PH Fintech Acudeen Taps Blockchain Frenzy With New Platform And Crypto Token

by Fintech News Singapore March 24, 2018Acudeen Technologies, a Filipino startup offering an online technology platform that connects small and medium-sized enterprises (SMEs) to financial institutions through invoice discounting, is conducting a token sale to raise up to US$35 million.

The company’s initial coin offering (ICO) is based in Singapore where the startup established its regional office in early 2018. A total of 10 billion ACU tokens will be sold at a price of US$1 per 100 coins with the proceeds going towards the startup’s geographic expansion and its migration onto a blockchain platform.

Mario Jordan Fetalino III, CEO of Acudeen Technologies Inc, at a Singapore Meetup event, March 2018

“The ACU tokens serve as our answer to the growing demand for our services outside of our current consumer market,” said Mario Jordan Fetalino III, founder and CEO of Acudeen Technologies. “The purpose of our token sale is to accelerate more businesses with our services in the coming years through this revolutionary technology.”

Founded in 2016, Acudeen has enabled over 400 SMEs in the Philippines to sell their movable assets like receivables for immediate liquidity ahead of their maturity date. In 2017, the company transacted over US$2.4 million worth of receivables and is expecting to hit US$25 million by the end of 2018.

Former 8990 Holdings president and CEO Jesus Januario Atencio was appointed last month to lead Acudeen, now sitting as the chairman of the company and replacing Fetalino.

Speaking at a meetup event last Monday, Atencio said that while the company has indeed helped democratize invoice discounting in the Philippines, many challenges remain, including late payments. Only 8% of companies paid on-time last year. But the new system, powered by blockchain technology, will solve this issue by incentivizing big companies to pay their invoices earlier.

“Acudeen’s current model in place already utilizes advanced methods of validating transactions,” the company said in a statement. “Tokenizing their services in a new ecosystem design further allows the company to bring financial inclusion to other parts of the world.”

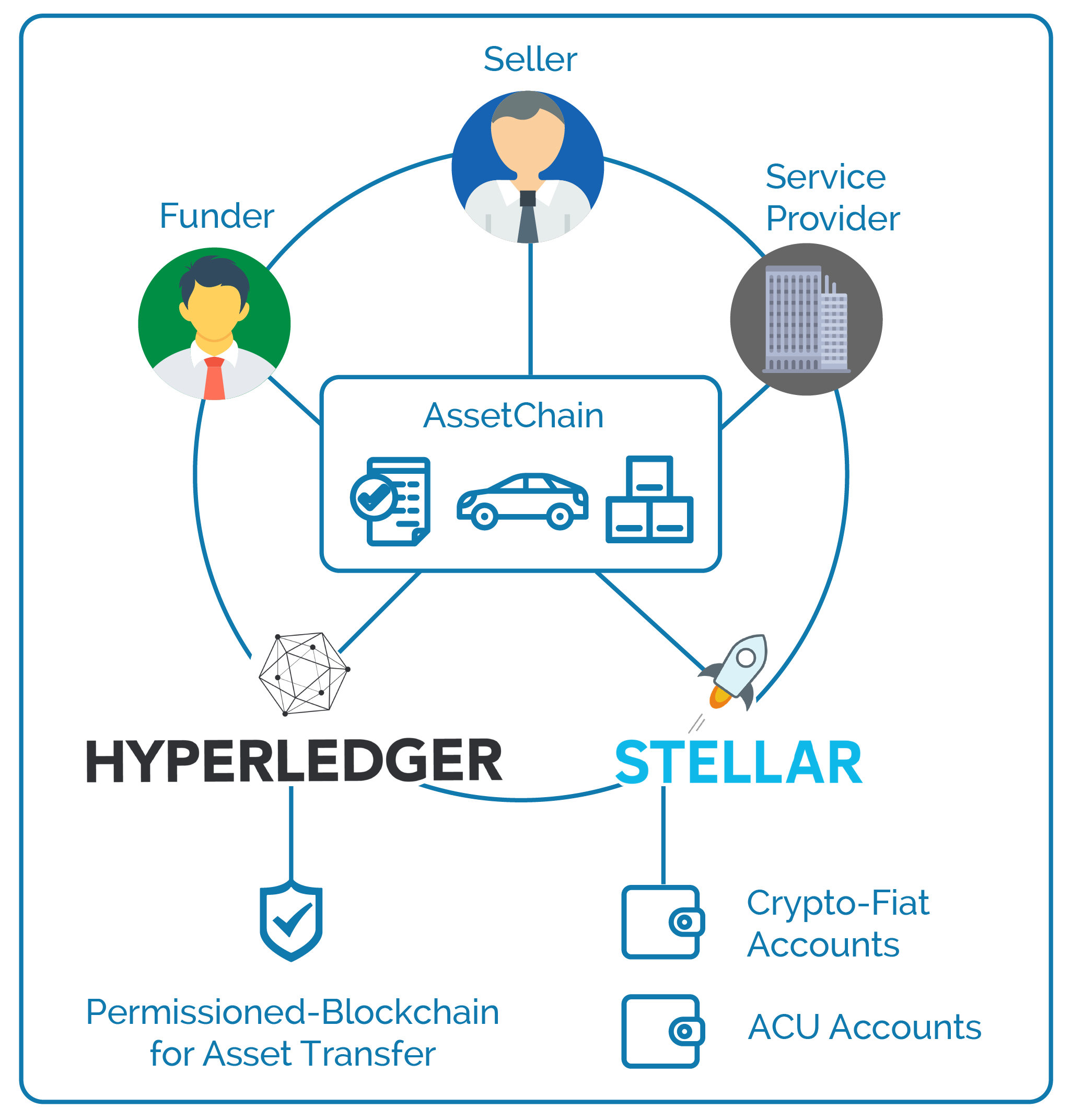

The premise of the new system will use three main drivers: the AssetChain Platform, a permissioned blockchain which will store all transaction data; the ACU tokens, which will be required to utilize services within the platform; and CryptoFIAT, Acudeen’s solution to completing invoice purchases using cryptocurrency.

“With this technology, the value of the cryptocurrency being used to transact represents an equivalent amount of fiat money securely stored in a trusted account leveraged by the AssetChain Platform, therefore saving time and avoiding exorbitant fees otherwise incurred using traditional methods,” the company said in a statement.

AssetChain

The ecosystem’s blockchain AssetChain will be built with the IBM Hyperledger Fabric and will provide confidentiality for business owners by enabling data to only be shared to participants involved in the

Acudeen plans to implement tokenized services on its marketplace by early next year while the shift to the blockchain platform is targeted to be completed by the end of 2019

Other regional meetups will take place throughout Asia in the coming weeks: Hong Kong from March 22 to 24, Indonesia on March 26 to 27, Thailand on April 2 to 3, Japan on April 5 and 6, and South Korea on April 7.

The ongoing ACU token pre-sale (invite-only) will run until April 8, and will be followed by the public sale set to begin on April 9.