks to help Singaporeans maximize their money by curating and aggregating product information of a number of personal financial products on a single digital platform.

Founded in 2009, MoneySmart provides users with a platform where they can access simplified financial advice, as well as compare prices and features for at least 16 different personal financial products, including loans, insurance, and credit card.

Founded in 2009, MoneySmart provides users with a platform where they can access simplified financial advice, as well as compare prices and features for at least 16 different personal financial products, including loans, insurance, and credit card.

Its purpose: make finance comprehensible to the masses and eliminate the traditional jargon that only a handful of professionals actually understand.

By aggregating and consolidating product information, the platform aims to provide the right tools for people to find what products suit their needs the best. Users can even purchase any of these products through the site.

In addition to its comparison tools and portal, MoneySmart runs a popular content blog that features posts such as “3 Assumptions About Retirement Singaporeans Will Regret Making,” “4 Singaporean Practices That are a Complete Waste of Money,” or even “3 Good Habits to Cultivate at Work No Matter What Your Company Culture is Like.”

“We started our blog because we wanted to educate and engage our audience more frequently,” Vinod Nair, founder and CEO of MoneySmart said. “We thought that content would be a great way to reach out to a new audience.”

“We’re not a bank, we don’t want to sound like one,” Nair added.

The platform draws some 1.5 million page views per month with 500,000 unique visitors.

MoneySmart team – Credit: http://www.moneysmart.sg/

Series A

That popularity has led MoneySmart to raise its Series A round of funding worth S$2.8 million last week.

Led by Singapore Press Holdings (SPH) Media Fund, the round included participation of Golden Gate Ventures, Convergence Ventures, OPT SEA, among others.

The company said it will use the new funding to fuel its growth in Singapore and Indonesia. It also has plans to expand to one other market, which could be either the Philippines, Thailand or Hong Kong, Nair said.

MoneySmart also seeks to build new products, tools and mobile phone apps, as well as recruiting and boosting its marketing efforts in Singapore and Indonesia, he added.

“With the rise of the middle class across South-east Asia, an increasing number of people are becoming more interested and sophisticated in financial investment knowledge,” Chua Boon Ping, chief executive of SPH Media Fund, said.

“There is a strong demand for a comprehensive site where people can look for and compare financial products that meet their individual needs.”

In November 2014, MoneySmart brought over Indonesian competitor KreditAga, now known as DuitPintar.com.

After acquiring KreditAga, MoneySmart saw annual revenue of over S$1 million at the end of 2014. DuitPintar.com accounts for another 500,000 page views.