5 Ecosystems Enablers and B2B Providers for Fintech Startups in Asia

by Fintech News Singapore June 18, 2019The platform-based business model has taken hold in the digital economy, and the concept is quickly spreading to banking and financial services. Aided by widespread Internet and mobile access, fintech companies and progressive banks have started to make inroads into platform-based banking.

For fintech startups and financial institutions in Southeast Asia looking to provide seamless, user-friendly, digital solutions, the following five companies are offering extensive ecosystems and business-to-business (B2B) solutions that will make your job much easier.

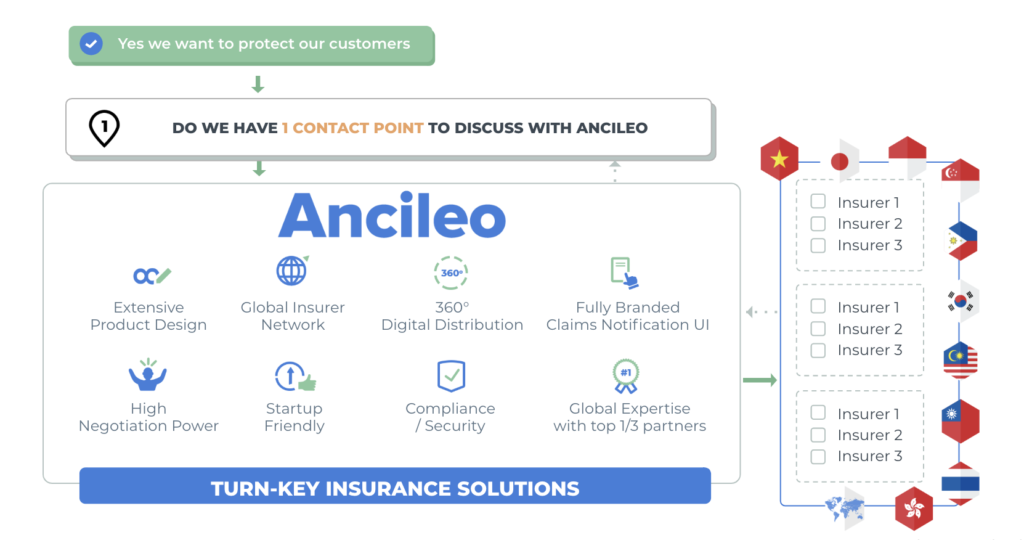

Ancileo: Insurance-as-a-service (Insurtech)

If you are a Fintech startup (eg. lending, payment, wallet…), you are likely already working on building your own insurance offering and you also found out that it can be a lengthy and complex process, Ancileo, a Singapore-based insurtech company, makes it a breeze! Combining flexible technology and a global network of top ⅓ insurance partners, they offer turn-key insurance solutions to Fintech players willing to start their own insurance offering.

Ancileo’s insurance Software-as-a-service platform provides plug and play, secure and customizable solutions that enable efficient insurance distribution via API integration, B2C white label and even call center sales.

In summary Fintech startups can focus on their core business while Ancileo does the heavy lifting to get their insurance offering up and running as fast as possible.

Leveraging WeChat’s massive user base (Mobile Payment)

WeChat app, https://www.wechat.com/

Back in January 2017, Tencent, the owner and creator of China’s number one superapp WeChat, launched Mini Programs, which are essentially lightweight apps that run inside the platform.

The company’s intention was to help users avoid downloading standalone apps from third-parties by allowing business owners to develop apps that are independent from Android or iOS but sit in the WeChat ecosystem.

The functionality has allowed Tencent to lock users in for even longer, and by November 2018, the WeChat ecosystem had over one million such mini programs. That made the WeChat ecosystem half the size of the Apple App Store, which recorded 2.1 million apps in April 2018.

200 million users were active on WeChat Mini Programs every day as of August 2018 and considering WeChat’s one billion monthly active users worldwide, it comes with little surprise that businesses owners and firms are rushing onto the platform.

Mobile money with Mynt (Money Transfer)

GCash, https://www.gcash.com

Mynt, a fintech partnership between the Philippines’ Globe Telecom, the Ayala Corporation, and Ant Financial, provides fintech solutions to consumers, merchants, and organizations in the Philippines, and focuses on five key services: payments, remittances, loans, business solutions and platforms.

Mynt is the operator of GCash, a mobile money platform, and Fuse, which offers loan products. The GCash app is the Philippines’ leading mobile wallet, growing exponentially to 15 million registered users nationwide in just three years. As of February 2019, GCash had over 30,000 QR merchants in the Philippines.

