soCash Enables ICBC Customers to Withdraw Money in Neighbourhood Stalls

by Fintech News Singapore July 3, 2019soCash, the Singapore-headquartered start-up which converts shops into virtual ATMs announced that it has tied-up a partnership with ICBC Singapore.

Through this new partnership, soCash will extend its services to all ICBC customers in Singapore and enable them to perform basic banking services like cash withdrawal from neighbourhood shops using the soCash app. More banking services will be rolled out progressively taking the bank closer to its growing customer base.

Hari Sivan

“As virtual banks emerge in Asia and traditional banks embrace digital business models, there is a growing need of more O2O (Online to offline) networks. Our collaboration with ICBC demonstrates soCash’s ability to enable banks scale beyond the vintage branch & kiosk-based models,”

said Hari Sivan, CEO of soCash.

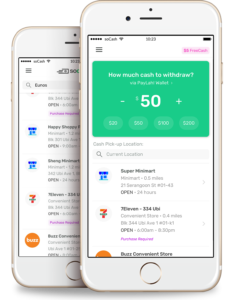

Launched in mid-2018, the soCash app started off allowing bank customers to withdraw cash from stores as an alternative to ATMs. As its technology directly plugs into the banks’ APIs, users can place a cash order via the soCash app and select a nearby merchant to collect the cash from, while the app deducts the selected amount from the customer’s account. This is all done digitally without the need for a card or even a PIN code. With thousands of partner shops primarily in HDB estates, condominiums and Industrial areas on its network, soCash has evolved into a digital distribution channel for banks offering a suite of services.

Today, there are 18 million cash withdrawals taking place every month in Singapore; despite the country’s financial ecosystem moving towards widespread cashless transactions. The continued growth of currency in circulation in the economy necessitates the need for expensive cash logistics solutions. soCash provides an alternative by enabling cash circulation bypassing these channels.

Today, there are 18 million cash withdrawals taking place every month in Singapore; despite the country’s financial ecosystem moving towards widespread cashless transactions. The continued growth of currency in circulation in the economy necessitates the need for expensive cash logistics solutions. soCash provides an alternative by enabling cash circulation bypassing these channels.

soCash seeks to bridge the gap between the demand for cash and the need for banks to keep their cash management costs down – namely by offering a mobile platform that promotes a more seamless flow of cash without the use of ATMs. With the ICBC partnership, soCash can strengthen its distribution network and move an inch closer towards internationalising its services. The company is already gearing up for its expansion in Malaysia, Hong Kong, and Indonesia after securing the regulatory approvals for the launch.