Tag "regulation"

The State Open Banking in Thailand in 2021

Though no legal regulation on open banking currently exists in Thailand, the government’s digital push with the Thailand 4.0 strategy, and the introduction the Personal Data Protection Act (PDPA) last year suggest a move to open banking frameworks is inevitable.

Read MoreCOVID-19 Has Given All Fintech Verticals A Boost Except Digital Lending

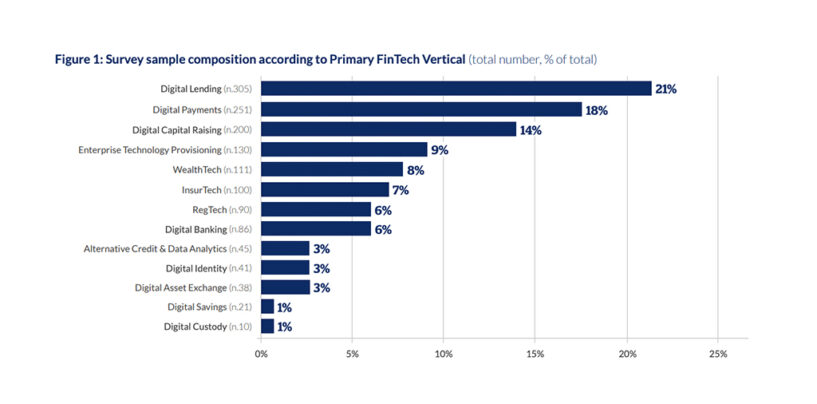

The COVID-19 pandemic has given the global fintech market a boost, with firms in areas including digital custody, digital asset exchange, digital savings, wealthtech and digital payments recording above-average increases in transaction volume in H1 2020, according to a joint

Read MoreCrowded Indonesian Market: 51 Licensed E-Money Providers

Bank Indonesia, the country’s central bank, has issued two new e-money licenses so far this year. These two new additions bring the total number of licensed e-money providers to 51, comprising 14 banks, and 37 non-bank providers, according to data

Read MoreOpen Banking, Data Protection Laws Bring in New Challenges for Digital Banks and Incumbents

Open banking, one of the hottest topics in financial services today, is bringing in new challenges and risks that both traditional financial institutions and fintech companies must address swiftly, said Frederik Mennes, director of product security at cybersecurity firm OneSpan.

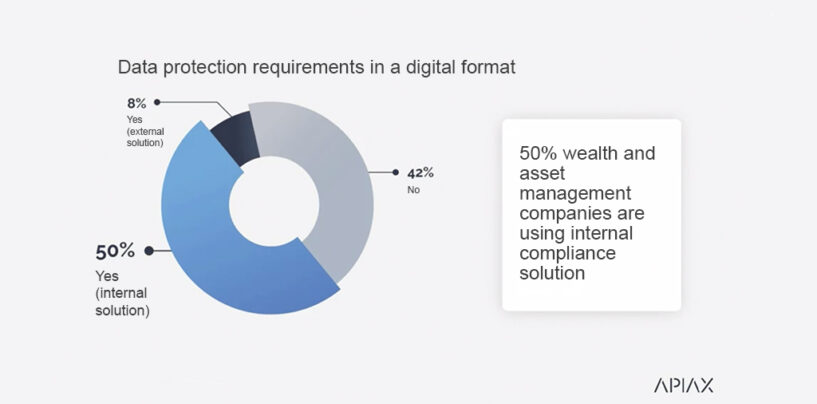

Read MoreEvolving Regulatory Landscape Pushes Wealth Managers Towards Regtech Specialists

The rapidly changing regulatory landscape is pushing wealth and asset management companies to turn to specialist regtech providers, experts said. In a webinar that took place on August 25, 2020, Ralf Huber, co-founder of Swiss regtech firm Apiax, and Claire

Read MoreWill AI Trigger Massive Job Losses in Financial Services?

In financial services, the adoption of artificial intelligence (AI) is growing rapidly, bringing in a plethora of opportunities for customer experience and personalization. Yet, the question of regulation still lingers and must be addressed to tackle the potential risks of

Read MoreMAS Proposes New Regulations Amid Emerging Risks Arising from Digital Assets

Singapore’s central bank, the Monetary Authority of Singapore (MAS), is proposing new regulations that it would give it more power to regulate the financial services industry, notably in the fields cybersecurity and virtual assets, the regulator said on July 21.

Read MorePartnerships Between Fintechs and Financial Institutions Drive Faster Innovation in ASEAN’s Digital Banking Sector

In Singapore, the first digital banking licenses are expected to be granted by the end of this year, marking the debut of a new area in the city-state’s banking industry. In June last year, the Monetary Authority of Singapore (MAS)

Read MoreSilent Eight Uses AI to Fight Financial Crime

COVID-19 continues to spread in Singapore with now more than 30,400 confirmed cases and over 20 deaths, according to the latest data from the John Hopkins University. Though the numbers continue to rise, with 614 new cases of COVID-19 infection

Read MoreA Look at Singapore’s Updated Income Tax Guide for Digital Tokens

The Inland Revenue Authority of Singapore (IRAS) released on April 17 an e-Tax Guide on the income tax treatment of transactions involving digital tokens, as well as initial coin offerings (ICOs). The guide focuses on three types of digital tokens,

Read More