In 2016, the company announced plans to launch a new cloud-based, white-label digital money fintech platform for retailed called Casa that features bill payments, money transfers, closed-loop merchant payment solutions, loyalty program management, and card management.

Mynt is currently expanding its mobile money customer base and is reportedly planning to roll out insurance products, en route to becoming a sprawling financial services platform in the image of China’s Ant Financial.

Digital wealth management with Bento (Wealthtech)

Bento, https://www.bento.cloud

Bento is a Singapore-based digital wealth management solutions provider that’s been live since October 2016.

Bento’s white-label, hybrid B2B platform is built for banks, wealth managers, brokers and insurance companies, enabling them to launch digital wealth solutions with low capex and quick time to market. The solution includes UI UX for client on boarding, VaR-based portfolio construction, client reporting and RM/advisor desktop with detailed portfolio analytics. It is modular and can be implemented as an end-to-end solution or just to cater for to a specific need.

Bento’s B2C entity is licensed under the Monetary Authority of Singapore (MAS) as a Registered Fund Management Company (RFMC). It manages assets for institutions such as endowments, charities, etc. using a proprietary asset allocation algorithm.

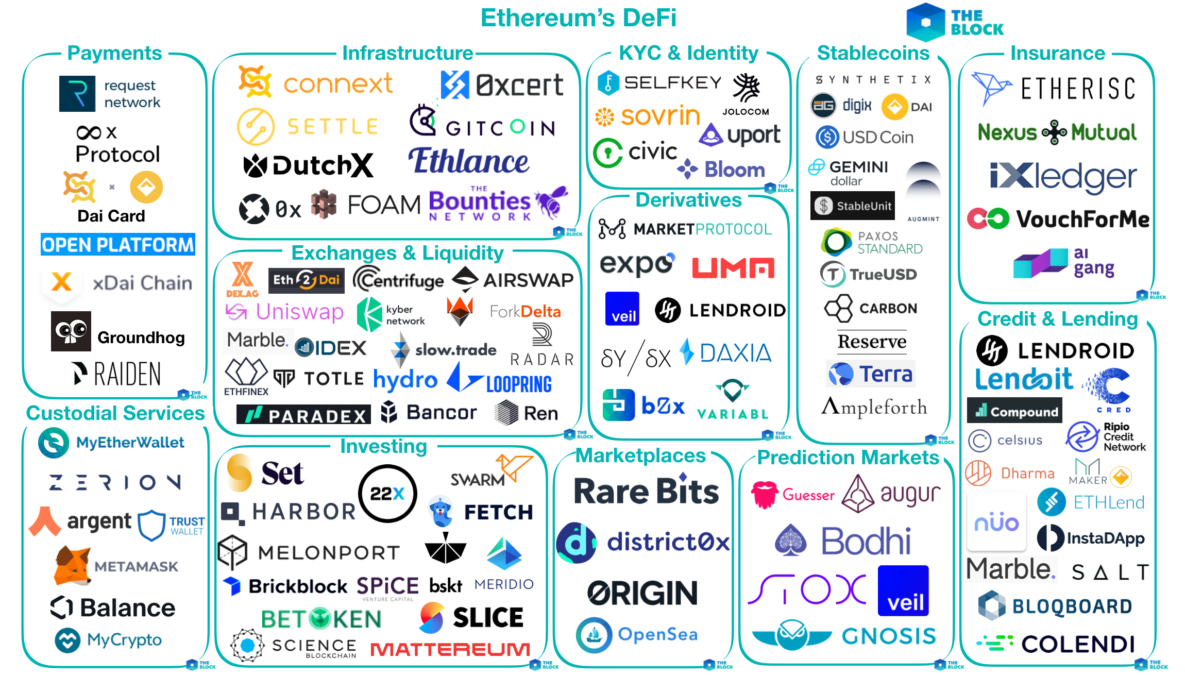

Decentralized financial services applications on Ethereum (Crypto)

Since the release of the Bitcoin protocol over a decade ago, a large number of crypto and blockchain platforms have emerged to solve various issues and serve diverse purposes. Ethereum, an open-source, public, blockchain-based distributed computing platform, is undeniably one of the most prominent of these platforms.

Released in 2015, Ethereum was created with the intend of providing a platform for the development of decentralized applications.

Over the past years, numerous decentralized financial applications have been built on Ethereum, leading to the emergence of the so-called decentralized finance (DeFi) wave. The idea behind DeFi is a financial system without a central governing authority that’s fully open to anyone the world.

Examples of DeFi apps include stablecoins such as Circle’s USDC and the Gemini dollar, real estate investment platform Brickblock, and on-chain liquidity protocol Kyber Network.

Mapping out Ethereum’s DeFi, The Block, March 2019