47 Japanese Banks Move Towards Commercial Phase Using Ripple

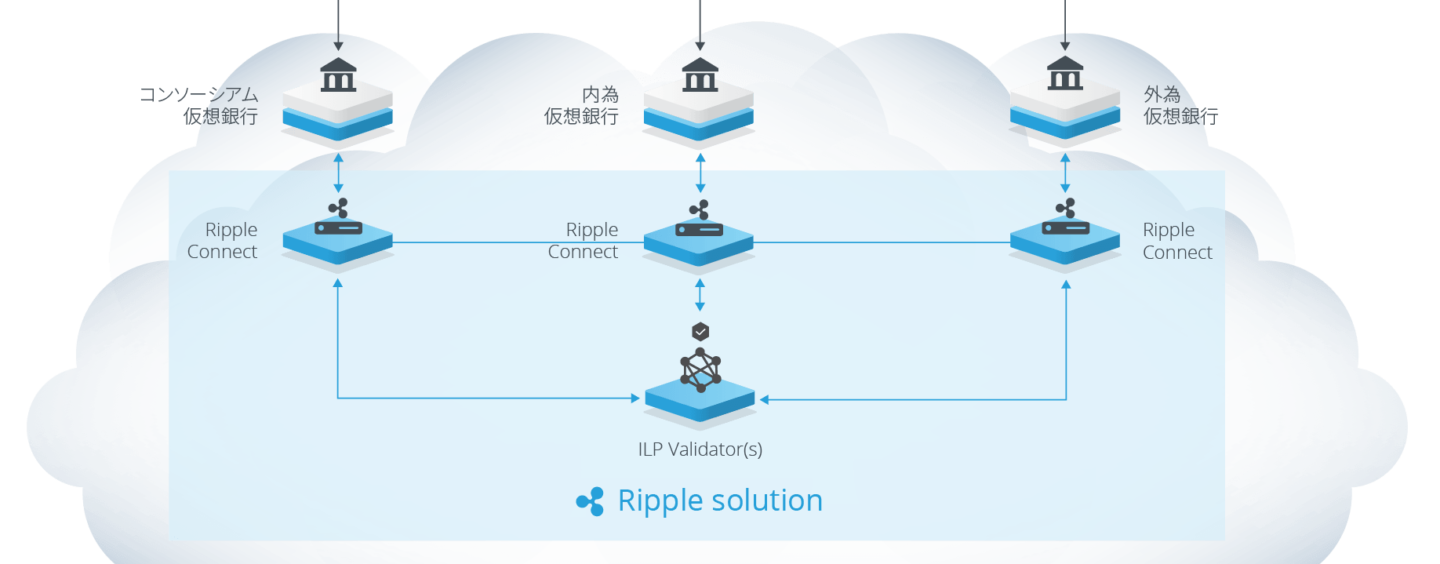

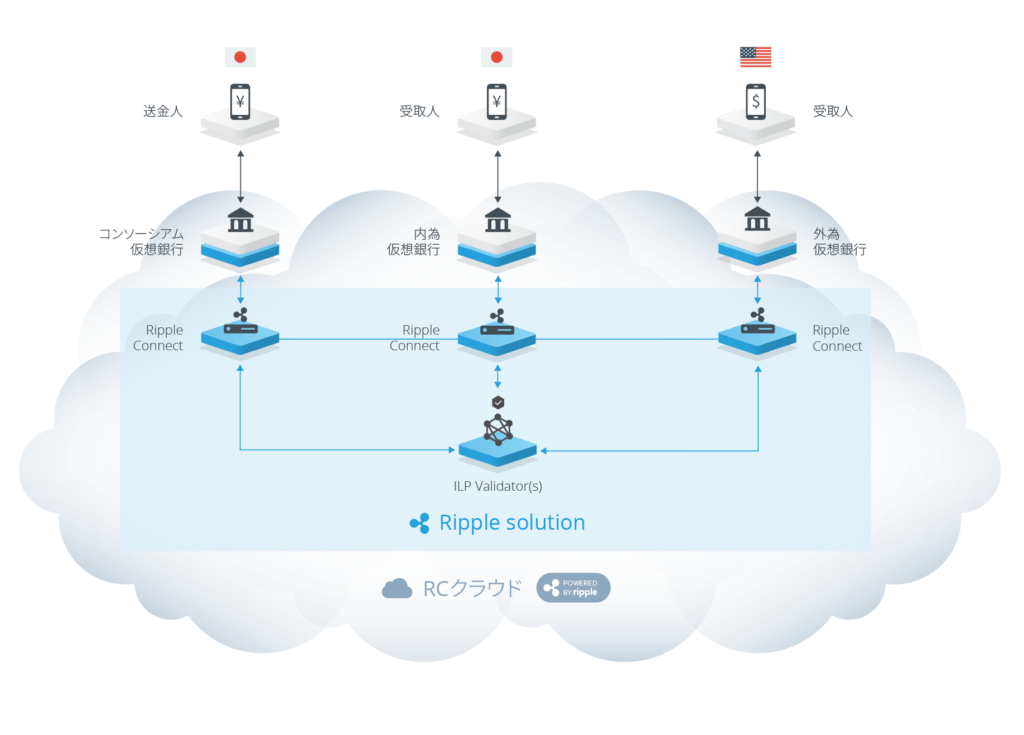

by Fintech News Singapore March 2, 2017SBI Ripple Asia announced today that a consortium of 47 banks have successfully completed a pilot implementation of Ripple in Japan using a cloud-based payments platform. This platform, RC Cloud, is powered by Ripple’s solution and is the first in the world to enable real-time money transfers both domestically and internationally. As a result, the consortium has confirmed that it will move into commercial phase.

“Consortiums are not hard to come by in this industry, but what makes this significant is that these leading Japanese banks are focused on a clear use case and moving blockchain into production,” said CEO of Ripple Brad Garlinghouse. “This is a concrete example that our solution is already transforming how money is sent around the world.”

With 47 banks utilizing Ripple’s solution to enhance their payments system, the consortium has made large strides in moving towards commercialization.

Throughout the process, various aspects of the RC Cloud operation have been evaluated including operational risks, regulatory considerations, standardization and potential interfaces to connect with banks’ accounting systems. The consortium also plans to connect with banks globally, continuing to expand the Ripple network.

“Domestic and cross-border payments have been silo processes that are expensive, but RC Cloud allows for a seamless transaction for both types of payments on one platform,” said CEO of SBI Ripple Asia Takashi Okita. “And as we continue to expand our network, we look forward to utilizing Ripple to enhance banks’ transactions across the world.”

The consortium’s achievement is evidence that Ripple’s distributed financial technology includes the only enterprise blockchain solutions for real-time cross-border payments and is a notable milestone for the growth of our global network.

Over 90 banks globally are working with Ripple, including top global banks such as Santander, Bank of America and Axis Bank. On top of that, over 30 pilots have been completed and over 10 banks are currently moving into commercial use. Ripple is enabling actual use cases, including the consortium’s successful pilot and its move toward commercialization, bringing the financial industry closer to moving value the way it moves information today.