Jachin Capital To Offer iAdvisor, its “Live” Online Investing Platform in Singapore

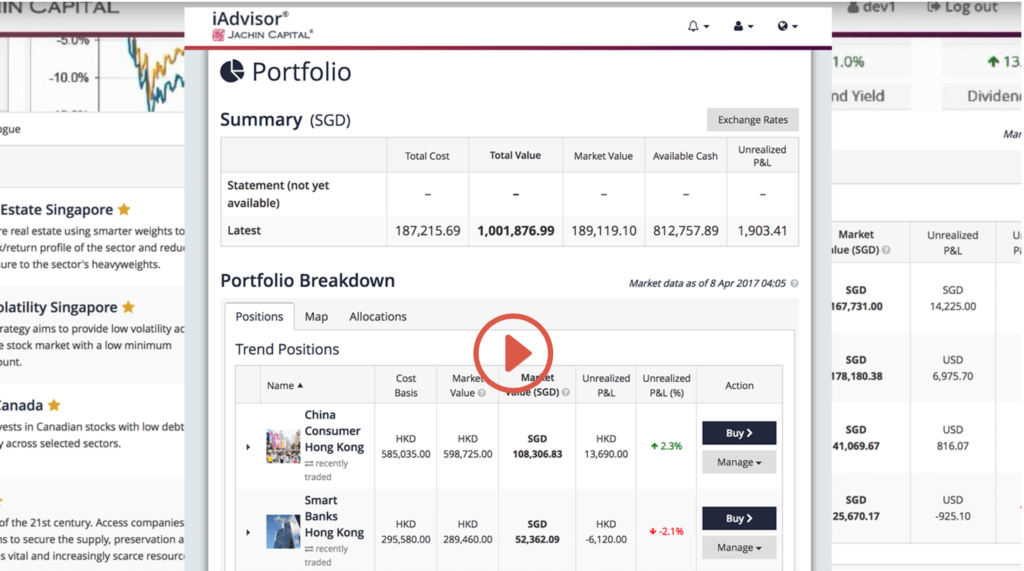

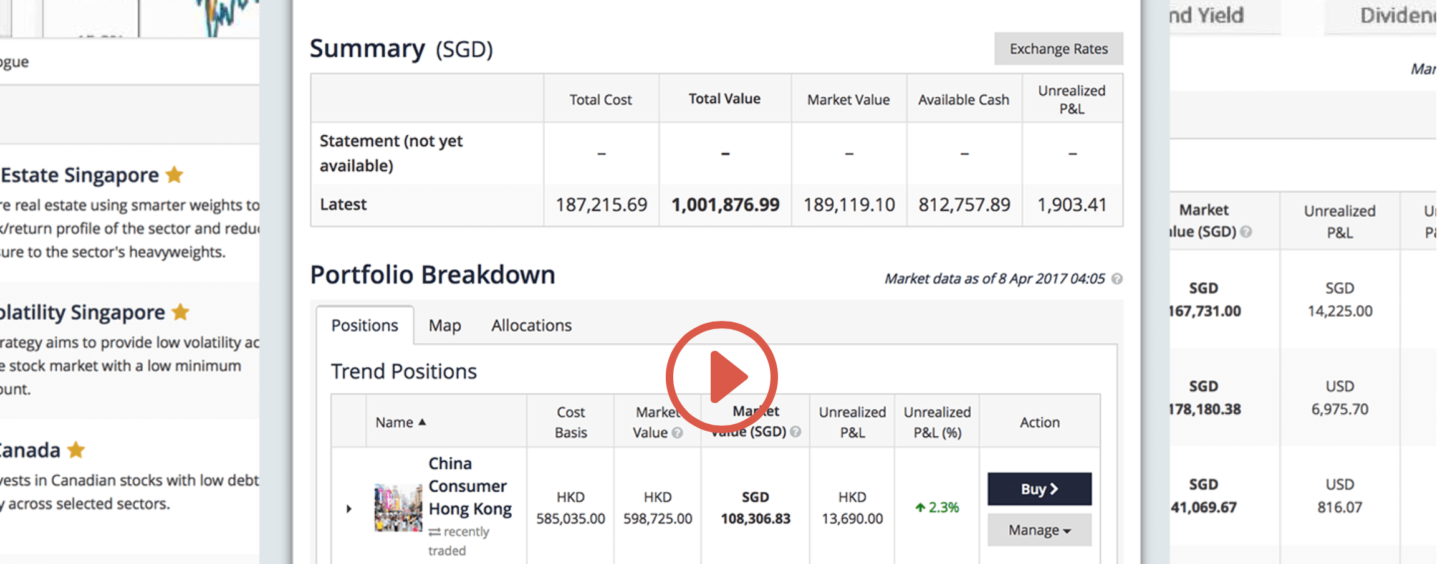

by Fintech News Singapore June 20, 2017Jachin Capital Pte Ltd, a home-grown independent fund manager, announced last month that it has received a Capital Markets Services Licence from the Monetary Authority of Singapore. With the licence, Jachin Capital can now offer its digital investing platform – iAdvisor – to all accredited investors in Singapore.

Starting from an investment theme or idea, Jachin Capital constructs portfolios based on a transparent rules-based framework. The portfolios are regularly reviewed and re-balanced. If you think the Chinese on-line consumer represents the wave of the future, you can invest in the “China Online US” portfolio and at the click of a button, you are investing in a basket of 20 US-listed internet-related stocks domiciled in China such as Alibaba and Baidu. Or, if you are looking for dividend yield in Singapore, you can invest in Jachin Capital’s “SMART Real Estate Singapore” portfolio. This presently gives you an annual dividend yield of 5%.

Currently, iAdvisor boasts 28 portfolios with investment themes ranging from banking to Fourth Industrial Revolution themes like cyber security, robotics and driverless cars. The underlying baskets for each theme are stocks listed in five countries.

The ability to invest directly in listed stocks in different countries is iAdvisor’s unique feature. This platform has been used by Jachin Capital for almost two years to manage its clients’ investments and has proven to be robust and resilient.

Joyce Woo, founder and CEO of Jachin Capital said: “We are pleased that the Monetary Authority of Singapore has approved our application for a Capital Markets Services Licence to offer our iAdvisor platform in Singapore. We started our journey in 2014 with the belief that investors should have an efficient way of investing directly in the underlying stocks when they want to put their money into an investment idea. We also believe that investors should be empowered by knowledge. Thus, iAdvisor provides investors with 24/7 access to everything they need to know about their portfolios such as risk indicators, performance metrics and P&L.

“We are also glad to contribute to Singapore’s exciting, evolving fintech sector,’’ added Joyce, who honed her 31-year banking career mostly in private banking.

iAdvisor was developed in collaboration with Hong Kong-based B2B fintech firm Quantifeed. Established in 2013, Quantifeed is a leading provider of digital wealth management solutions in Asia Pacific, with clients in Australia, China, Hong Kong, Taiwan and Singapore.

Quantifeed CEO and co-founder, Alex Ypsilanti, said: “Wealth management is rapidly progressing towards a more digital future and Quantifeed is at the forefront of this movement. Jachin Capital uses our technology and portfolio expertise to provide an engaging and personalised online investment experience to customers. Our partnership enables Jachin Capital to deliver wealth management at an affordable price and be a digital leader in the market.”