Singapore state investor Temasek is betting big on fintech. Nearly half of the company’s new investments of S$29 billion made during the financial year ended March 31, 2018, went into technology, life sciences, agribusiness, consumer and non-bank financial services.

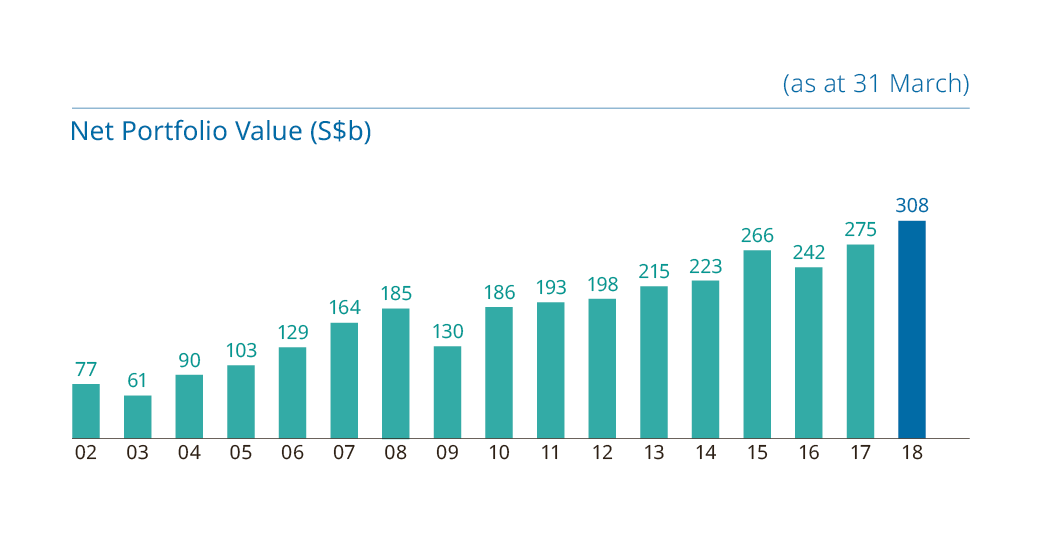

Temasek owned and managed a net portfolio of S$308 billion as of March 31, with S$16 billion divested and S$29 billion invested during the year.

Net portfolio value, Temasek

By sector, 26% are from financial services, 21% from telecommunications and media, 16% from both consumer and transport, 6% from agribusiness, 3% from energy, 8% from multi-sector funds, and 4% from others (including credit), according to its annual report.

Incorporated in 1974, Temasek is a Singaporean holding company that can be characterized as a national wealth fund owned by the government of Singapore, although it has frequently disputed this terminology, and prefers to be referred to as an investment company, because it invests mostly in equities, is the outright owner of many assets, and pays taxes like other commercial investment firms.

Temasek’s portfolio covers a broad spectrum of sectors, but in financial services, its key investment fields have evolved from banking and consumer, to non-bank financial services including insurtech, fintech and digital payment in recent years.

Some of Temasek’s most recent fintech investments include Policybazaar, an Indian insurance aggregator and comparison platform, Ant Financial, the financial services affiliate of Chinese e-commerce giant Alibaba, CashShield, a Singapore-based enterprise risk management company, and Go-Jek, an Indonesian ride-hailing and payments startup.

PolicyBazaar homepage

Earlier this month, Temasek led the US$100 million Series D of Flywire, an international payments processor from the US. Flywire has processed over US$8 billion for over 1,400 clients in business, education and healthcare, so far.

Another recent investment is London-based artificial intelligence (AI) startup Eigen Technologies. The startup, which uses AI to read legal and financial documents, making it easier for lawyers and bankers to analyze complex contracts, raised £13 million from Temasek and Goldman Sachs Principal Strategic Investments in June. Goldman Sachs is a client of Eigen Technologies, so are ING, Linklaters and Evercore.

Pine Labs, Twitter

Other fintech investments include C2FO, an online B2B marketplace for working capital from the US, Funding Circle, a UK-based lending platform, R3, a US-based blockchain firm that leads a consortium of more than 80 banks, and AvidXchange, a US company providing accounts payable and on-demand invoice management solutions.

One notable deal is Global Healthcare Exchange, a US-based firm that provides electronic trading exchange, and electronic payment and supply chain services to customers in the healthcare industry including providers, suppliers, distributors and group purchasing organizations. Temasek bought a majority stake in the company for US$1.8 billion back in May 2017.

Some of Temasek’s most notable exits include Alibaba, and online payment specialists Adyen and PayPal.