A report by the Global Transaction Banking (GTB) department of Deutsche Bank named Reimagining ASEAN: The digital journey to 2025, revealed that significant gaps remain before it becomes an “advanced digital region”.

This is despite key economic policies signed by the ASEAN Economic Community (AEC), which emphasise on the need for ASEAN countries to embrace evolving digital technology. The move will align the 2025 AEC vision with ASEAN’s Information and Communication Technology (ICT) Masterplan 2020 and the Master Plan on ASEAN Connectivity 2025.

For example, Indonesia and Vietnam – two of ASEAN’s most populous economies with young demographics – still lack effective regulations to protect intellectual property and support digital entrepreneurs, said Deutsche Bank.

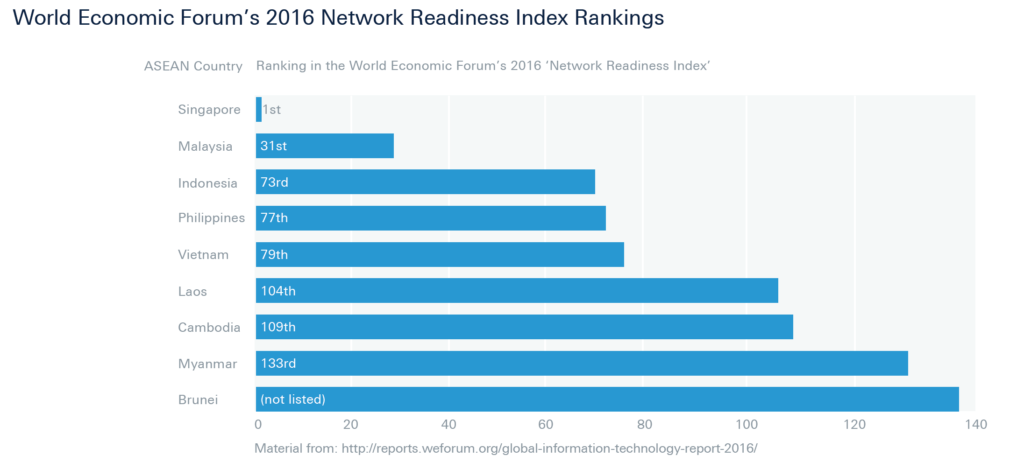

Despite the progress and steps in the right direction, ASEAN as a whole still has a way to go before it can be considered an “advanced digital region”. In the World Economic Forum’s (WEF) Network Readiness Index Rankings, Malaysia was the only other ASEAN country besides Singapore to be placed in the top 40.

The AEC 2025 Consolidated Strategic Action Plan (“the Plan”) includes a number of strategic measures that harmonise with the ASEAN ICT Masterplan 2020 and the ASEAN Telecommunications and Information Technology Ministers Meetings. The Plan has a specific section on cross-border e-commerce transactions that includes measures such as establishing online dispute resolution systems, studying suitable mechanisms for the authentication of electronic signatures and trade documents, and promoting cybersecurity, regional data protection and privacy principles.

Making headway

ASEAN, blessed with a young, dynamic population (around 40% of its citizens are under 30), is making rapid digital progress over the past decade. The region ranks third globally in terms of the number of mobile users, behind China and India. It ranks fourth globally in terms of the number of internet users, behind China, India and the US.

ASEAN, blessed with a young, dynamic population (around 40% of its citizens are under 30), is making rapid digital progress over the past decade. The region ranks third globally in terms of the number of mobile users, behind China and India. It ranks fourth globally in terms of the number of internet users, behind China, India and the US.

ASEAN’s members are also making early headway globally – Singapore’s digitalisation trajectory puts it at the top of the WEF’s 2016 Network Readiness Index, which assesses the factors, policies and institutions that enable a country to fully leverage information communication and technology for increased competitiveness and well-being. Singapore was commended for its Smart Nation Programme and “strong government commitment to the digital agenda”.

In 2017, Vietnam reaffirmed its vision – which will be backed by government policy and infrastructure – to become a cashless economy and to significantly improve electronic payment methods by 2020

Vietnam

“While it’s a hugely ambitious aim given the current cash habits, it’s a clear sign of Vietnam’s dedication to improving electronic payment methods and drive e-commerce adoption,” says Jens Ruebbert at Deutsche Bank in Vietnam. “We are already seeing increased numbers of bank accounts, card payments and ATMs in Vietnam. This move will aid increased financial inclusion and, at the same time, drive costs down and increase efficiency for businesses.”

Meeting challenges head on

According to Dr JC Parrenas, Coordinator of APEC’s Asia Pacific Financial Forum (APFF), the rapid evolution of technology and new business models is presenting policymakers, regulators and the private sector with critical challenges.

Dr Parrenas observed that the development and application of technology in Asia is uneven and concentrated in certain fields such as payments and peer-to-peer lending. He also noted that emerging markets hoping to leapfrog their way to modernisation will benefit from these innovations, but must adequately address new risks and concerns.

To ensure sustainable, robust and resilient growth, ASEAN governments would need to prioritise internet and broadband infrastructure, including skills and knowledge, said Deutsche Bank. ASEAN also needs to acknowledge and protect itself from cybersecurity threats, introduce national single windows to boost global e-commerce trade, and ensure a strong and holistic legal framework for payment and financial services, the report added.

Alexandra LeCompte, Director, Regional Sales for Cash Management and Lead for GTB’s Asia Pacific Digital Council at Deutsche Bank, says: “Digitalisation is already resulting in our corporate clients reaching out to buyers and suppliers in increasingly remote locations – and we are adapting accordingly to help facilitate this,”

“We are looking at the potential of innovative solutions such as distributed ledger technology to improve financial services in the region – especially cross-border. And at how big data and payments/collections analytics can help companies make better decisions.” added LeCompte.

Featured image via Pixabay