InsurTech

Temasek Divests Entire Stake in PolicyBazaar’s Parent Firm for US$292M

Singapore’s sovereign wealth fund Temasek has offloaded its entire holdings in PB Fintech, the parent company behind insurance broker PolicyBazaar and consumer credit marketplace PaisaBazaar, according to Mint. This transaction, completed through a block sale, is valued at approximately INR

Read MoreMAS Plans to Ease Insurance Application with Less Data Collection

The Monetary Authority of Singapore (MAS) has put forth a proposal aimed at reducing the amount of information that financial institutions need to collect from clients for certain insurance policies. This initiative was outlined in a consultation paper seeking public

Read MoreEtiqa Rolls Out Pet Insurance Policy Amid Rising Vet Costs in Singapore

Etiqa Insurance Singapore has unveiled a new pet insurance policy in response to the growing number of pets and the corresponding rise in veterinary costs in the island-state. The new policy “Tiq Pet Insurance” covers a range of medical expenses

Read MoreIgloo Expands Weather Protection Insurance Coverage for Vietnamese Farmers

Regional insurtech firm Igloo has joined forces with Aurora Mobility Solutions (AMS) and telecoms company Mobifone to expand its Weather Index Insurance coverage to a broader network of Vietnamese farmers. Igloo provides an enhanced Weather Index Insurance package, encompassing all

Read MoreFormer Lazada Execs’ Insurance Marketplace Lifepal Acquired by Roojai

Thailand-based Roojai Group announced the acquisition of Lifepal, an Indonesian digital direct-to-consumer (D2C) insurance marketplace, according to a report by TechNode Global. Lifepal was founded in 2019 by former Lazada executives Giacomo Ficari and Nicolo Robba, to offer over 300

Read MoreWarburg Pincus-Backed Oona Insurance Names Vincent Soegianto as Indonesia CEO

Oona Insurance, a digital general insurance platform in Southeast Asia set up by Warburg Pincus, announced the appointment of Vincent C. Soegianto as the new CEO for its operations in Indonesia. A veteran in the financial services industry, Soegianto, is

Read MoreFitch Sees Credit Rating Boost for Sumitomo Life Once Singlife Acquisition Finalises

Credit rating agency Fitch Ratings highlighted that Sumitomo Life Insurance Company’s planned acquisition of Singapore-based financial services firm Singlife is poised to bolster the Japanese insurer’s credit standing. The acquisition, still awaiting regulatory approval in Japan and Singapore, is expected

Read MoreJULO Steps up Digital Loans with Embedded Device Protection Insurance

JULO, an Indonesian fintech offering digital peer-to-peer lending, announced that it has launched ‘JULO Cares’, an embedded insurance coverage. This new offering, backed by global general insurer Sompo, provides device protection for users availing of JULO’s digital credit services. Throughout

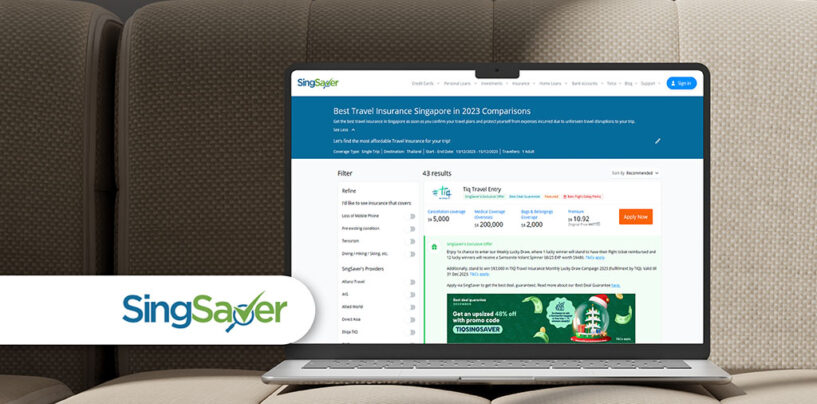

Read MoreSingSaver Adds 43 Travel Insurance Products to Comparison Platform

SingSaver, a personal finance comparison platform in Singapore that is a part of the MoneyHero Group, has recently enhanced its service offerings to include a comprehensive comparison of 43 travel insurance products. This development aims to simplify the process for

Read MoreSinglife Calls Early-Stage Insurtechs to Join 2nd Edition Accelerator Programme

Singapore-based financial services company Singlife has announced the launch of the second edition of its accelerator programme, Singlife Connect 2.0. This initiative follows the success of the programme’s first edition and aims to support up to ten startups specialising in

Read More